Short-run economic fluctuations often reflect temporary changes in demand, supply, and production capacity, impacting output and employment levels. Long-run economic growth depends on factors such as technological innovation, capital accumulation, and improvements in labor productivity, which enhance overall potential output. Policymakers aim to balance short-run stabilization with strategies that promote sustainable long-run expansion.

Table of Comparison

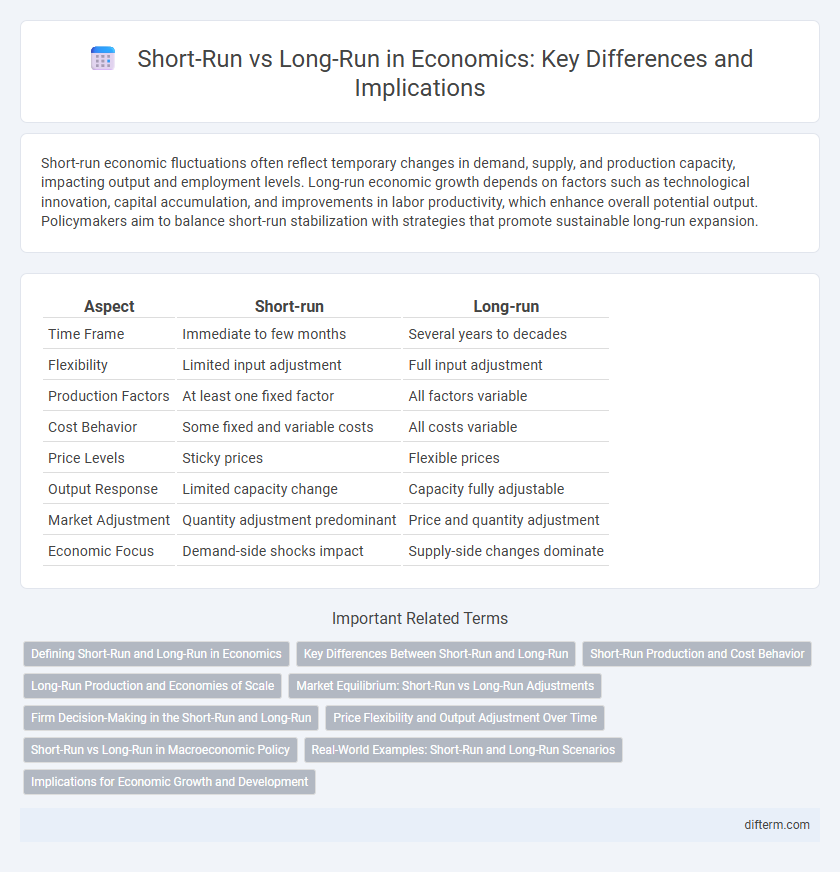

| Aspect | Short-run | Long-run |

|---|---|---|

| Time Frame | Immediate to few months | Several years to decades |

| Flexibility | Limited input adjustment | Full input adjustment |

| Production Factors | At least one fixed factor | All factors variable |

| Cost Behavior | Some fixed and variable costs | All costs variable |

| Price Levels | Sticky prices | Flexible prices |

| Output Response | Limited capacity change | Capacity fully adjustable |

| Market Adjustment | Quantity adjustment predominant | Price and quantity adjustment |

| Economic Focus | Demand-side shocks impact | Supply-side changes dominate |

Defining Short-Run and Long-Run in Economics

The short-run in economics refers to a period during which at least one factor of production is fixed, limiting firms' ability to fully adjust to changes in market conditions. The long-run represents a timeframe where all inputs can be varied, allowing businesses to optimize production and achieve economies of scale. Understanding the distinction between short-run and long-run is crucial for analyzing supply behavior, cost structures, and market equilibrium dynamics.

Key Differences Between Short-Run and Long-Run

Short-run economic analysis typically assumes at least one fixed input, such as capital, leading to varying cost structures and limited production flexibility, whereas long-run analysis assumes all inputs are variable with firms optimizing input combinations for cost efficiency. In the short-run, firms may experience diminishing marginal returns due to fixed factors, but in the long-run, economies of scale enable adjustments to factory size and technology, impacting total cost and output levels. Price adjustments and market equilibrium can differ as demand and supply response lags in the short-run but fully reflect changes in the long-run, influencing investment and resource allocation decisions.

Short-Run Production and Cost Behavior

Short-run production is characterized by fixed and variable inputs, where at least one input, such as capital, remains constant while labor and materials vary. Cost behavior in the short run involves fixed costs that do not change with output levels and variable costs that increase as production expands. Understanding the relationship between marginal cost and average total cost is critical for optimizing output and minimizing costs in the short run.

Long-Run Production and Economies of Scale

In the long run, firms can adjust all input factors, allowing for optimal production levels and achieving economies of scale that reduce average costs as output expands. This flexibility contrasts with the short run, where at least one input is fixed, limiting the firm's ability to lower costs significantly. Economies of scale arise from factors such as labor specialization, bulk purchasing, and technological improvements, which enhance efficiency and competitive advantage over time.

Market Equilibrium: Short-Run vs Long-Run Adjustments

Market equilibrium in the short run occurs when aggregate demand equals aggregate supply, often influenced by rigid prices and wages that prevent immediate adjustment. In the long run, prices and wages become flexible, enabling full adjustment of output to potential levels, restoring natural unemployment and optimizing resource allocation. This shift from short-run to long-run equilibrium reflects the economy's ability to self-correct over time through supply-side flexibility and factor mobility.

Firm Decision-Making in the Short-Run and Long-Run

In the short-run, firms make decisions based on fixed and variable inputs, optimizing production without altering capital assets, often focusing on covering variable costs to avoid losses. Long-run decision-making allows firms to adjust all inputs, including capital, enabling entry or exit from the market and optimizing scale to achieve minimum average cost. Understanding these temporal distinctions is critical for analyzing firm behavior, cost structures, and industry supply dynamics.

Price Flexibility and Output Adjustment Over Time

In the short run, prices tend to be sticky due to menu costs, contracts, and wage rigidity, limiting firms' ability to adjust output in response to demand changes. Over the long run, prices become flexible as contracts expire and firms can fully adapt, allowing output to return to its natural level determined by factors like technology and resources. This price flexibility in the long run ensures that markets clear and economic resources are allocated efficiently.

Short-Run vs Long-Run in Macroeconomic Policy

Short-run macroeconomic policy primarily targets immediate fluctuations in output and employment through demand management tools such as fiscal stimulus and monetary easing. Long-run macroeconomic policy emphasizes structural reforms, productivity enhancement, and investment in human capital to sustain economic growth and stability. Central banks and governments balance short-run stabilization with long-run goals to maximize overall economic welfare.

Real-World Examples: Short-Run and Long-Run Scenarios

In the short run, businesses often face fixed costs and limited ability to adjust production, as seen during supply chain disruptions like the COVID-19 pandemic, which caused temporary production slowdowns. In contrast, long-run scenarios allow firms to adapt by investing in new technologies or expanding capacity, exemplified by the rise of remote work infrastructure after the pandemic. Economic policies targeting immediate relief, such as stimulus checks, address short-run challenges, whereas structural reforms aim to boost long-term growth and productivity.

Implications for Economic Growth and Development

Short-run economic fluctuations primarily affect output and employment without altering potential GDP, while long-run growth depends on factors like technological innovation, capital accumulation, and labor force expansion. Policymakers targeting short-run stability may implement fiscal or monetary stimulus, but sustainable development requires structural reforms and investments that enhance productivity over time. Understanding the distinction between short-run cyclical changes and long-run growth trends is crucial for designing effective economic strategies that promote sustained improvements in living standards.

Short-run vs Long-run Infographic

difterm.com

difterm.com