Microfinance encompasses a broader range of financial services including savings, insurance, and training, targeting low-income individuals to improve overall financial inclusion. Microcredit specifically refers to the provision of small loans aimed at fostering entrepreneurship and business growth among underserved populations. Understanding the distinct roles of microfinance and microcredit is crucial for designing effective economic development strategies.

Table of Comparison

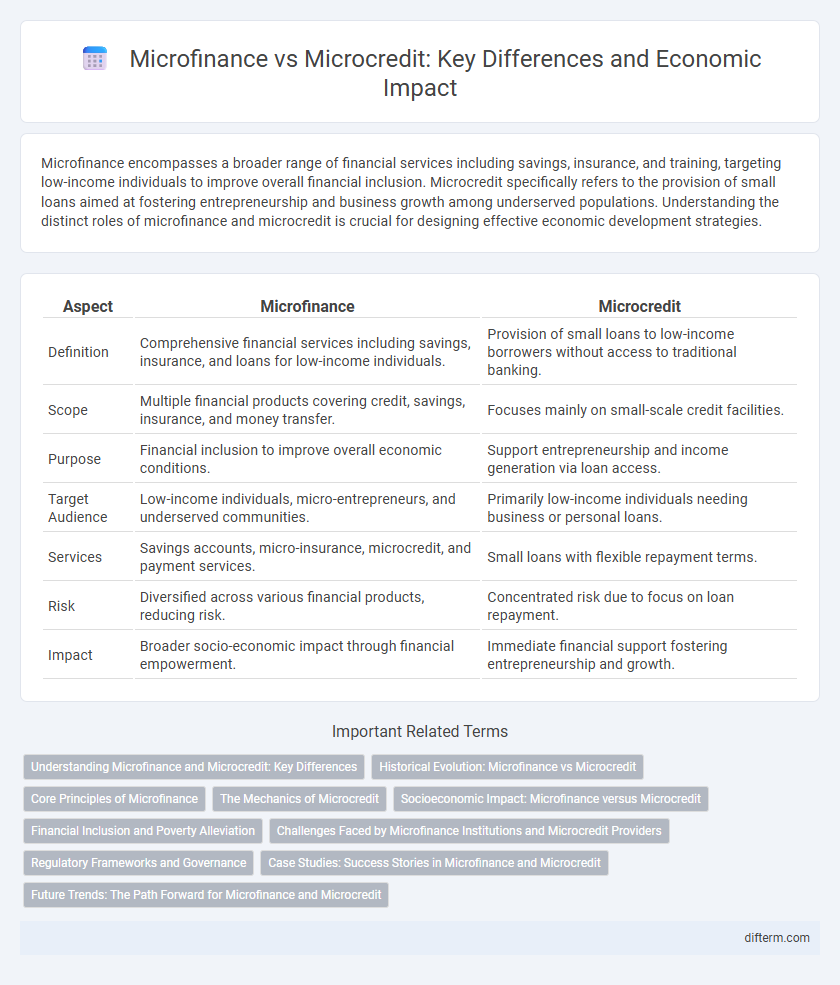

| Aspect | Microfinance | Microcredit |

|---|---|---|

| Definition | Comprehensive financial services including savings, insurance, and loans for low-income individuals. | Provision of small loans to low-income borrowers without access to traditional banking. |

| Scope | Multiple financial products covering credit, savings, insurance, and money transfer. | Focuses mainly on small-scale credit facilities. |

| Purpose | Financial inclusion to improve overall economic conditions. | Support entrepreneurship and income generation via loan access. |

| Target Audience | Low-income individuals, micro-entrepreneurs, and underserved communities. | Primarily low-income individuals needing business or personal loans. |

| Services | Savings accounts, micro-insurance, microcredit, and payment services. | Small loans with flexible repayment terms. |

| Risk | Diversified across various financial products, reducing risk. | Concentrated risk due to focus on loan repayment. |

| Impact | Broader socio-economic impact through financial empowerment. | Immediate financial support fostering entrepreneurship and growth. |

Understanding Microfinance and Microcredit: Key Differences

Microfinance encompasses a broad range of financial services, including microcredit, savings, insurance, and payment systems, designed to support low-income individuals and small businesses. Microcredit specifically refers to the provision of small loans aimed at enabling entrepreneurship and income generation among underserved populations. Understanding these distinctions is crucial for policymakers and financial institutions to tailor effective economic development strategies and enhance financial inclusion.

Historical Evolution: Microfinance vs Microcredit

Microcredit emerged in the 1970s as a targeted financial innovation, pioneered by the Grameen Bank to provide small loans to impoverished entrepreneurs lacking collateral. Microfinance expanded this model, integrating diverse financial services such as savings, insurance, and money transfers to address broader economic needs in developing countries. Over time, microfinance evolved from solely credit provision to a comprehensive toolkit for poverty alleviation and financial inclusion.

Core Principles of Microfinance

Microfinance encompasses a broad range of financial services including microcredit, savings, insurance, and fund transfers designed to support low-income individuals and small businesses. Its core principles emphasize financial inclusion, empowerment through access to capital, and sustainable economic development by promoting responsible lending and savings practices. Microcredit, a subset of microfinance, specifically provides small loans with the goal of enabling entrepreneurial activities and poverty alleviation.

The Mechanics of Microcredit

Microcredit operates by providing small loans to low-income individuals or groups who lack access to traditional banking services, enabling them to invest in income-generating activities. The mechanics involve assessing creditworthiness through group lending models, where peer pressure ensures loan repayment, reducing default risks. Interest rates are typically higher than conventional loans due to administrative costs and risk factors, yet microcredit remains a crucial tool for financial inclusion in developing economies.

Socioeconomic Impact: Microfinance versus Microcredit

Microfinance encompasses a broader range of financial services including savings, insurance, and credit, enhancing economic resilience and social inclusion more effectively than microcredit alone, which primarily provides small loans. Microfinance's diversified offerings contribute to poverty alleviation by supporting long-term financial stability and entrepreneurial growth among underserved populations. Empirical studies demonstrate that microfinance institutions lead to improved health, education, and empowerment outcomes compared to the limited scope of microcredit programs.

Financial Inclusion and Poverty Alleviation

Microfinance encompasses a broad range of financial services, including savings, insurance, and microcredit, designed to promote financial inclusion among underserved populations. Microcredit specifically refers to small loans provided to low-income individuals to empower entrepreneurship and generate income. Both play critical roles in poverty alleviation by enabling access to essential capital, fostering economic participation, and supporting sustainable livelihoods.

Challenges Faced by Microfinance Institutions and Microcredit Providers

Microfinance institutions and microcredit providers face significant challenges including high operational costs, risk of loan defaults, and limited access to funding, which constrain their ability to scale services. Regulatory barriers and inadequate infrastructure in developing regions further exacerbate these issues, impacting client outreach and financial sustainability. Effective risk management and innovative technology adoption are critical to overcoming these obstacles and enhancing service delivery.

Regulatory Frameworks and Governance

Microfinance and microcredit operate under distinct regulatory frameworks that influence their governance structures and operational scope. Microfinance institutions (MFIs) are typically subject to comprehensive regulations encompassing deposit mobilization, risk management, and consumer protection to ensure financial stability and transparency. In contrast, microcredit providers often face more limited oversight focused primarily on lending practices, which can result in varied levels of accountability and borrower protection across different jurisdictions.

Case Studies: Success Stories in Microfinance and Microcredit

Microfinance and microcredit have transformed economic landscapes in developing regions, exemplified by the Grameen Bank in Bangladesh, which empowered millions through small loans and financial services. Case studies reveal microfinance institutions fostering entrepreneurship, increasing household income, and promoting financial inclusion more comprehensively than isolated microcredit programs. Evidence from Kenya's M-PESA initiative demonstrates how integrated microfinance solutions accelerate economic growth by combining credit access with mobile banking technology.

Future Trends: The Path Forward for Microfinance and Microcredit

Emerging technologies such as blockchain and artificial intelligence are poised to revolutionize microfinance and microcredit by enhancing transparency, reducing transaction costs, and improving risk assessment models. Expansion of digital financial services is expected to increase accessibility for underserved populations, fostering greater financial inclusion in developing economies. Regulatory frameworks will likely evolve to balance innovation with consumer protection, shaping the sustainable growth of microfinance institutions worldwide.

Microfinance vs Microcredit Infographic

difterm.com

difterm.com