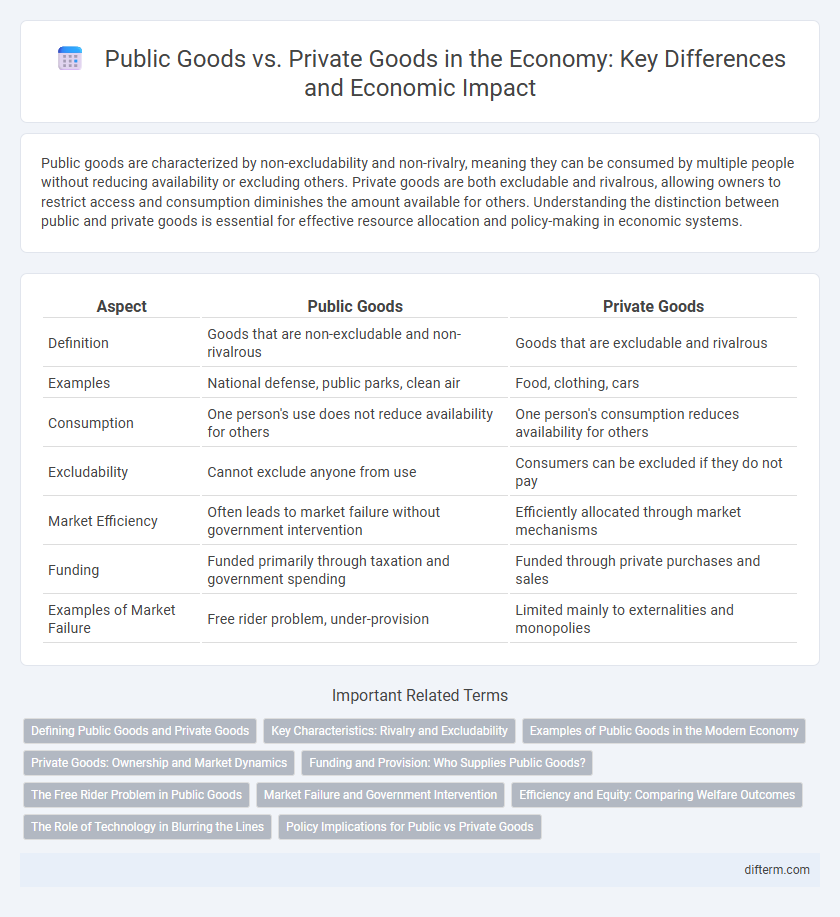

Public goods are characterized by non-excludability and non-rivalry, meaning they can be consumed by multiple people without reducing availability or excluding others. Private goods are both excludable and rivalrous, allowing owners to restrict access and consumption diminishes the amount available for others. Understanding the distinction between public and private goods is essential for effective resource allocation and policy-making in economic systems.

Table of Comparison

| Aspect | Public Goods | Private Goods |

|---|---|---|

| Definition | Goods that are non-excludable and non-rivalrous | Goods that are excludable and rivalrous |

| Examples | National defense, public parks, clean air | Food, clothing, cars |

| Consumption | One person's use does not reduce availability for others | One person's consumption reduces availability for others |

| Excludability | Cannot exclude anyone from use | Consumers can be excluded if they do not pay |

| Market Efficiency | Often leads to market failure without government intervention | Efficiently allocated through market mechanisms |

| Funding | Funded primarily through taxation and government spending | Funded through private purchases and sales |

| Examples of Market Failure | Free rider problem, under-provision | Limited mainly to externalities and monopolies |

Defining Public Goods and Private Goods

Public goods are non-excludable and non-rivalrous, meaning individuals cannot be prevented from using them, and one person's consumption does not reduce availability for others, such as national defense and public parks. Private goods are both excludable and rivalrous, where consumption by one individual reduces availability for others and access can be restricted, like food and clothing. The distinction between public and private goods affects market efficiency, government intervention, and resource allocation in economic systems.

Key Characteristics: Rivalry and Excludability

Public goods are characterized by non-rivalry and non-excludability, meaning consumption by one individual does not reduce availability for others, and no one can be effectively excluded from using them. In contrast, private goods exhibit rivalry and excludability, where one person's consumption reduces the amount available to others, and access can be restricted through pricing or ownership. These key characteristics influence market efficiency and the allocation of resources in economic systems.

Examples of Public Goods in the Modern Economy

National defense, public parks, and street lighting exemplify public goods in the modern economy because they are non-excludable and non-rivalrous, meaning consumption by one individual does not reduce availability for others. Public broadcasting services and clean air are additional key examples that illustrate how these goods benefit society collectively without direct pricing mechanisms. The government often funds and regulates these goods to address market failures and ensure equitable access for all citizens.

Private Goods: Ownership and Market Dynamics

Private goods are defined by their excludability and rivalry, where ownership grants individuals exclusive control over consumption and use. Market dynamics for private goods involve supply and demand forces, price mechanisms, and competition, which influence production levels and allocation efficiency. Ownership rights facilitate trade and incentivize innovation, ensuring resources are allocated to those who value them most.

Funding and Provision: Who Supplies Public Goods?

Public goods are typically funded and supplied by governments due to their non-excludable and non-rivalrous nature, making private sector provision inefficient or unprofitable. Funding sources for public goods include taxation, government budgets, and sometimes international aid, ensuring widespread accessibility. In contrast, private goods are produced and funded by private firms incentivized by market demand and profit motives, allowing for exclusive consumption.

The Free Rider Problem in Public Goods

Public goods are characterized by non-excludability and non-rivalry, leading to the free rider problem where individuals consume benefits without paying. This results in under-provision or depletion of resources since producers cannot easily charge consumers. Efficient management of public goods often requires government intervention or collective funding mechanisms to address free riding and ensure equitable access.

Market Failure and Government Intervention

Public goods, characterized by non-excludability and non-rivalry, often lead to market failure as private markets underprovide them due to free-rider problems. In contrast, private goods are efficiently allocated through market mechanisms because they are both excludable and rivalrous. Government intervention typically corrects market failure in public goods by funding and regulating their provision to ensure adequate supply and social welfare.

Efficiency and Equity: Comparing Welfare Outcomes

Public goods, characterized by non-excludability and non-rivalry, often lead to inefficient market outcomes due to free-rider problems, necessitating government intervention to achieve equity through redistribution and universal access. Private goods, being both excludable and rivalrous, promote efficiency via competitive markets but can result in inequitable outcomes without mechanisms to support low-income populations. Balancing efficiency and equity involves designing policies that mitigate market failures in public goods while ensuring fair allocation and access to private goods.

The Role of Technology in Blurring the Lines

Advancements in technology have redefined traditional distinctions between public goods and private goods by enhancing accessibility and reducing exclusivity through digital platforms and network effects. Digital innovations such as open-source software and streaming services exhibit characteristics of both categories, offering widespread availability while allowing controlled access or monetization. This technological evolution challenges economic models by creating hybrid goods that combine non-excludability with excludability, reshaping public policy and market dynamics.

Policy Implications for Public vs Private Goods

Policy implications for public goods involve government intervention to address market failures due to non-excludability and non-rivalry, ensuring adequate provision and funding through taxation or subsidies. Private goods, characterized by excludability and rivalry, rely on market mechanisms for efficient allocation, but policies may still regulate externalities and promote competition. Balancing public and private goods provision requires careful design of regulatory frameworks and public-private partnerships to optimize social welfare and economic efficiency.

Public goods vs Private goods Infographic

difterm.com

difterm.com