Portfolio investment involves purchasing stocks or bonds in a foreign country without seeking control over the businesses, making it more liquid and short-term oriented. Foreign direct investment (FDI) entails acquiring a lasting interest in a foreign enterprise, usually including management control and long-term commitment. While portfolio investment is driven by market returns and diversification, FDI contributes more significantly to economic development by enhancing technology transfer and employment opportunities.

Table of Comparison

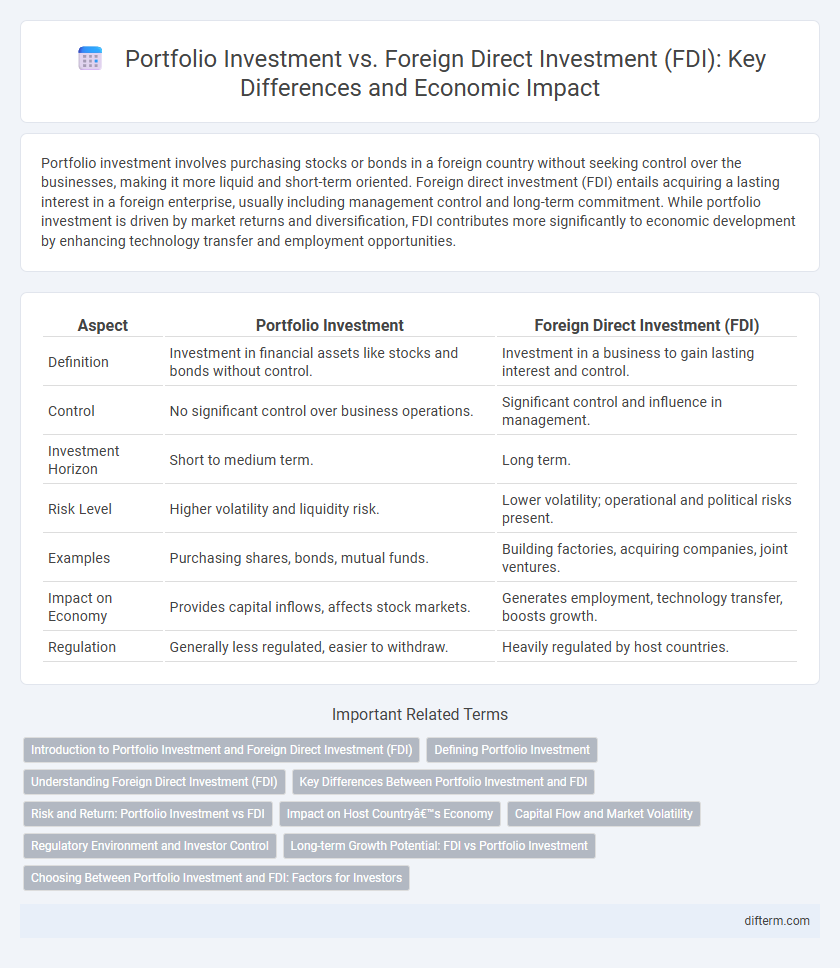

| Aspect | Portfolio Investment | Foreign Direct Investment (FDI) |

|---|---|---|

| Definition | Investment in financial assets like stocks and bonds without control. | Investment in a business to gain lasting interest and control. |

| Control | No significant control over business operations. | Significant control and influence in management. |

| Investment Horizon | Short to medium term. | Long term. |

| Risk Level | Higher volatility and liquidity risk. | Lower volatility; operational and political risks present. |

| Examples | Purchasing shares, bonds, mutual funds. | Building factories, acquiring companies, joint ventures. |

| Impact on Economy | Provides capital inflows, affects stock markets. | Generates employment, technology transfer, boosts growth. |

| Regulation | Generally less regulated, easier to withdraw. | Heavily regulated by host countries. |

Introduction to Portfolio Investment and Foreign Direct Investment (FDI)

Portfolio investment involves purchasing stocks, bonds, or other financial assets in a foreign country without acquiring significant control, enabling investors to diversify assets and achieve liquidity. Foreign Direct Investment (FDI) occurs when an investor establishes a lasting interest and substantial control in a foreign enterprise, often exceeding 10% ownership, leading to direct management involvement. Both investment types significantly influence economies by mobilizing capital, with portfolio investments favoring financial market stability and FDI promoting industrial development and technology transfer.

Defining Portfolio Investment

Portfolio investment involves purchasing financial assets such as stocks, bonds, or mutual funds in foreign markets without seeking control over the business operations. It is typically characterized by short-term capital flows driven by market conditions and aimed at earning returns through dividends, interest, or capital gains. Unlike Foreign Direct Investment (FDI), portfolio investment does not result in significant influence or managerial control over the invested company.

Understanding Foreign Direct Investment (FDI)

Foreign Direct Investment (FDI) involves a company or individual acquiring a lasting interest in a foreign enterprise, typically by owning at least 10% of the company's voting stock, which enables significant influence over management. FDI contributes to economic growth by facilitating technology transfer, creating jobs, and enhancing infrastructure in the host country. Unlike portfolio investment, which is primarily financial and more liquid, FDI reflects a long-term strategic commitment aimed at establishing or expanding operational presence abroad.

Key Differences Between Portfolio Investment and FDI

Portfolio investment involves purchasing securities such as stocks and bonds in foreign markets without seeking control over the business, primarily aiming for short-term financial returns. In contrast, Foreign Direct Investment (FDI) entails acquiring a significant ownership stake and managerial control in a foreign company, focusing on long-term strategic interests and operational involvement. Key differences include the degree of ownership, control, risk exposure, and investment horizon, with portfolio investments being more liquid and less involved, while FDI represents a deeper commitment with potential for technology transfer and economic impact.

Risk and Return: Portfolio Investment vs FDI

Portfolio investments typically offer higher liquidity but come with greater volatility and market risk, leading to potentially higher short-term returns yet increased exposure to economic fluctuations. Foreign direct investment (FDI) generally involves longer-term commitments with lower liquidity, reducing immediate market risk but offering stability and steady returns through control over assets and operations in foreign markets. The risk-return profile of portfolio investments is more sensitive to global financial market changes, while FDI provides more resilience against economic shocks due to its tangible asset base and strategic involvement.

Impact on Host Country’s Economy

Portfolio investment provides short-term capital inflows, enhancing liquidity and market depth but often lacks control and long-term commitment, which can lead to volatile economic impacts in the host country. Foreign direct investment (FDI) delivers substantial benefits through technology transfer, infrastructure development, and job creation, fostering sustainable economic growth and increasing productivity. FDI's lasting presence strengthens local industries and balances the host country's trade deficit, while portfolio investment may prompt rapid capital outflows during financial instability, posing economic risks.

Capital Flow and Market Volatility

Portfolio investment involves capital flow into financial assets like stocks and bonds, subject to higher market volatility due to rapid buying and selling activities. Foreign direct investment (FDI) entails long-term capital commitments in physical assets such as factories or infrastructure, generally resulting in more stable capital flows and lower sensitivity to market fluctuations. The contrast in capital flow stability between portfolio investment and FDI significantly impacts market volatility and economic resilience.

Regulatory Environment and Investor Control

Portfolio investment involves purchasing securities like stocks or bonds without obtaining control over business operations, operating under less stringent regulatory oversight compared to Foreign Direct Investment (FDI). FDI entails acquiring significant ownership stakes or establishing business operations in a foreign country, subject to comprehensive regulatory frameworks designed to monitor and influence investor activities and economic impact. Investor control in FDI enables direct management and strategic decision-making, while portfolio investors remain passive stakeholders with limited influence on corporate governance.

Long-term Growth Potential: FDI vs Portfolio Investment

Foreign direct investment (FDI) typically drives long-term economic growth by fostering capital formation, technology transfer, and job creation within host countries. Portfolio investment, while providing liquidity and market efficiency, often exhibits short-term orientation and higher volatility, limiting its impact on sustained economic development. Empirical studies highlight that economies with higher FDI inflows experience greater productivity gains and infrastructure improvements compared to those reliant primarily on portfolio investment.

Choosing Between Portfolio Investment and FDI: Factors for Investors

Investors weigh liquidity and control when choosing between portfolio investment and foreign direct investment (FDI), with portfolio investment offering easier entry and exit but limited influence on management, while FDI involves substantial capital commitment and direct operational control. Economic stability, regulatory environment, and expected returns play critical roles in shaping this decision, as countries with favorable policies and stable markets attract more FDI. Risk tolerance also determines preference; conservative investors may lean toward diversified portfolio investments, whereas those seeking long-term growth and strategic involvement prioritize FDI.

Portfolio investment vs Foreign direct investment (FDI) Infographic

difterm.com

difterm.com