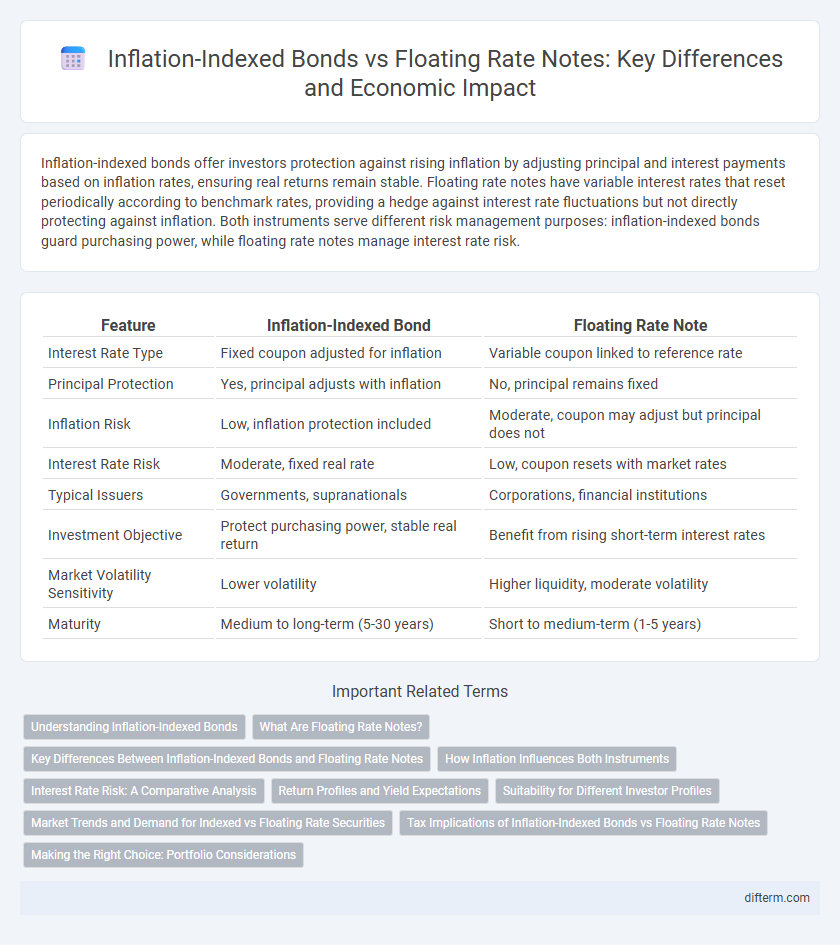

Inflation-indexed bonds offer investors protection against rising inflation by adjusting principal and interest payments based on inflation rates, ensuring real returns remain stable. Floating rate notes have variable interest rates that reset periodically according to benchmark rates, providing a hedge against interest rate fluctuations but not directly protecting against inflation. Both instruments serve different risk management purposes: inflation-indexed bonds guard purchasing power, while floating rate notes manage interest rate risk.

Table of Comparison

| Feature | Inflation-Indexed Bond | Floating Rate Note |

|---|---|---|

| Interest Rate Type | Fixed coupon adjusted for inflation | Variable coupon linked to reference rate |

| Principal Protection | Yes, principal adjusts with inflation | No, principal remains fixed |

| Inflation Risk | Low, inflation protection included | Moderate, coupon may adjust but principal does not |

| Interest Rate Risk | Moderate, fixed real rate | Low, coupon resets with market rates |

| Typical Issuers | Governments, supranationals | Corporations, financial institutions |

| Investment Objective | Protect purchasing power, stable real return | Benefit from rising short-term interest rates |

| Market Volatility Sensitivity | Lower volatility | Higher liquidity, moderate volatility |

| Maturity | Medium to long-term (5-30 years) | Short to medium-term (1-5 years) |

Understanding Inflation-Indexed Bonds

Inflation-indexed bonds protect investors by adjusting principal and interest payments according to inflation rates, ensuring real returns remain stable despite rising prices. These bonds are typically linked to consumer price indices, making them effective tools to hedge against inflation risk compared to floating rate notes, which have interest payments that fluctuate with market rates but do not directly account for inflation. Understanding the mechanics of inflation-indexed bonds is crucial for diversifying fixed income portfolios and preserving purchasing power in inflationary environments.

What Are Floating Rate Notes?

Floating Rate Notes (FRNs) are debt securities with variable interest rates that adjust periodically based on a benchmark, such as LIBOR or the U.S. Treasury rate, helping investors hedge against rising interest rates. Unlike inflation-indexed bonds that protect against inflation by adjusting principal and interest payments according to consumer price indices, FRNs primarily reduce interest rate risk by fluctuating interest payments. These notes provide investors with predictable cash flows tied to prevailing market rates, making them attractive in environments with uncertain interest rate movements.

Key Differences Between Inflation-Indexed Bonds and Floating Rate Notes

Inflation-indexed bonds provide principal and interest payments adjusted according to inflation rates, protecting investors from purchasing power erosion. Floating rate notes feature variable interest rates tied to benchmark rates like LIBOR or SOFR, resulting in fluctuating coupon payments aligned with market interest rate movements. The key difference lies in inflation protection versus interest rate sensitivity, where inflation-indexed bonds hedge against rising consumer prices while floating rate notes offer income linked to short-term interest rate changes.

How Inflation Influences Both Instruments

Inflation-indexed bonds adjust their principal and interest payments based on changes in inflation, protecting investors from inflation risk by maintaining purchasing power. Floating rate notes have variable interest rates tied to benchmark rates, which may increase with inflation-driven monetary policy hikes but do not directly adjust for inflation itself. Inflation pressures therefore make inflation-indexed bonds more effective for preserving real returns, while floating rate notes offer variable income that may partially offset inflation impacts through rate resets.

Interest Rate Risk: A Comparative Analysis

Inflation-indexed bonds provide protection against inflation by adjusting principal and interest payments based on inflation rates, thereby reducing interest rate risk in rising inflation environments. Floating rate notes feature variable interest rates tied to benchmark rates, minimizing interest rate risk when market rates increase but remaining vulnerable to declining rates. Investors seeking to hedge against inflation-related interest rate fluctuations may prefer inflation-indexed bonds, while those anticipating rising benchmark rates may benefit from floating rate notes.

Return Profiles and Yield Expectations

Inflation-indexed bonds offer returns that adjust with inflation, providing protection against rising prices and preserving purchasing power, typically resulting in lower nominal yields but more stable real returns. Floating rate notes feature interest payments tied to benchmark rates like LIBOR or SOFR, delivering variable yields that rise with interest rate increases, thus offering higher income potential during inflationary periods but without direct inflation protection. Investors seeking inflation shielding prioritize inflation-indexed bonds for real yield stability, whereas those aiming for income sensitivity to rate changes lean toward floating rate notes for potentially higher nominal returns.

Suitability for Different Investor Profiles

Inflation-indexed bonds provide stable purchasing power by adjusting principal and interest with inflation, making them ideal for conservative investors seeking protection against rising prices. Floating rate notes offer variable coupon payments tied to benchmark interest rates, appealing to investors with higher risk tolerance aiming to benefit from interest rate fluctuations. The choice depends on an investor's risk appetite, income needs, and inflation expectations, with inflation-indexed bonds favored in inflationary environments and floating rate notes preferred when interest rates are expected to rise.

Market Trends and Demand for Indexed vs Floating Rate Securities

Inflation-indexed bonds have seen rising demand due to growing investor concerns about long-term inflation risks, while floating rate notes attract attention for their protection against rising short-term interest rates. Market trends indicate a shift towards inflation-linked securities in regions with persistent inflationary pressures, whereas floating rate notes remain favored in volatile interest rate environments. The contrasting investor preferences highlight a nuanced approach to managing interest rate and inflation exposure in fixed income portfolios.

Tax Implications of Inflation-Indexed Bonds vs Floating Rate Notes

Inflation-indexed bonds generate taxable income annually on the inflation adjustments added to the principal, even though investors do not receive this income until maturity, potentially increasing current tax liabilities. Floating rate notes typically have interest payments that fluctuate with market rates and are taxed as ordinary income in the year received. Investors should consider that inflation-indexed bonds may result in higher tax burdens during periods of rising inflation compared to floating rate notes, which offer more predictable annual tax treatment.

Making the Right Choice: Portfolio Considerations

Inflation-indexed bonds protect purchasing power by adjusting principal and interest payments according to inflation rates, making them ideal for portfolios seeking real return stability in volatile markets. Floating rate notes offer interest payments tied to benchmark rates, providing flexibility and reduced interest rate risk in rising rate environments but less inflation protection. Portfolio diversification benefits from balancing these instruments based on inflation expectations, interest rate outlook, and risk tolerance for optimized income and capital preservation.

Inflation-indexed bond vs Floating rate note Infographic

difterm.com

difterm.com