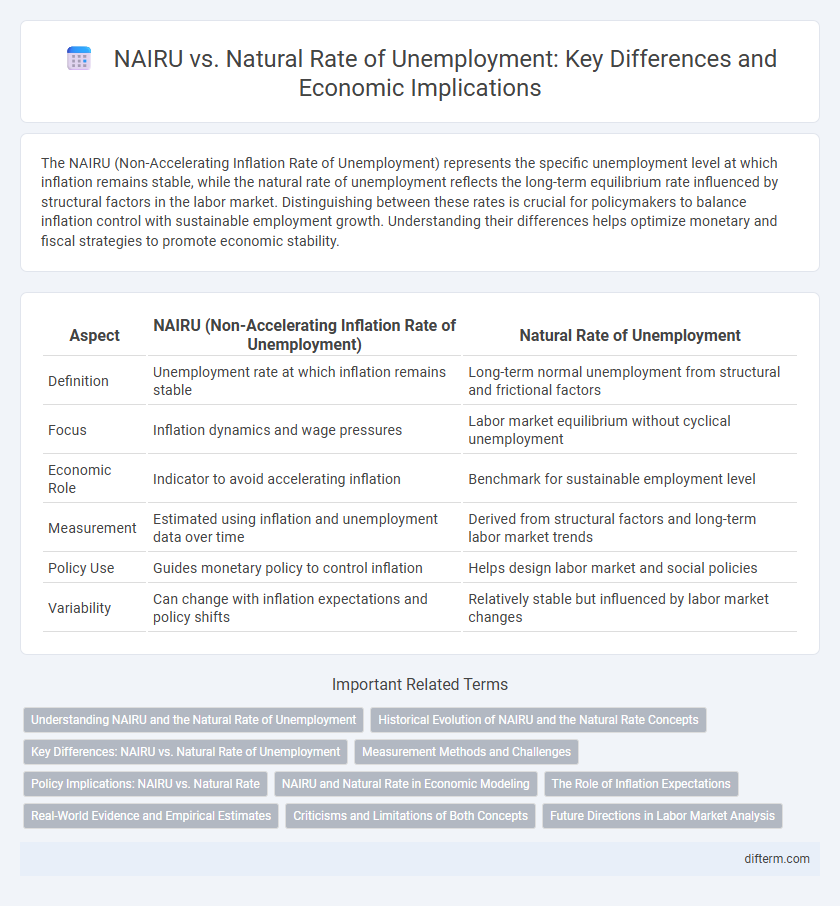

The NAIRU (Non-Accelerating Inflation Rate of Unemployment) represents the specific unemployment level at which inflation remains stable, while the natural rate of unemployment reflects the long-term equilibrium rate influenced by structural factors in the labor market. Distinguishing between these rates is crucial for policymakers to balance inflation control with sustainable employment growth. Understanding their differences helps optimize monetary and fiscal strategies to promote economic stability.

Table of Comparison

| Aspect | NAIRU (Non-Accelerating Inflation Rate of Unemployment) | Natural Rate of Unemployment |

|---|---|---|

| Definition | Unemployment rate at which inflation remains stable | Long-term normal unemployment from structural and frictional factors |

| Focus | Inflation dynamics and wage pressures | Labor market equilibrium without cyclical unemployment |

| Economic Role | Indicator to avoid accelerating inflation | Benchmark for sustainable employment level |

| Measurement | Estimated using inflation and unemployment data over time | Derived from structural factors and long-term labor market trends |

| Policy Use | Guides monetary policy to control inflation | Helps design labor market and social policies |

| Variability | Can change with inflation expectations and policy shifts | Relatively stable but influenced by labor market changes |

Understanding NAIRU and the Natural Rate of Unemployment

The Non-Accelerating Inflation Rate of Unemployment (NAIRU) represents the specific unemployment rate at which inflation remains stable, reflecting the economy's short-term equilibrium. The natural rate of unemployment encompasses structural and frictional unemployment, indicating the long-term sustainable level without cyclical fluctuations. Distinguishing NAIRU from the natural rate helps policymakers target inflation control while understanding underlying labor market dynamics.

Historical Evolution of NAIRU and the Natural Rate Concepts

The historical evolution of NAIRU (Non-Accelerating Inflation Rate of Unemployment) and the natural rate of unemployment reflects shifts in macroeconomic theory and policy focus, originating from Milton Friedman's 1968 concept of the natural rate, which posited a stable unemployment rate consistent with stable inflation. NAIRU emerged in the 1970s and 1980s as policymakers emphasized the trade-off between inflation and unemployment, refining the natural rate by incorporating inflation expectations and labor market rigidities. These concepts have been central to understanding the dynamics of inflation targeting and unemployment stabilization in modern economic frameworks.

Key Differences: NAIRU vs. Natural Rate of Unemployment

NAIRU (Non-Accelerating Inflation Rate of Unemployment) represents the unemployment level at which inflation remains stable, while the natural rate of unemployment reflects the long-term equilibrium rate accounting for frictional and structural factors. The NAIRU is often seen as dynamic, changing with inflation expectations, whereas the natural rate is considered a more stable benchmark based on labor market fundamentals. Policymakers use NAIRU to guide inflation targeting, whereas the natural rate serves as a reference for assessing labor market health and potential output.

Measurement Methods and Challenges

Measuring NAIRU involves statistical techniques like the Phillips curve estimation and state-space models, which rely on inflation and unemployment data to infer the unemployment rate consistent with stable inflation. The natural rate of unemployment is often estimated through long-term historical trends or structural models that consider labor market frictions and demographic changes. Both measures face challenges including data revisions, changing labor market dynamics, and the difficulty of distinguishing cyclical from structural unemployment.

Policy Implications: NAIRU vs. Natural Rate

The Non-Accelerating Inflation Rate of Unemployment (NAIRU) and the natural rate of unemployment provide critical benchmarks for monetary and fiscal policy decisions aimed at maintaining price stability and full employment. Policymakers use NAIRU estimates to adjust interest rates and government spending to avoid triggering inflationary pressures while supporting labor market recovery. Differences in these concepts influence the timing and intensity of interventions, with NAIRU emphasizing inflation control and the natural rate focusing on long-term structural unemployment.

NAIRU and Natural Rate in Economic Modeling

NAIRU (Non-Accelerating Inflation Rate of Unemployment) represents the specific unemployment rate at which inflation remains stable, playing a critical role in inflation targeting and monetary policy decisions. The natural rate of unemployment incorporates structural factors such as market frictions and labor market dynamics, serving as a baseline in economic modeling for long-term equilibrium analysis. Integrating NAIRU and the natural rate in macroeconomic models enhances the accuracy of forecasting inflationary pressures and guiding optimal policy interventions.

The Role of Inflation Expectations

Inflation expectations critically influence the differences between the Non-Accelerating Inflation Rate of Unemployment (NAIRU) and the natural rate of unemployment, as expectations shape wage-setting and price-setting behavior in labor markets. When inflation expectations adjust upward, NAIRU tends to rise above the natural rate due to tighter wage-price dynamics aimed at stabilizing inflation. Central banks monitor these expectations closely to manage monetary policy effectively, minimizing the risk of inflation spirals while targeting sustainable employment levels.

Real-World Evidence and Empirical Estimates

Empirical estimates reveal that the Natural Rate of Unemployment often fluctuates due to structural shifts in labor markets, whereas NAIRU (Non-Accelerating Inflation Rate of Unemployment) emphasizes inflation dynamics with a more stable threshold. Real-world evidence from economies like the United States highlights discrepancies between NAIRU and the natural rate, underscoring challenges in policy targeting during periods of technological change and globalization. Advanced econometric models suggest that both concepts serve as complementary tools for understanding labor market slack, yet their practical application demands contextual calibration to contemporary economic conditions.

Criticisms and Limitations of Both Concepts

The NAIRU and natural rate of unemployment face criticisms for their reliance on unobservable variables, making precise measurement challenging and policy application uncertain. Both concepts assume a stable equilibrium in labor markets, overlooking structural changes and dynamic economic shocks that can shift unemployment rates unpredictably. Their limitations include neglecting heterogeneity among workers and industries, which can lead to oversimplified models that fail to capture real-world labor market complexities.

Future Directions in Labor Market Analysis

Emerging research on NAIRU (Non-Accelerating Inflation Rate of Unemployment) and the natural rate of unemployment emphasizes integrating dynamic labor market variables and real-time data to enhance forecasting accuracy. Advances in machine learning algorithms and big data analytics facilitate more precise estimation of these rates, accounting for structural shifts such as technological automation and demographic changes. Future labor market analysis aims to develop adaptable models that capture evolving economic conditions and policy impacts on unemployment dynamics.

NAIRU vs natural rate of unemployment Infographic

difterm.com

difterm.com