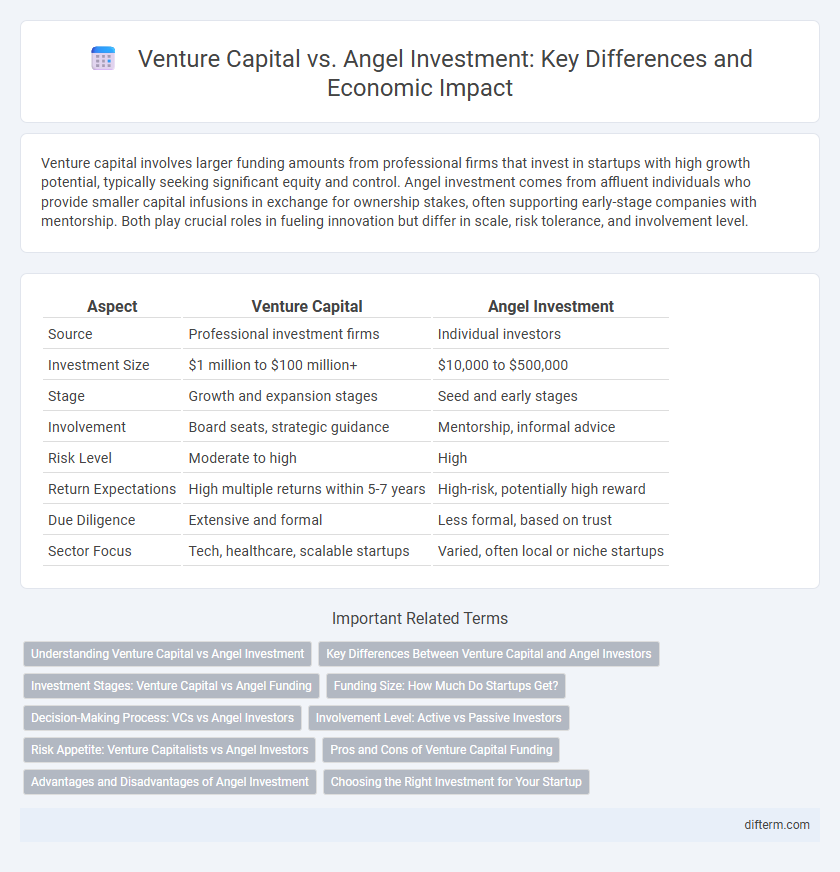

Venture capital involves larger funding amounts from professional firms that invest in startups with high growth potential, typically seeking significant equity and control. Angel investment comes from affluent individuals who provide smaller capital infusions in exchange for ownership stakes, often supporting early-stage companies with mentorship. Both play crucial roles in fueling innovation but differ in scale, risk tolerance, and involvement level.

Table of Comparison

| Aspect | Venture Capital | Angel Investment |

|---|---|---|

| Source | Professional investment firms | Individual investors |

| Investment Size | $1 million to $100 million+ | $10,000 to $500,000 |

| Stage | Growth and expansion stages | Seed and early stages |

| Involvement | Board seats, strategic guidance | Mentorship, informal advice |

| Risk Level | Moderate to high | High |

| Return Expectations | High multiple returns within 5-7 years | High-risk, potentially high reward |

| Due Diligence | Extensive and formal | Less formal, based on trust |

| Sector Focus | Tech, healthcare, scalable startups | Varied, often local or niche startups |

Understanding Venture Capital vs Angel Investment

Venture capital involves institutional investors or funds providing large-scale financial support to startups with high growth potential in exchange for equity, typically during later funding stages. Angel investment, by contrast, consists of affluent individuals offering early-stage capital, mentorship, and networking resources to nascent companies, often assuming higher risk for potentially significant returns. Understanding these distinctions is essential for entrepreneurs selecting the appropriate funding source to accelerate business growth effectively.

Key Differences Between Venture Capital and Angel Investors

Venture capital involves large pooled funds managed by firms investing in startups with high growth potential, often requiring significant equity and board involvement. Angel investors are typically high-net-worth individuals providing early-stage funding with smaller amounts and more flexible terms, focusing on personal expertise and networking to support entrepreneurs. The key differences include investment scale, involvement level, and funding stages, with venture capital suited for scaling businesses and angel investment targeting seed or early development phases.

Investment Stages: Venture Capital vs Angel Funding

Venture capital primarily targets later-stage companies with proven business models seeking significant capital for expansion, often participating in Series A rounds and beyond. Angel investment typically focuses on early-stage startups, providing seed funding to support initial product development and market entry. The difference in investment stages reflects varying risk tolerances and funding amounts, with angels taking early risks and VCs scaling growth.

Funding Size: How Much Do Startups Get?

Venture capital funding typically ranges from $1 million to over $10 million, enabling startups to scale rapidly and invest heavily in growth and product development. Angel investments are generally smaller, between $25,000 and $500,000, often providing early-stage startups with crucial seed capital to develop prototypes and validate market demand. The larger funding size of venture capital allows for more extensive expansion compared to the more modest, initial financial support offered by angel investors.

Decision-Making Process: VCs vs Angel Investors

Venture capital firms rely on rigorous due diligence involving financial projections, market analysis, and exit potential to guide their investment decisions, often requiring structured presentations and multiple evaluation rounds. Angel investors make faster, more intuitive decisions based on personal expertise, industry experience, and founder potential, emphasizing trust and vision over extensive data. The decision-making process in venture capital is formal and risk-averse, whereas angel investment embraces agility and a higher tolerance for early-stage uncertainty.

Involvement Level: Active vs Passive Investors

Venture capital firms often take an active role by providing strategic guidance, governance, and extensive networks to portfolio companies, driving growth and scaling operations. Angel investors typically maintain a more passive involvement, offering capital primarily during early-stage funding rounds with limited operational input. This distinction influences the level of control and engagement entrepreneurs can expect during their company's development.

Risk Appetite: Venture Capitalists vs Angel Investors

Venture capitalists typically exhibit a higher risk appetite by investing larger sums in scalable startups with proven traction, seeking significant returns within a defined timeframe. Angel investors usually take on more personal financial risk by funding early-stage ventures or ideas with unproven market potential, motivated by long-term growth and mentorship opportunities. The varying risk tolerance between these two investor types shapes their investment strategies and portfolio diversification in the entrepreneurial ecosystem.

Pros and Cons of Venture Capital Funding

Venture capital funding offers significant advantages such as access to substantial capital, expertise, and extensive networks that can accelerate a startup's growth and market entry. However, it often involves relinquishing considerable equity, facing stringent due diligence, and meeting aggressive performance expectations, which can pressure founders and limit operational control. High scalability potential and professional guidance are notable benefits, but the risk of dilution and loss of strategic autonomy remain critical drawbacks in venture capital investments.

Advantages and Disadvantages of Angel Investment

Angel investment offers entrepreneurs early-stage funding often accompanied by valuable mentorship and industry connections, accelerating startup growth. However, it typically involves smaller capital amounts than venture capital and can lead to significant equity dilution for founders. Limited regulation and informal agreements may pose risks, but the personalized support from angel investors can enhance business development and market entry.

Choosing the Right Investment for Your Startup

Venture capital offers larger funding rounds and strategic support suitable for startups aiming rapid growth and scalability, while angel investment provides early-stage capital often paired with personalized mentorship. Evaluating your startup's development phase, funding needs, and desired level of investor involvement helps determine whether to pursue venture capital or angel investment. Startups seeking expansive market entry generally benefit from venture capital, whereas those prioritizing flexible terms and founder control may prefer angel investors.

Venture capital vs Angel investment Infographic

difterm.com

difterm.com