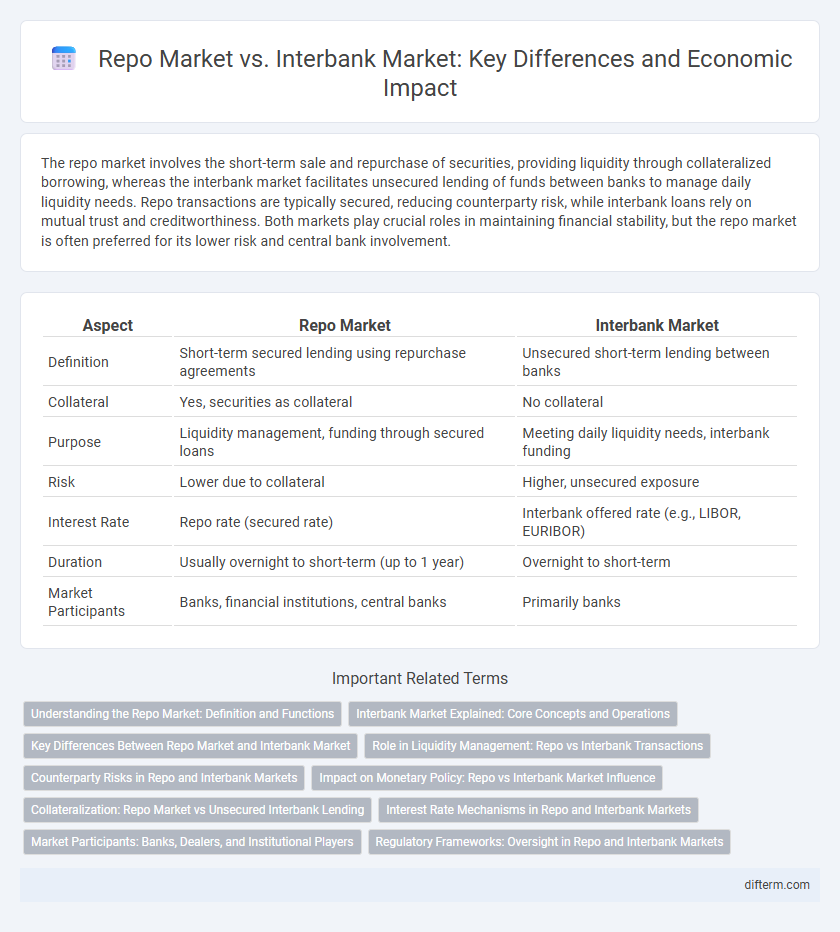

The repo market involves the short-term sale and repurchase of securities, providing liquidity through collateralized borrowing, whereas the interbank market facilitates unsecured lending of funds between banks to manage daily liquidity needs. Repo transactions are typically secured, reducing counterparty risk, while interbank loans rely on mutual trust and creditworthiness. Both markets play crucial roles in maintaining financial stability, but the repo market is often preferred for its lower risk and central bank involvement.

Table of Comparison

| Aspect | Repo Market | Interbank Market |

|---|---|---|

| Definition | Short-term secured lending using repurchase agreements | Unsecured short-term lending between banks |

| Collateral | Yes, securities as collateral | No collateral |

| Purpose | Liquidity management, funding through secured loans | Meeting daily liquidity needs, interbank funding |

| Risk | Lower due to collateral | Higher, unsecured exposure |

| Interest Rate | Repo rate (secured rate) | Interbank offered rate (e.g., LIBOR, EURIBOR) |

| Duration | Usually overnight to short-term (up to 1 year) | Overnight to short-term |

| Market Participants | Banks, financial institutions, central banks | Primarily banks |

Understanding the Repo Market: Definition and Functions

The repo market facilitates short-term borrowing through repurchase agreements, where securities are sold and later repurchased at a predetermined price, providing liquidity and collateralized funding to financial institutions. It plays a crucial role in monetary policy implementation and financial stability by enabling central banks to inject or absorb cash efficiently. Unlike the interbank market, which involves unsecured lending between banks, the repo market minimizes credit risk through secured transactions using government securities as collateral.

Interbank Market Explained: Core Concepts and Operations

The interbank market is a crucial financial system where banks trade funds among themselves to manage liquidity and meet reserve requirements efficiently. Transactions in this market typically involve unsecured short-term loans, with interest rates reflecting banks' credit risk, contrasting with the repo market's collateralized lending structure. Key operations include overnight lending, interest rate setting such as the LIBOR or federal funds rate, and facilitating monetary policy transmission.

Key Differences Between Repo Market and Interbank Market

The repo market involves the sale and repurchase of securities, providing short-term collateralized loans primarily used for liquidity management and financing. The interbank market consists of unsecured short-term loans between banks, aimed at meeting reserve requirements and managing daily funding needs. Key differences include collateralization, with repos secured by securities, whereas interbank loans are typically unsecured, impacting risk profiles and interest rates in each market.

Role in Liquidity Management: Repo vs Interbank Transactions

Repo market transactions provide short-term collateralized borrowing, enabling financial institutions to efficiently manage liquidity by temporarily exchanging securities for cash. Interbank market transactions, typically unsecured, facilitate direct lending between banks, helping maintain daily reserve requirements and smooth payment flows. Both markets are essential for liquidity management, with the repo market offering secured funding and the interbank market providing flexible, unsecured credit.

Counterparty Risks in Repo and Interbank Markets

Counterparty risk in the repo market is generally lower compared to the interbank market due to the collateralized nature of repo transactions, where securities serve as primary collateral, mitigating default risk. In contrast, interbank lending often involves unsecured loans, increasing exposure to counterparty credit risk, especially during periods of financial stress or market volatility. Effective risk management in both markets involves stringent credit assessments, daily margin calls in repo agreements, and central clearing mechanisms to minimize systemic risk.

Impact on Monetary Policy: Repo vs Interbank Market Influence

The repo market directly influences short-term interest rates by providing central banks with a key tool for liquidity management and open market operations. In contrast, the interbank market reflects prevailing credit conditions and overnight lending rates, impacting the transmission of monetary policy through commercial bank interactions. Understanding the dynamics between these markets is crucial for assessing the effectiveness of central bank interventions and overall financial stability.

Collateralization: Repo Market vs Unsecured Interbank Lending

The repo market relies on collateralized transactions where borrowers provide securities as collateral to secure short-term funding, reducing counterparty credit risk. In contrast, the interbank market primarily involves unsecured lending, exposing lenders to higher credit risk due to the absence of collateral. This collateralization in the repo market enhances liquidity and stability by mitigating default risk compared to the unsecured nature of interbank lending.

Interest Rate Mechanisms in Repo and Interbank Markets

Interest rate mechanisms in the repo market primarily depend on collateral quality and overnight funding demand, leading to typically lower, secured rates reflecting lower credit risk. In contrast, the interbank market features unsecured lending among banks, with interest rates influenced by creditworthiness assessments and liquidity conditions, often resulting in higher rates than repo transactions. Central banks monitor both markets closely as they provide critical signals for monetary policy transmission and overall financial system stability.

Market Participants: Banks, Dealers, and Institutional Players

Banks actively participate in both the repo and interbank markets, using the former for short-term collateralized borrowing and the latter for unsecured overnight lending to manage liquidity. Dealers primarily operate in the repo market, facilitating transactions by acting as intermediaries between institutional players seeking to lend or borrow cash against securities. Institutional players, including hedge funds and mutual funds, rely on the repo market to optimize portfolio funding while utilizing the interbank market for managing daily operational cash flow needs.

Regulatory Frameworks: Oversight in Repo and Interbank Markets

Regulatory frameworks governing the repo market emphasize strict collateral management and counterparty risk assessment to enhance transparency and systemic stability. In contrast, interbank market oversight prioritizes capital adequacy and liquidity requirements to mitigate credit risk among financial institutions. Both markets are subject to evolving regulations by authorities such as the Basel Committee and central banks to ensure resilient financial infrastructure.

Repo market vs interbank market Infographic

difterm.com

difterm.com