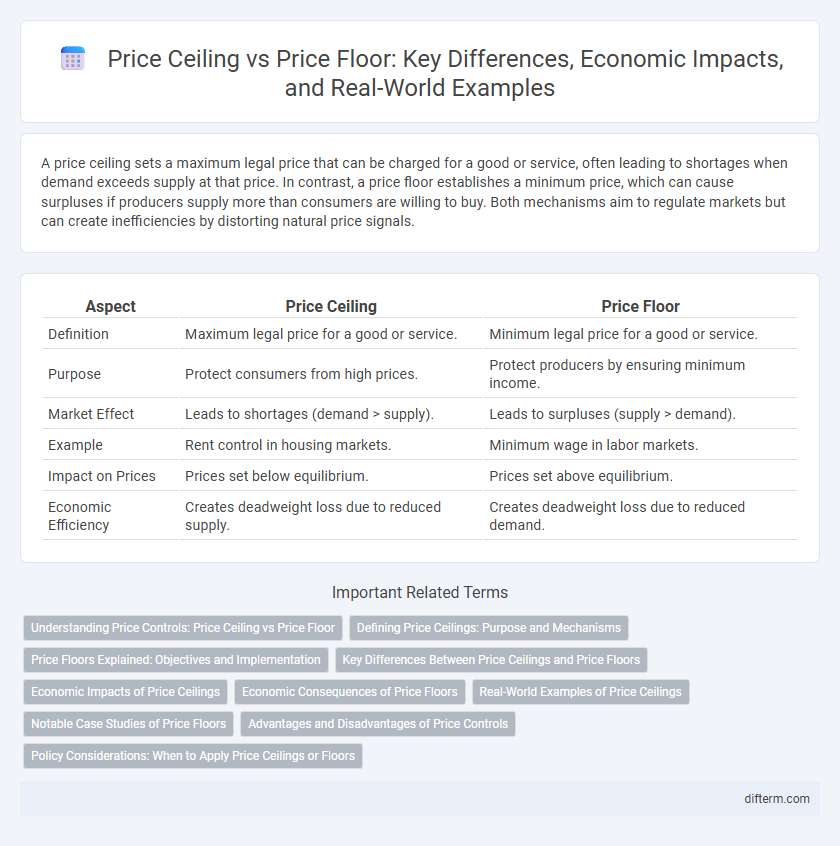

A price ceiling sets a maximum legal price that can be charged for a good or service, often leading to shortages when demand exceeds supply at that price. In contrast, a price floor establishes a minimum price, which can cause surpluses if producers supply more than consumers are willing to buy. Both mechanisms aim to regulate markets but can create inefficiencies by distorting natural price signals.

Table of Comparison

| Aspect | Price Ceiling | Price Floor |

|---|---|---|

| Definition | Maximum legal price for a good or service. | Minimum legal price for a good or service. |

| Purpose | Protect consumers from high prices. | Protect producers by ensuring minimum income. |

| Market Effect | Leads to shortages (demand > supply). | Leads to surpluses (supply > demand). |

| Example | Rent control in housing markets. | Minimum wage in labor markets. |

| Impact on Prices | Prices set below equilibrium. | Prices set above equilibrium. |

| Economic Efficiency | Creates deadweight loss due to reduced supply. | Creates deadweight loss due to reduced demand. |

Understanding Price Controls: Price Ceiling vs Price Floor

Price controls are government-imposed limits on the prices charged for goods and services to regulate market outcomes. A price ceiling sets the maximum price sellers can charge, often leading to shortages when demand exceeds supply, while a price floor establishes a minimum price, potentially causing surpluses if supply surpasses demand. Understanding the economic impact of price ceilings and floors is crucial for analyzing market equilibrium disruptions and policy effectiveness.

Defining Price Ceilings: Purpose and Mechanisms

Price ceilings establish a maximum legal price for goods or services, designed to protect consumers from excessively high costs during market shortages. This regulatory mechanism aims to increase affordability by preventing prices from rising above an imposed limit, often leading to increased demand but potential supply shortages. Governments implement price ceilings in essential markets such as housing and energy to stabilize prices and ensure access for lower-income populations.

Price Floors Explained: Objectives and Implementation

Price floors are government-imposed minimum prices set above the equilibrium price to ensure producers receive a fair income, commonly used in markets like agriculture and labor. These interventions aim to prevent prices from falling too low, protecting producers from volatile or unfairly low market conditions while potentially leading to surpluses if demand decreases. Implementing price floors requires careful monitoring to balance producer support against market distortions and inefficiencies.

Key Differences Between Price Ceilings and Price Floors

Price ceilings set a maximum price limit below the equilibrium price to prevent prices from rising too high, often leading to shortages as demand exceeds supply. Price floors establish a minimum price above the equilibrium price to ensure producers receive a baseline income, frequently resulting in surpluses where supply surpasses demand. Key differences include their opposite impacts on market equilibrium, with price ceilings causing excess demand and price floors causing excess supply.

Economic Impacts of Price Ceilings

Price ceilings create shortages by setting maximum allowable prices below equilibrium, reducing incentives for producers to supply goods and services. This intervention can lead to black markets, decreased product quality, and inefficiencies in resource allocation. Consumers may benefit from lower prices in the short term but often face long-term scarcity and reduced market innovation.

Economic Consequences of Price Floors

Price floors set above equilibrium prices lead to persistent surpluses as supply exceeds demand, causing inefficient resource allocation and wasted production. This market distortion often results in government intervention through purchasing or storing excess goods, increasing fiscal burdens. Long-term economic consequences include reduced market competitiveness and potential black markets as producers and consumers seek alternatives.

Real-World Examples of Price Ceilings

Rent control policies in cities like New York and San Francisco serve as prominent examples of price ceilings, capping maximum rent prices to protect tenants from sharp increases. These regulations often lead to reduced housing supply due to decreased landlord incentives, resulting in housing shortages and increased waiting lists. Similar price ceiling effects are observed in Venezuela's caps on staple food prices, which caused chronic shortages and black markets.

Notable Case Studies of Price Floors

The minimum wage laws in the United States represent a significant case study of price floors, where governments set legally binding minimum prices for labor to protect workers from exploitation. Another notable example is agricultural price floors in the European Union, designed to stabilize farmers' incomes by guaranteeing a minimum price for products like milk and wheat. These price floors often lead to surpluses, as supply exceeds demand at the enforced minimum price, highlighting market distortions in labor and commodity markets.

Advantages and Disadvantages of Price Controls

Price ceilings, designed to keep essential goods affordable, protect consumers from price gouging but often lead to shortages and reduced product quality due to decreased producer incentives. Price floors, such as minimum wage laws, guarantee fair earnings and help prevent market exploitation, yet they can cause surpluses and unemployment if set above the equilibrium price. Both price controls can distort market signals, leading to inefficiencies in resource allocation and unintended economic consequences.

Policy Considerations: When to Apply Price Ceilings or Floors

Price ceilings are effective when preventing prices from rising too high on essential goods, such as housing or basic food items, to protect consumers from inflationary pressures. Price floors are suitable in markets where producers need guaranteed income levels, like minimum wage laws or agricultural product guarantees, to avoid market failures and ensure economic stability. Policymakers consider factors such as market supply-demand imbalances, potential shortages or surpluses, and social welfare impacts before implementing these price controls.

Price ceiling vs Price floor Infographic

difterm.com

difterm.com