Gresham's law states that "bad money drives out good money," meaning people tend to hoard currency perceived as more valuable and spend the less valuable one. Thiers' law, on the other hand, emphasizes that coins containing more metal value than their face value will be melted down or exported, reducing their circulation. Understanding the interaction between these laws is crucial for effective monetary policy and preventing currency devaluation.

Table of Comparison

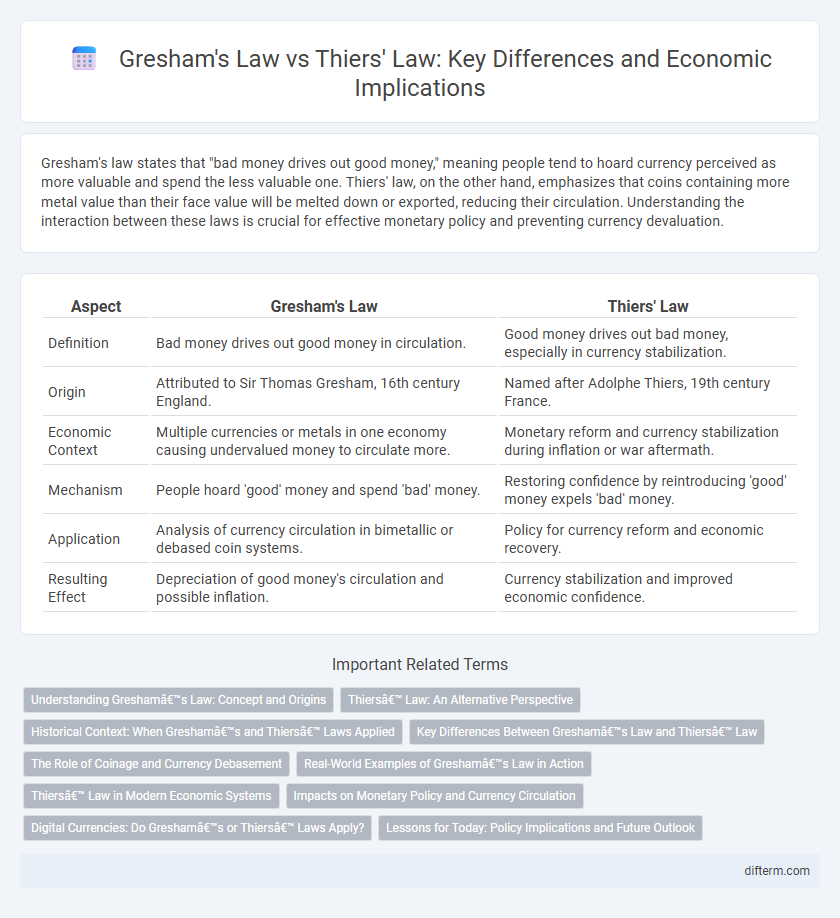

| Aspect | Gresham's Law | Thiers' Law |

|---|---|---|

| Definition | Bad money drives out good money in circulation. | Good money drives out bad money, especially in currency stabilization. |

| Origin | Attributed to Sir Thomas Gresham, 16th century England. | Named after Adolphe Thiers, 19th century France. |

| Economic Context | Multiple currencies or metals in one economy causing undervalued money to circulate more. | Monetary reform and currency stabilization during inflation or war aftermath. |

| Mechanism | People hoard 'good' money and spend 'bad' money. | Restoring confidence by reintroducing 'good' money expels 'bad' money. |

| Application | Analysis of currency circulation in bimetallic or debased coin systems. | Policy for currency reform and economic recovery. |

| Resulting Effect | Depreciation of good money's circulation and possible inflation. | Currency stabilization and improved economic confidence. |

Understanding Gresham’s Law: Concept and Origins

Gresham's Law states that "bad money drives out good," meaning inferior currency circulates more widely while higher-quality money is hoarded or disappears from the economy. Originating from Sir Thomas Gresham in the 16th century during currency debasement in England, this principle illustrates the impact of legal tender laws on monetary circulation. Thiers' Law, less known, contrasts by emphasizing conditions where good money dominates, highlighting varying currency behaviors under different economic policies.

Thiers’ Law: An Alternative Perspective

Thiers' Law offers an alternative perspective to Gresham's Law by suggesting that good money can drive out bad money under certain economic conditions, particularly when the public has confidence in currency stability and government backing. Unlike Gresham's Law, which asserts that inferior currency circulates while superior currency is hoarded, Thiers' Law highlights the role of trust and legal tender laws in determining money circulation. This concept is crucial in understanding modern monetary policy and the dynamics of currency acceptance in both stable and volatile economies.

Historical Context: When Gresham’s and Thiers’ Laws Applied

Gresham's law, formulated in the 16th century, describes how "bad money drives out good money" during periods of bimetallism when different coins circulate simultaneously with varying intrinsic values. Thiers' law emerged in 19th-century France, addressing currency stabilization after political upheaval and hyperinflation, emphasizing the restoration of confidence through sound money policies. Both laws historically applied during monetary crises, highlighting challenges in maintaining currency value and trust in different economic systems.

Key Differences Between Gresham’s Law and Thiers’ Law

Gresham's Law states that "bad money drives out good money" when both forms circulate simultaneously at a fixed legal tender value, causing the undervalued currency to disappear from circulation. Thiers' Law contrasts this by suggesting that good money tends to drive out bad money under a system without fixed legal tender laws, allowing market value to dictate currency preference. The key difference lies in legal enforcement and market dynamics influencing currency circulation, where Gresham's Law depends on government mandates and Thiers' Law emphasizes natural market selection.

The Role of Coinage and Currency Debasement

Gresham's law asserts that "bad money drives out good," highlighting how currency debasement leads to the circulation of lower-quality coins while hoarded higher-quality coins disappear. Thiers' law counters this by emphasizing that stable, trusted coinage underpins economic confidence and transactional efficiency, reducing the negative impact of debasement. The role of coinage is central, as government policies controlling metal content influence currency value, public trust, and overall monetary stability.

Real-World Examples of Gresham’s Law in Action

Gresham's Law, "bad money drives out good," is vividly illustrated by the 20th-century U.S. coinage when silver coins were hoarded and melted for their metal value exceeding face value. In contrast, Thiers' Law, which describes how undervalued currency can drive out overvalued currency, is less commonly observable but relevant in hyperinflation scenarios such as Zimbabwe's economy. The widespread disappearance of high-quality coins and notes in circulation emphasizes the practical impact of Gresham's Law in everyday economic exchanges.

Thiers’ Law in Modern Economic Systems

Thiers' Law, asserting that "bad money drives out good money" under unregulated monetary systems, is increasingly relevant in modern economies facing digital currencies and fiat manipulation. Unlike Gresham's Law, which primarily addresses physical coinage debasement, Thiers' Law highlights how state-controlled money supply and inflation can erode currency value, prompting shifts toward alternative or stable assets. Contemporary financial systems must consider Thiers' Law implications to maintain currency stability and public trust amidst evolving monetary policies and technological disruptions.

Impacts on Monetary Policy and Currency Circulation

Gresham's law states that "bad money drives out good," causing inferior currency to dominate circulation and complicate effective monetary policy by devaluing the money supply. Thiers' law, by contrast, emphasizes the role of state confidence in maintaining currency value, impacting monetary policy through government backing and regulatory control. Both laws influence currency circulation dynamics, with Gresham's law highlighting market behavior towards flawed money and Thiers' law underlining institutional trust as crucial for stable monetary systems.

Digital Currencies: Do Gresham’s or Thiers’ Laws Apply?

Gresham's Law, which states that "bad money drives out good," offers insight into digital currencies as undervalued or unstable tokens tend to be rejected in favor of more stable alternatives like Bitcoin or Ethereum. Thiers' Law, focusing on the dynamic of money demand and supply, explains how digital currencies gain legitimacy when user trust and liquidity increase, promoting adoption despite price volatility. In digital economies, these laws interplay by influencing whether users hoard perceived "good" digital assets or circulate "bad" tokens, shaping market behavior and currency stability.

Lessons for Today: Policy Implications and Future Outlook

Gresham's law emphasizes the tendency of "bad money" to drive "good money" out of circulation, highlighting the critical need for clear currency valuation policies to prevent market distortions and maintain monetary stability. Thiers' law, which suggests the inverse dynamic where "good money" can circulate alongside or replace debased currency under certain conditions, informs modern policymakers on managing currency confidence during economic reforms. These principles guide current economic strategies by stressing transparent monetary regulations, the importance of public trust in currency systems, and the adoption of adaptive frameworks to address emerging challenges in digital and fiat money ecosystems.

Gresham’s law vs Thiers’ law Infographic

difterm.com

difterm.com