The balance of payment records all economic transactions between a country and the rest of the world, encompassing trade, investments, and financial transfers, while the balance of trade specifically measures the difference between a nation's exports and imports of goods and services. A surplus in the balance of trade contributes positively to the current account in the balance of payment, reflecting stronger export performance relative to imports. Understanding the distinction between these two indicators is crucial for assessing a country's overall economic health and its position in international markets.

Table of Comparison

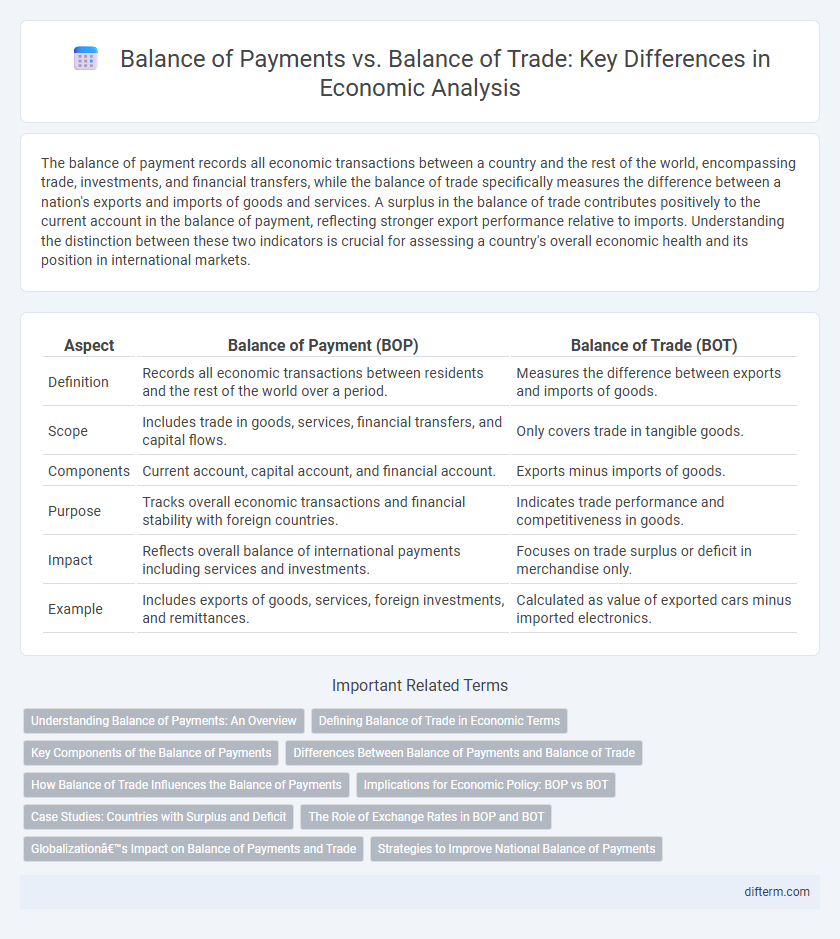

| Aspect | Balance of Payment (BOP) | Balance of Trade (BOT) |

|---|---|---|

| Definition | Records all economic transactions between residents and the rest of the world over a period. | Measures the difference between exports and imports of goods. |

| Scope | Includes trade in goods, services, financial transfers, and capital flows. | Only covers trade in tangible goods. |

| Components | Current account, capital account, and financial account. | Exports minus imports of goods. |

| Purpose | Tracks overall economic transactions and financial stability with foreign countries. | Indicates trade performance and competitiveness in goods. |

| Impact | Reflects overall balance of international payments including services and investments. | Focuses on trade surplus or deficit in merchandise only. |

| Example | Includes exports of goods, services, foreign investments, and remittances. | Calculated as value of exported cars minus imported electronics. |

Understanding Balance of Payments: An Overview

The balance of payments (BOP) records all economic transactions between residents of a country and the rest of the world, encompassing the trade of goods, services, investment incomes, and financial transfers. Unlike the balance of trade, which measures only the difference between exports and imports of goods and services, the BOP provides a comprehensive overview including the current account, capital account, and financial account. Understanding the balance of payments is crucial for assessing a country's economic stability, external economic position, and policy implications related to exchange rates and international investment flows.

Defining Balance of Trade in Economic Terms

Balance of trade refers to the difference between a country's exports and imports of goods during a specific period, representing a crucial component of the overall balance of payments. It measures the net inflow or outflow of physical goods and directly impacts a nation's trade surplus or deficit. Understanding the balance of trade helps economists assess the economic health, competitiveness, and currency stability of an economy.

Key Components of the Balance of Payments

The Balance of Payments (BOP) encompasses the current account, capital account, and financial account, recording all economic transactions between residents and the rest of the world. Key components include trade in goods and services, income flows, and unilateral transfers within the current account, alongside foreign investments and reserves tracked in the capital and financial accounts. Unlike the Balance of Trade, which only measures exports and imports of goods, the BOP provides a comprehensive overview of a country's economic dealings on a global scale.

Differences Between Balance of Payments and Balance of Trade

The balance of payments (BOP) records all economic transactions between residents of a country and the rest of the world, including trade, financial transfers, and investment flows, while the balance of trade (BOT) specifically measures the difference between exports and imports of goods and services. The BOP consists of the current account, capital account, and financial account, encompassing a broader scope, whereas the BOT is a subset focused solely on the trade of goods and services. Countries monitor both indicators to assess economic health; a surplus or deficit in the BOT directly impacts the current account, but the BOP presents a comprehensive view of international economic interactions.

How Balance of Trade Influences the Balance of Payments

The balance of trade, which measures the difference between a country's exports and imports of goods, directly affects the current account within the broader balance of payments framework. A trade surplus generates a positive inflow of foreign currency, strengthening the current account and potentially increasing foreign reserves, whereas a trade deficit leads to a negative current account, requiring financing through capital or financial account transactions. Fluctuations in the balance of trade consequently shape the overall balance of payments by influencing exchange rates, foreign investment flows, and macroeconomic policies.

Implications for Economic Policy: BOP vs BOT

The balance of payment (BOP) provides a comprehensive overview of all economic transactions between a country and the rest of the world, influencing monetary and fiscal policy decisions to maintain currency stability and foreign reserves. The balance of trade (BOT), a subset of the BOP focusing solely on imports and exports of goods, directly impacts trade policies, tariffs, and export incentives to address trade deficits or surpluses. Policymakers use BOP data to manage overall external economic relationships, while BOT figures guide sector-specific interventions aiming to enhance export competitiveness and reduce trade imbalances.

Case Studies: Countries with Surplus and Deficit

Countries with a balance of payments surplus, such as China and Germany, accumulate foreign reserves and strengthen currency stability through export-driven trade policies. Conversely, nations like the United States and India often experience balance of payments deficits due to high import demand and capital outflows despite occasional trade surpluses. Case studies reveal that managing these imbalances requires tailored fiscal and monetary strategies to sustain economic growth and currency valuation.

The Role of Exchange Rates in BOP and BOT

Exchange rates significantly influence the balance of payments (BOP) by affecting the value of a country's exports and imports, which are core components of the balance of trade (BOT). A depreciation in the domestic currency typically makes exports cheaper and imports more expensive, improving the trade balance and subsequently the current account in the BOP. Conversely, currency appreciation can worsen the BOT by making exports costlier and imports cheaper, thereby impacting a nation's overall balance of payments position.

Globalization’s Impact on Balance of Payments and Trade

Globalization intensifies cross-border transactions, significantly affecting the balance of payments by increasing capital flows and foreign investments, while also expanding the balance of trade through higher export-import volumes. Technological advancements and reduced trade barriers boost multinational corporations' activities, leading to complex financial accounts beyond goods and services exchanges. Emerging economies experience dynamic shifts with surplus trade balances but fluctuating capital accounts, reflecting globalization's multifaceted impact on economic stability.

Strategies to Improve National Balance of Payments

Strategies to improve the national balance of payments focus on enhancing export competitiveness, attracting foreign direct investment, and managing exchange rates to stabilize trade flows. Implementing policies that promote innovation, diversify export markets, and reduce reliance on imports can strengthen the balance of trade component. Monetary and fiscal measures aimed at improving capital account inflows also contribute to a healthier overall balance of payments position.

Balance of payment vs Balance of trade Infographic

difterm.com

difterm.com