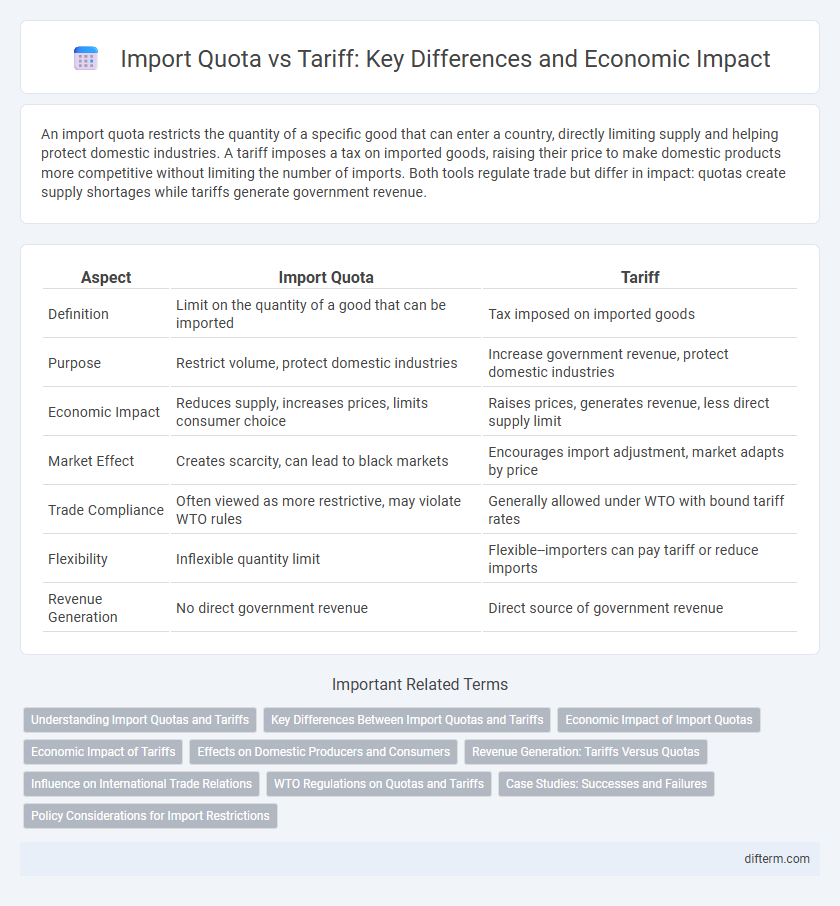

An import quota restricts the quantity of a specific good that can enter a country, directly limiting supply and helping protect domestic industries. A tariff imposes a tax on imported goods, raising their price to make domestic products more competitive without limiting the number of imports. Both tools regulate trade but differ in impact: quotas create supply shortages while tariffs generate government revenue.

Table of Comparison

| Aspect | Import Quota | Tariff |

|---|---|---|

| Definition | Limit on the quantity of a good that can be imported | Tax imposed on imported goods |

| Purpose | Restrict volume, protect domestic industries | Increase government revenue, protect domestic industries |

| Economic Impact | Reduces supply, increases prices, limits consumer choice | Raises prices, generates revenue, less direct supply limit |

| Market Effect | Creates scarcity, can lead to black markets | Encourages import adjustment, market adapts by price |

| Trade Compliance | Often viewed as more restrictive, may violate WTO rules | Generally allowed under WTO with bound tariff rates |

| Flexibility | Inflexible quantity limit | Flexible--importers can pay tariff or reduce imports |

| Revenue Generation | No direct government revenue | Direct source of government revenue |

Understanding Import Quotas and Tariffs

Import quotas restrict the quantity of specific goods that can enter a country, directly limiting supply to protect domestic industries or balance trade deficits. Tariffs impose taxes on imported goods, increasing their cost to reduce demand and generate government revenue. Both trade policies serve as tools to regulate international trade, affecting market prices, consumer choices, and economic efficiency differently.

Key Differences Between Import Quotas and Tariffs

Import quotas impose a fixed physical limit on the quantity of a specific good that can be imported, directly restricting supply. Tariffs, on the other hand, impose a tax on imported goods, increasing their cost and indirectly reducing demand. While quotas create scarcity and often lead to higher prices regardless of demand, tariffs generate government revenue and allow market forces to adjust import volumes based on price sensitivity.

Economic Impact of Import Quotas

Import quotas restrict the quantity of goods entering a country, leading to limited supply and increased domestic prices. This reduction in imports can protect local industries but often results in higher costs for consumers and potential inefficiencies in resource allocation. Unlike tariffs, which generate government revenue, import quotas create market distortions without direct fiscal benefits, often provoking retaliatory trade measures.

Economic Impact of Tariffs

Tariffs directly increase the cost of imported goods, leading to higher prices for consumers and potentially reduced consumption. Import quotas restrict the quantity of goods entering a market, causing scarcity and price hikes but often allowing for predictable market adjustments. Economically, tariffs generate government revenue, while import quotas may create quota rents benefiting importers or foreign producers with licenses.

Effects on Domestic Producers and Consumers

Import quotas limit the quantity of foreign goods allowed, often benefiting domestic producers by reducing competition and enabling higher prices. Tariffs increase the cost of imported goods, which can protect local industries but also raise prices for consumers, potentially decreasing overall consumption. Both measures can lead to inefficiencies in the market, affecting consumer choice and potentially leading to retaliation from trade partners.

Revenue Generation: Tariffs Versus Quotas

Tariffs generate direct government revenue by imposing a fixed tax on each imported unit, providing a predictable income stream. Import quotas limit the quantity of goods imported without generating revenue unless combined with license auctions, making them less effective for tax collection. Economies favor tariffs over quotas when prioritizing stable revenue alongside protecting domestic industries.

Influence on International Trade Relations

Import quotas restrict the quantity of goods that can enter a country, directly limiting trade volume and often causing diplomatic tensions by signaling protectionist policies. Tariffs impose taxes on imported goods, altering trade costs and potentially leading to retaliatory measures in international markets. Both tools influence trade relations by impacting market access, pricing strategies, and negotiating power between countries.

WTO Regulations on Quotas and Tariffs

The World Trade Organization (WTO) regulates import quotas and tariffs to promote fair trade and prevent protectionist policies. While tariffs impose a tax on imported goods affecting their price, import quotas set a physical limit on the quantity of goods entering a country, often viewed as more restrictive under WTO rules. WTO agreements generally favor tariffs over quotas, requiring member countries to convert quotas into tariff equivalents to enhance transparency and market access.

Case Studies: Successes and Failures

Import quotas have demonstrated varied economic impacts across countries, such as Japan's post-war steel industry growth, where quotas protected domestic producers but led to international trade tensions. Conversely, India's import quotas on textiles in the 1980s resulted in supply shortages and price inflation, highlighting the drawbacks of quantity restrictions over tariff-based measures. Tariffs, as seen in the US-China trade war, effectively generated government revenue but risked retaliation and market distortions, underscoring the complex trade-offs in protectionist policies.

Policy Considerations for Import Restrictions

Import quota policies set quantitative limits on the volume of goods allowed into a country, directly controlling the supply and preserving domestic industries from foreign competition. Tariffs impose taxes on imported goods, raising their prices to discourage consumption while generating government revenue, but they do not limit quantities. Policymakers weigh the trade-offs between import quotas' supply certainty and tariffs' revenue potential, considering factors like market efficiency, international trade obligations, and economic impact on consumers and producers.

import quota vs tariff Infographic

difterm.com

difterm.com