The capital market facilitates long-term funding by enabling the issuance and trading of securities such as stocks and bonds, supporting business growth and infrastructure development. In contrast, the money market deals with short-term debt instruments like Treasury bills and commercial paper, providing liquidity and efficient cash management for governments and corporations. Both markets play complementary roles in the overall financial system by balancing investment horizons and funding needs.

Table of Comparison

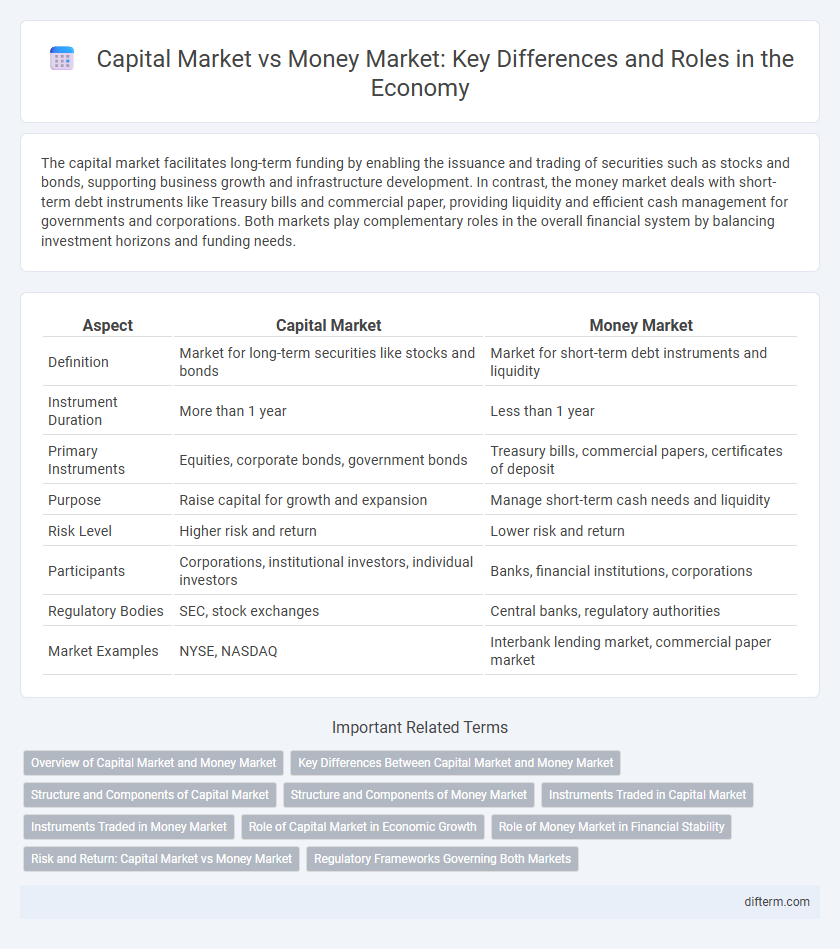

| Aspect | Capital Market | Money Market |

|---|---|---|

| Definition | Market for long-term securities like stocks and bonds | Market for short-term debt instruments and liquidity |

| Instrument Duration | More than 1 year | Less than 1 year |

| Primary Instruments | Equities, corporate bonds, government bonds | Treasury bills, commercial papers, certificates of deposit |

| Purpose | Raise capital for growth and expansion | Manage short-term cash needs and liquidity |

| Risk Level | Higher risk and return | Lower risk and return |

| Participants | Corporations, institutional investors, individual investors | Banks, financial institutions, corporations |

| Regulatory Bodies | SEC, stock exchanges | Central banks, regulatory authorities |

| Market Examples | NYSE, NASDAQ | Interbank lending market, commercial paper market |

Overview of Capital Market and Money Market

Capital markets facilitate the trading of long-term securities such as stocks and bonds, providing businesses and governments with avenues for raising substantial capital for expansion and infrastructure projects. Money markets specialize in short-term debt instruments like Treasury bills and commercial paper, offering high liquidity and low-risk options for managing immediate funding needs. Both markets play crucial roles in financial stability by matching investors with borrowers based on duration and risk preferences.

Key Differences Between Capital Market and Money Market

The capital market involves long-term securities such as stocks and bonds, facilitating the raising of funds for extended periods, whereas the money market deals in short-term debt instruments like treasury bills and commercial paper, typically maturing within one year. Capital markets prioritize investment and wealth growth with higher risk and return profiles, while money markets emphasize liquidity and safety with lower risk and returns. Key differences also include the types of participants, with capital markets attracting investors and companies for equity financing, and money markets serving banks, financial institutions, and governments for managing short-term funding needs.

Structure and Components of Capital Market

The capital market is structured into primary and secondary markets, where primary deals with new securities issuance and secondary facilitates trading of existing securities. Key components include equity instruments like stocks, debt securities such as bonds, and intermediaries like stock exchanges, investment banks, and regulatory bodies overseeing transactions. This market primarily supports long-term funding and investment, contrasting with the money market's focus on short-term debt instruments.

Structure and Components of Money Market

The money market primarily consists of short-term debt instruments such as Treasury bills, commercial paper, certificates of deposit, and repurchase agreements, facilitating liquidity management and funding for governments, financial institutions, and corporations. Unlike the capital market, which deals in long-term securities like stocks and bonds, the money market operates with highly liquid and low-risk instruments that mature within one year. Its structure includes key participants such as central banks, commercial banks, mutual funds, and money market funds, all contributing to the efficient transfer of short-term capital.

Instruments Traded in Capital Market

Capital markets primarily trade long-term instruments such as stocks, bonds, debentures, and equity shares, which facilitate capital formation for companies and governments. These instruments have maturities extending beyond one year, providing investors with opportunities for growth, dividends, and interest income. Unlike the money market, which deals with short-term debt securities, capital market instruments are pivotal for long-term financial investments and economic development.

Instruments Traded in Money Market

Money market instruments primarily include Treasury bills, commercial paper, certificates of deposit, and repurchase agreements, all characterized by short maturities and high liquidity. These instruments facilitate the efficient management of short-term funding needs for governments, financial institutions, and corporations. In contrast to capital market securities, money market instruments are less risky and offer lower returns, serving as key tools for liquidity and cash flow management in the financial system.

Role of Capital Market in Economic Growth

The capital market plays a crucial role in economic growth by channeling long-term funds from investors to businesses, enabling large-scale investments in infrastructure, technology, and expansion projects. Unlike the money market, which facilitates short-term liquidity, the capital market supports sustainable development by providing equity and debt instruments that help firms raise permanent capital. Efficient capital markets enhance resource allocation, reduce funding costs, and promote innovation, thereby driving productivity and overall economic progress.

Role of Money Market in Financial Stability

The money market plays a crucial role in maintaining financial stability by providing short-term liquidity to financial institutions, corporations, and governments, ensuring smooth functioning of payment systems and funding operations. It supports the efficient allocation of capital by enabling participants to manage their short-term funding needs and mitigate risks associated with cash flow mismatches. Stability in the money market reduces the risk of systemic shocks, which can otherwise propagate through the broader financial system and disrupt economic activities.

Risk and Return: Capital Market vs Money Market

The capital market generally involves higher risk and potentially greater returns due to its investment in long-term securities like stocks and bonds, which are subject to market volatility and economic cycles. In contrast, the money market offers lower risk and modest returns by focusing on short-term debt instruments such as treasury bills and commercial paper, providing liquidity and safety for investors. Understanding these differences enables investors to balance portfolios according to their risk tolerance and return expectations.

Regulatory Frameworks Governing Both Markets

Capital markets are primarily regulated by securities commissions such as the U.S. Securities and Exchange Commission (SEC) and the Financial Conduct Authority (FCA) in the UK, enforcing strict disclosure and reporting requirements to protect investors and ensure market transparency. Money markets fall under the oversight of central banks and monetary authorities like the Federal Reserve and the European Central Bank, which implement regulatory measures focused on liquidity management, short-term credit risk, and interest rate stability. Both markets operate under frameworks that include anti-money laundering (AML) rules and investor protection laws but differ in regulatory emphasis based on the nature of instruments traded and market participants.

capital market vs money market Infographic

difterm.com

difterm.com