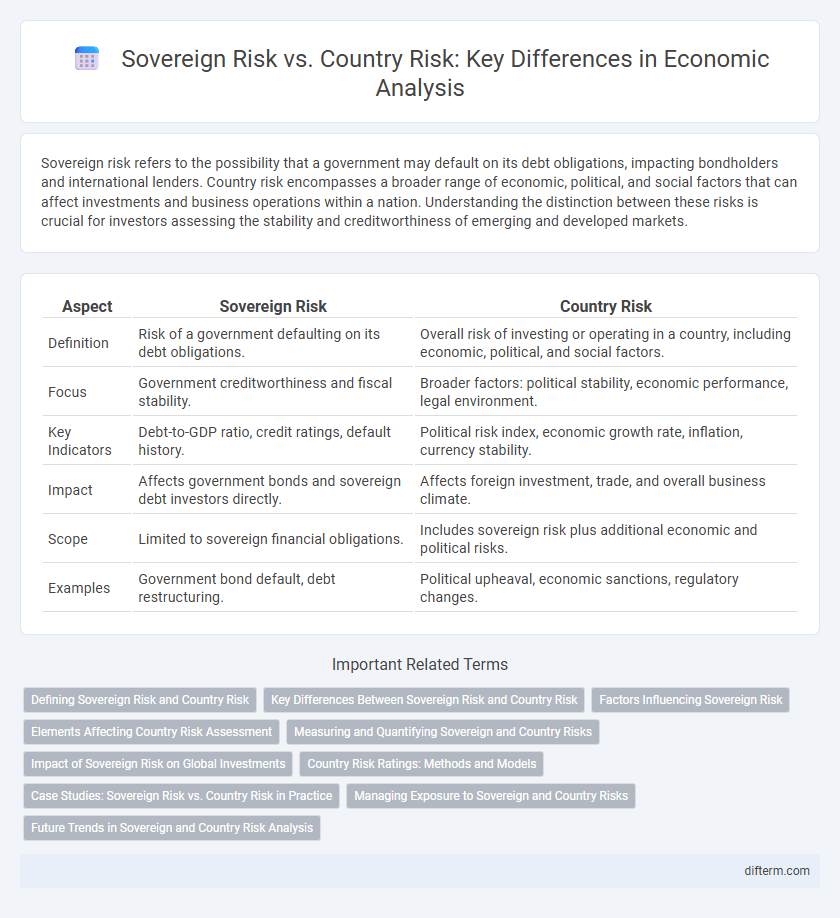

Sovereign risk refers to the possibility that a government may default on its debt obligations, impacting bondholders and international lenders. Country risk encompasses a broader range of economic, political, and social factors that can affect investments and business operations within a nation. Understanding the distinction between these risks is crucial for investors assessing the stability and creditworthiness of emerging and developed markets.

Table of Comparison

| Aspect | Sovereign Risk | Country Risk |

|---|---|---|

| Definition | Risk of a government defaulting on its debt obligations. | Overall risk of investing or operating in a country, including economic, political, and social factors. |

| Focus | Government creditworthiness and fiscal stability. | Broader factors: political stability, economic performance, legal environment. |

| Key Indicators | Debt-to-GDP ratio, credit ratings, default history. | Political risk index, economic growth rate, inflation, currency stability. |

| Impact | Affects government bonds and sovereign debt investors directly. | Affects foreign investment, trade, and overall business climate. |

| Scope | Limited to sovereign financial obligations. | Includes sovereign risk plus additional economic and political risks. |

| Examples | Government bond default, debt restructuring. | Political upheaval, economic sanctions, regulatory changes. |

Defining Sovereign Risk and Country Risk

Sovereign risk refers to the likelihood that a government will default on its debt obligations or enact policies that negatively impact foreign investors and creditors. Country risk encompasses a broader array of economic, political, and social factors that affect the overall investment environment within a nation, including sovereign risk as one of its components. Understanding sovereign risk is essential for evaluating creditworthiness, whereas country risk provides a comprehensive assessment of potential challenges to investment returns in a specific country.

Key Differences Between Sovereign Risk and Country Risk

Sovereign risk specifically refers to the risk that a government will default on its debt obligations or fail to meet financial commitments, directly impacting bondholders and international lenders. Country risk encompasses a broader spectrum of political, economic, and social factors that can affect investments and business operations within a nation, including currency instability, political unrest, and regulatory changes. While sovereign risk is a subset focused on government creditworthiness, country risk assesses overall macroeconomic conditions and geopolitical factors influencing all types of investments.

Factors Influencing Sovereign Risk

Sovereign risk is primarily influenced by a country's fiscal health, including debt levels, budget deficits, and foreign currency reserves, which affect its ability to meet debt obligations. Political stability, governance quality, and economic policies also play critical roles in determining sovereign risk by influencing investor confidence and economic resilience. External factors such as global economic conditions, commodity prices, and exchange rate volatility further impact sovereign risk by affecting a nation's revenue streams and external debt servicing capacity.

Elements Affecting Country Risk Assessment

Country risk assessment encompasses political stability, economic conditions, and external debt levels, all of which influence sovereign risk evaluation. Key elements include government creditworthiness, fiscal policies, inflation rates, and geopolitical tensions that affect a nation's ability to meet financial obligations. Market volatility, currency fluctuations, and trade balance also play crucial roles in determining the overall country risk profile.

Measuring and Quantifying Sovereign and Country Risks

Measuring sovereign risk involves evaluating a nation's ability and willingness to fulfill its debt obligations, typically quantified through credit ratings, debt-to-GDP ratios, and fiscal deficits. Country risk expands beyond sovereign risk by incorporating political stability, economic performance, and regulatory environment, using indices like the Political Risk Index and macroeconomic indicators such as inflation rates and foreign exchange reserves. Quantitative analysis of both risks relies on combining these financial metrics with qualitative assessments to provide comprehensive risk profiles for investors and policymakers.

Impact of Sovereign Risk on Global Investments

Sovereign risk directly affects global investments by influencing the likelihood of a government defaulting on its debt or imposing capital controls, which can lead to significant financial losses for international investors. This risk prompts higher borrowing costs for affected countries and increased volatility in global markets, as investors reassess exposure to sovereign bonds and related assets. Understanding sovereign risk is crucial for portfolio diversification, risk management, and the stability of cross-border capital flows in the global economy.

Country Risk Ratings: Methods and Models

Country risk ratings evaluate the economic, political, and financial stability of a nation using quantitative and qualitative methods to assess potential risks for investors. Models often incorporate macroeconomic indicators, political risk factors, and external vulnerabilities, integrating data from credit risk agencies, international organizations, and market analysis. Advanced methodologies include econometric models, machine learning techniques, and expert judgment to generate comprehensive risk scores that influence sovereign credit spreads and foreign direct investment decisions.

Case Studies: Sovereign Risk vs. Country Risk in Practice

Case studies reveal sovereign risk as the possibility of a government defaulting on its debt obligations, often influenced by fiscal mismanagement or political instability, exemplified by Argentina's debt crisis in 2001. Country risk extends beyond sovereign default to include economic, political, and social factors affecting the broader investment climate, as seen in Venezuela's hyperinflation and political turmoil impacting foreign investments. Investors utilize risk assessment models combining credit ratings, macroeconomic indicators, and geopolitical analysis to differentiate sovereign risk from overall country risk for portfolio management.

Managing Exposure to Sovereign and Country Risks

Effective management of sovereign and country risks involves diversifying investments across multiple nations to mitigate potential losses from political instability or economic downturns. Utilizing credit default swaps and political risk insurance further protects against defaults and expropriation associated with sovereign risk. Continuous monitoring of macroeconomic indicators, fiscal policies, and geopolitical developments helps in adjusting exposure proactively to safeguard portfolio stability.

Future Trends in Sovereign and Country Risk Analysis

Future trends in sovereign and country risk analysis emphasize the integration of artificial intelligence and big data analytics to enhance predictive accuracy and real-time monitoring. Increasing geopolitical tensions, climate change impacts, and global debt levels are reshaping risk assessment frameworks, demanding more dynamic and scenario-based models. Investors and policymakers are prioritizing ESG factors alongside traditional economic indicators to address evolving fiscal vulnerabilities and sustainability challenges.

Sovereign risk vs Country risk Infographic

difterm.com

difterm.com