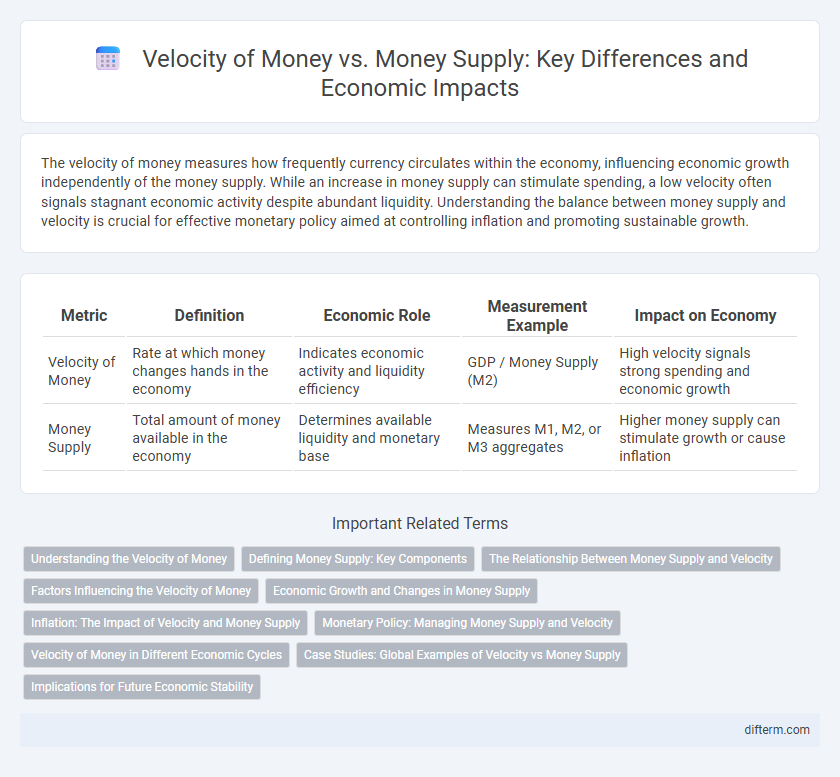

The velocity of money measures how frequently currency circulates within the economy, influencing economic growth independently of the money supply. While an increase in money supply can stimulate spending, a low velocity often signals stagnant economic activity despite abundant liquidity. Understanding the balance between money supply and velocity is crucial for effective monetary policy aimed at controlling inflation and promoting sustainable growth.

Table of Comparison

| Metric | Definition | Economic Role | Measurement Example | Impact on Economy |

|---|---|---|---|---|

| Velocity of Money | Rate at which money changes hands in the economy | Indicates economic activity and liquidity efficiency | GDP / Money Supply (M2) | High velocity signals strong spending and economic growth |

| Money Supply | Total amount of money available in the economy | Determines available liquidity and monetary base | Measures M1, M2, or M3 aggregates | Higher money supply can stimulate growth or cause inflation |

Understanding the Velocity of Money

Velocity of money measures how quickly money circulates within an economy, reflecting the frequency of transactions over a specific period. It complements money supply by indicating economic activity intensity rather than just the quantity of money available. Monitoring velocity helps economists assess demand-side factors and inflationary pressures beyond traditional monetary aggregates.

Defining Money Supply: Key Components

Money supply comprises various key components including M0, M1, and M2, each representing different levels of liquidity in the economy. M0 refers to physical currency in circulation, while M1 includes M0 plus demand deposits and other checkable deposits, reflecting money readily accessible for transactions. M2 expands further by adding savings accounts, time deposits, and retail money market funds, providing a broader measure of money that influences the velocity of money and economic activity.

The Relationship Between Money Supply and Velocity

The relationship between money supply and velocity reflects how frequently money circulates within an economy to support transactions. When the money supply expands without a corresponding increase in economic activity, velocity tends to decrease as more money chases the same amount of goods and services. Conversely, rapid economic growth can increase velocity even if the money supply remains stable, indicating a more efficient use of available currency.

Factors Influencing the Velocity of Money

The velocity of money is influenced by factors such as interest rates, inflation expectations, and changes in payment technologies, which affect how quickly money circulates in the economy. A rise in interest rates typically increases velocity as holding money becomes more costly, while higher inflation prompts faster spending to avoid value erosion. Innovations in digital payments and increased consumer confidence also accelerate the velocity by facilitating quicker transactions and encouraging spending over saving.

Economic Growth and Changes in Money Supply

Velocity of money measures the frequency at which a unit of currency circulates in the economy, directly impacting economic growth by influencing transaction volumes. Changes in money supply alter inflation rates and purchasing power, which subsequently affect velocity and overall economic activity. A balanced interplay between velocity and money supply is crucial for sustaining stable growth and controlling inflation levels.

Inflation: The Impact of Velocity and Money Supply

The velocity of money measures how fast currency circulates within the economy, directly influencing inflation when coupled with changes in the money supply. A rising money supply combined with an increasing velocity often leads to higher inflation rates as more money chases the same amount of goods and services. Conversely, if the money supply grows but velocity declines, inflationary pressures may remain subdued despite the increased liquidity.

Monetary Policy: Managing Money Supply and Velocity

Monetary policy influences economic stability by carefully managing both the money supply and the velocity of money, which together determine overall spending levels and inflation rates. Central banks adjust interest rates and use open market operations to control the money supply, indirectly affecting the velocity as consumers and businesses decide how quickly to circulate funds. Understanding the interplay between money supply growth and velocity helps policymakers fine-tune interventions that stabilize prices while promoting sustainable economic growth.

Velocity of Money in Different Economic Cycles

Velocity of money measures how quickly currency circulates within the economy, reflecting consumer spending and business investments at various stages of economic cycles. During expansion phases, velocity typically accelerates as increased confidence boosts transaction frequency, while in recessions, velocity tends to decelerate despite efforts to increase money supply through monetary policy. Understanding changes in velocity of money provides critical insights into economic momentum beyond merely tracking money supply growth.

Case Studies: Global Examples of Velocity vs Money Supply

Case studies from Japan and the United States highlight how velocity of money can diverge significantly from money supply growth, with Japan experiencing prolonged low velocity despite quantitative easing interventions. In contrast, the U.S. saw periods of rapid money supply expansion during the 2008 financial crisis and the COVID-19 pandemic, but velocity declined sharply as consumer spending and lending contracted. These global examples demonstrate that an increase in money supply does not necessarily translate into higher economic activity if the velocity of money remains subdued.

Implications for Future Economic Stability

The velocity of money, indicating how quickly money circulates in the economy, inversely affects the money supply's impact on inflation and growth. A declining velocity suggests that increases in money supply may not translate into proportional economic expansion, potentially signaling stagnant demand and reduced fiscal stimulus effectiveness. Monitoring these dynamics is crucial for anticipating future economic stability and crafting policies that balance liquidity with sustainable growth.

Velocity of money vs money supply Infographic

difterm.com

difterm.com