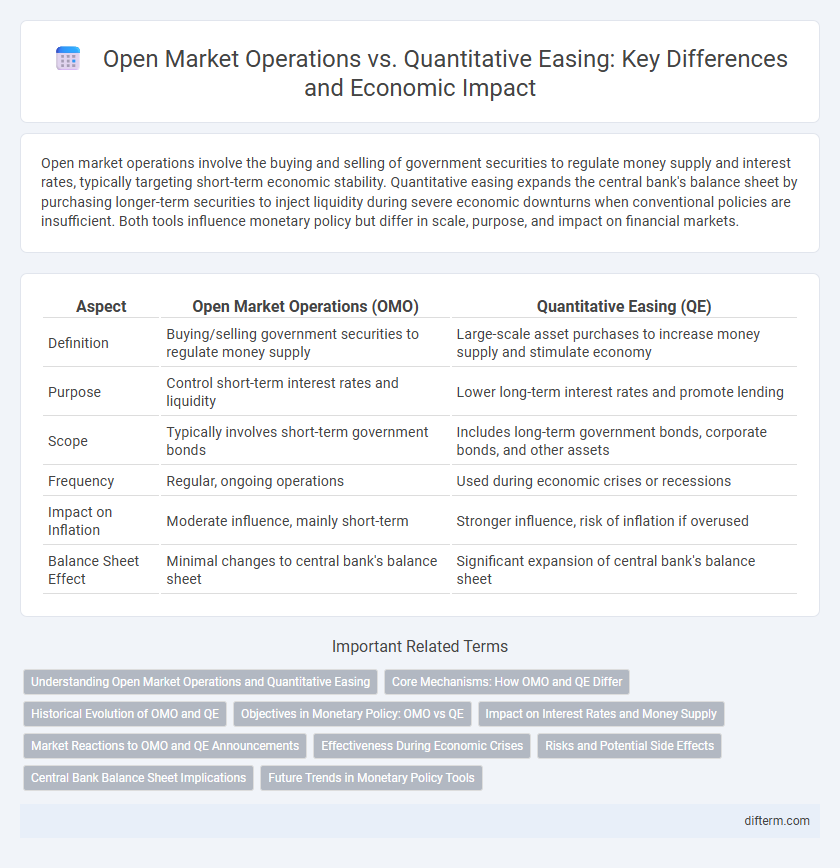

Open market operations involve the buying and selling of government securities to regulate money supply and interest rates, typically targeting short-term economic stability. Quantitative easing expands the central bank's balance sheet by purchasing longer-term securities to inject liquidity during severe economic downturns when conventional policies are insufficient. Both tools influence monetary policy but differ in scale, purpose, and impact on financial markets.

Table of Comparison

| Aspect | Open Market Operations (OMO) | Quantitative Easing (QE) |

|---|---|---|

| Definition | Buying/selling government securities to regulate money supply | Large-scale asset purchases to increase money supply and stimulate economy |

| Purpose | Control short-term interest rates and liquidity | Lower long-term interest rates and promote lending |

| Scope | Typically involves short-term government bonds | Includes long-term government bonds, corporate bonds, and other assets |

| Frequency | Regular, ongoing operations | Used during economic crises or recessions |

| Impact on Inflation | Moderate influence, mainly short-term | Stronger influence, risk of inflation if overused |

| Balance Sheet Effect | Minimal changes to central bank's balance sheet | Significant expansion of central bank's balance sheet |

Understanding Open Market Operations and Quantitative Easing

Open Market Operations (OMO) involve the central bank buying or selling government securities in the open market to regulate money supply and influence short-term interest rates, which helps control inflation and stabilize the economy. Quantitative Easing (QE) is an unconventional monetary policy where the central bank purchases longer-term securities to inject liquidity into the financial system, aiming to stimulate economic activity during periods of low inflation and slow growth. Both tools adjust the money supply but differ in scale, target assets, and economic conditions under which they are applied.

Core Mechanisms: How OMO and QE Differ

Open Market Operations (OMO) involve short-term buying and selling of government securities to regulate liquidity and control interest rates directly within the banking system. Quantitative Easing (QE) employs large-scale asset purchases, including long-term securities, to inject substantial capital, aiming to lower long-term interest rates and stimulate economic growth during downturns. The core mechanism difference lies in OMO's focus on immediate liquidity adjustment versus QE's strategic expansion of the central bank's balance sheet to influence broader financial conditions.

Historical Evolution of OMO and QE

Open market operations (OMO) emerged in the early 20th century as a primary monetary policy tool used by central banks to control short-term interest rates and regulate money supply through buying and selling government securities. Quantitative easing (QE) evolved during the 2008 global financial crisis when traditional OMOs were insufficient to stimulate economic growth, leading central banks to purchase large-scale assets, including long-term government bonds and mortgage-backed securities, to inject liquidity. The historical evolution of OMO and QE reflects a shift from conventional liquidity management toward proactive crisis-response strategies aimed at stabilizing financial systems and encouraging lending during periods of economic distress.

Objectives in Monetary Policy: OMO vs QE

Open market operations (OMO) primarily aim to regulate short-term interest rates and control liquidity by buying or selling government securities in the open market, ensuring price stability and economic growth. Quantitative easing (QE) targets long-term interest rates and expands the central bank's balance sheet to stimulate lending and investment during periods of economic downturn or liquidity traps. Both tools serve monetary policy objectives, but OMO maintains daily liquidity management, while QE acts as an unconventional measure to support broader economic recovery.

Impact on Interest Rates and Money Supply

Open market operations directly influence short-term interest rates by buying or selling government securities, thereby adjusting the money supply in the economy. Quantitative easing involves large-scale asset purchases beyond traditional open market operations, significantly increasing the money supply and lowering long-term interest rates to stimulate economic growth. The primary difference lies in their scale and duration of impact, with quantitative easing targeting broader financial conditions and sustaining lower interest rates over a longer period.

Market Reactions to OMO and QE Announcements

Market reactions to Open Market Operations (OMO) typically involve immediate fluctuations in short-term interest rates and liquidity conditions, reflecting the central bank's intent to manage monetary policy targets. Quantitative Easing (QE) announcements often lead to broader asset price adjustments, including declines in government bond yields and increases in equity markets, driven by expectations of prolonged monetary accommodation. Investor sentiment and expectations about future economic growth and inflation play crucial roles in shaping these distinct market responses.

Effectiveness During Economic Crises

Open market operations (OMOs) involve buying or selling government securities to regulate short-term interest rates and liquidity, proving effective for fine-tuning economic conditions during mild downturns. Quantitative easing (QE) amplifies this by purchasing longer-term securities to inject substantial liquidity, often yielding stronger impacts in severe economic crises when traditional OMOs reach their limits. During the 2008 financial crisis and the COVID-19 pandemic, QE demonstrated greater effectiveness in lowering long-term interest rates, supporting credit flow, and stabilizing financial markets compared to standard OMOs.

Risks and Potential Side Effects

Open market operations primarily affect short-term interest rates with limited risk of inflation but can lead to liquidity shortages if mismanaged. Quantitative easing involves large-scale asset purchases that risk asset bubbles, long-term inflation, and reduced central bank balance sheet flexibility. Both tools carry potential distortions in financial markets and can impact the economy's stability if used excessively.

Central Bank Balance Sheet Implications

Open market operations directly influence central bank balance sheets by buying or selling short-term government securities, adjusting reserve levels and interest rates with minimal long-term asset accumulation. Quantitative easing involves large-scale purchases of longer-duration securities, significantly expanding the central bank's balance sheet and increasing the monetary base to stimulate economic activity. The sustained asset growth from quantitative easing can lead to prolonged inflationary pressures and challenges in unwinding balance sheet positions.

Future Trends in Monetary Policy Tools

Future trends in monetary policy tools emphasize a sophisticated balance between open market operations (OMO) and quantitative easing (QE) to manage economic stability and inflation control. Central banks are increasingly integrating digital currencies and real-time data analytics to enhance the precision and responsiveness of OMO, while QE remains a powerful instrument for larger-scale liquidity injections during economic downturns. Innovations in algorithm-driven trading systems and AI analytics are expected to optimize the timing and scale of these tools, fostering more adaptive and transparent monetary policy frameworks.

Open market operations vs Quantitative easing Infographic

difterm.com

difterm.com