Purchasing Power Parity (PPP) adjusts for differences in price levels between countries, providing a more accurate comparison of economic productivity and living standards than nominal exchange rates. Exchange rates can fluctuate due to market speculation, interest rate changes, and geopolitical events, often distorting the true value of currencies in terms of domestic purchasing power. PPP offers a stable measure by reflecting the relative cost of a standard basket of goods, enabling better comparisons of economic output and income across nations.

Table of Comparison

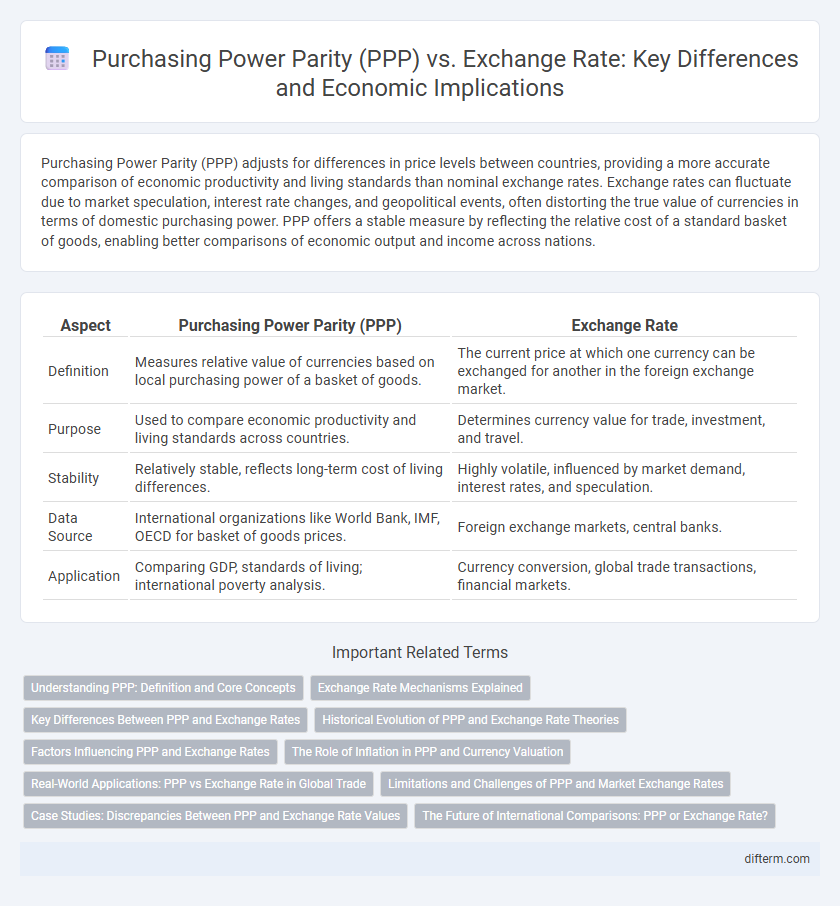

| Aspect | Purchasing Power Parity (PPP) | Exchange Rate |

|---|---|---|

| Definition | Measures relative value of currencies based on local purchasing power of a basket of goods. | The current price at which one currency can be exchanged for another in the foreign exchange market. |

| Purpose | Used to compare economic productivity and living standards across countries. | Determines currency value for trade, investment, and travel. |

| Stability | Relatively stable, reflects long-term cost of living differences. | Highly volatile, influenced by market demand, interest rates, and speculation. |

| Data Source | International organizations like World Bank, IMF, OECD for basket of goods prices. | Foreign exchange markets, central banks. |

| Application | Comparing GDP, standards of living; international poverty analysis. | Currency conversion, global trade transactions, financial markets. |

Understanding PPP: Definition and Core Concepts

Purchasing Power Parity (PPP) is an economic theory that compares different countries' currencies through a "basket of goods" to determine the relative value and cost of living. Unlike nominal exchange rates, PPP accounts for price level differences, providing a more accurate measure of a currency's true purchasing power and economic productivity. Core concepts of PPP include the Law of One Price, which states that identical goods should have the same price in different countries when prices are expressed in a common currency.

Exchange Rate Mechanisms Explained

Exchange rate mechanisms determine the value of one currency relative to another based on market supply and demand, government interventions, or fixed pegs to stable currencies. Unlike Purchasing Power Parity (PPP), which compares the relative cost of a standard basket of goods across countries to assess currency value, exchange rates reflect real-time financial flows, interest rates, and market sentiment. Understanding exchange rate regimes--floating, fixed, or pegged--clarifies how currency values respond to economic indicators and international trade dynamics.

Key Differences Between PPP and Exchange Rates

Purchasing Power Parity (PPP) compares the relative value of currencies based on the cost of a standard basket of goods, reflecting long-term economic equilibrium, while exchange rates fluctuate due to market demand, interest rates, and capital flows, capturing short-term currency value. PPP provides a more stable measure for comparing living standards and economic productivity across countries, whereas exchange rates often reflect speculation, geopolitical events, and monetary policy. The key difference lies in PPP's focus on price level adjustments for real purchasing power versus exchange rates' alignment with financial market conditions and currency supply-demand dynamics.

Historical Evolution of PPP and Exchange Rate Theories

Purchasing Power Parity (PPP) theory emerged in the early 20th century to address limitations in nominal exchange rates by comparing relative price levels across countries, providing a long-term equilibrium baseline for exchange rate determination. Classical exchange rate theories, such as the Gold Standard and the Bretton Woods system, evolved alongside PPP, emphasizing fixed parity mechanisms, while modern floating exchange rate regimes reflect market-driven adjustments influenced by interest rates, inflation, and capital flows. Empirical studies highlight PPP's convergence in the long run, though short-term deviations persist due to market imperfections, policy interventions, and differential economic shocks.

Factors Influencing PPP and Exchange Rates

Inflation differentials between countries directly impact Purchasing Power Parity by altering the relative price levels of goods and services, while exchange rates fluctuate due to factors such as interest rate differentials, trade balances, and capital flows. Market speculation and government interventions further influence currency exchange rates, often causing deviations from the PPP-implied values. Long-term economic growth disparities also shape PPP adjustments, reflecting changes in productivity and consumption patterns across nations.

The Role of Inflation in PPP and Currency Valuation

Inflation significantly impacts Purchasing Power Parity (PPP) by altering the relative price levels between countries, causing PPP-based currency valuations to adjust accordingly. Persistent inflation differentials distort exchange rates, leading to deviations from PPP in the short term as nominal exchange rates fluctuate to maintain trade competitiveness. Understanding inflation trends is crucial for accurately interpreting PPP signals and forecasting currency movements in global economic analysis.

Real-World Applications: PPP vs Exchange Rate in Global Trade

Purchasing Power Parity (PPP) offers a more accurate reflection of the relative value of currencies by accounting for differences in cost of living and inflation rates, unlike nominal exchange rates that are influenced by market speculation and monetary policies. Multinational companies utilize PPP for pricing strategies and market entry decisions, ensuring that goods and services have equitable value across countries. In global trade, PPP-adjusted figures facilitate better comparison of economic productivity and standards of living, aiding policymakers in crafting balanced trade agreements and economic forecasts.

Limitations and Challenges of PPP and Market Exchange Rates

Purchasing Power Parity (PPP) often struggles to capture short-term economic fluctuations due to its reliance on long-term price level comparisons, making it less effective for real-time market analysis. Market exchange rates, influenced by speculative activities, capital flows, and geopolitical events, frequently deviate from PPP values, causing volatility and misalignment in currency valuation. Both measures face limitations: PPP may overlook trade barriers and non-tradable goods, while exchange rates can be distorted by government interventions and market sentiment.

Case Studies: Discrepancies Between PPP and Exchange Rate Values

Case studies reveal significant discrepancies between Purchasing Power Parity (PPP) and exchange rate values, particularly in emerging markets such as India and Brazil, where local price levels deviate substantially from international currency valuations. Analyzing China's economy illustrates how exchange rates often undervalue the yuan compared to PPP measures, reflecting controlled currency policies and differing inflation rates. These discrepancies highlight challenges in using exchange rates alone for cross-country economic comparisons and emphasize the need for PPP adjustments to capture real purchasing power accurately.

The Future of International Comparisons: PPP or Exchange Rate?

The future of international comparisons increasingly favors Purchasing Power Parity (PPP) over market exchange rates due to its ability to provide a more accurate reflection of living standards and economic productivity across countries. PPP adjusts for price level differences, eliminating distortions caused by volatile currency fluctuations and speculative trade impacts seen in exchange rate comparisons. As global economic integration deepens, researchers and policymakers rely more on PPP to assess real income gaps and inform development strategies.

PPP (Purchasing Power Parity) vs exchange rate Infographic

difterm.com

difterm.com