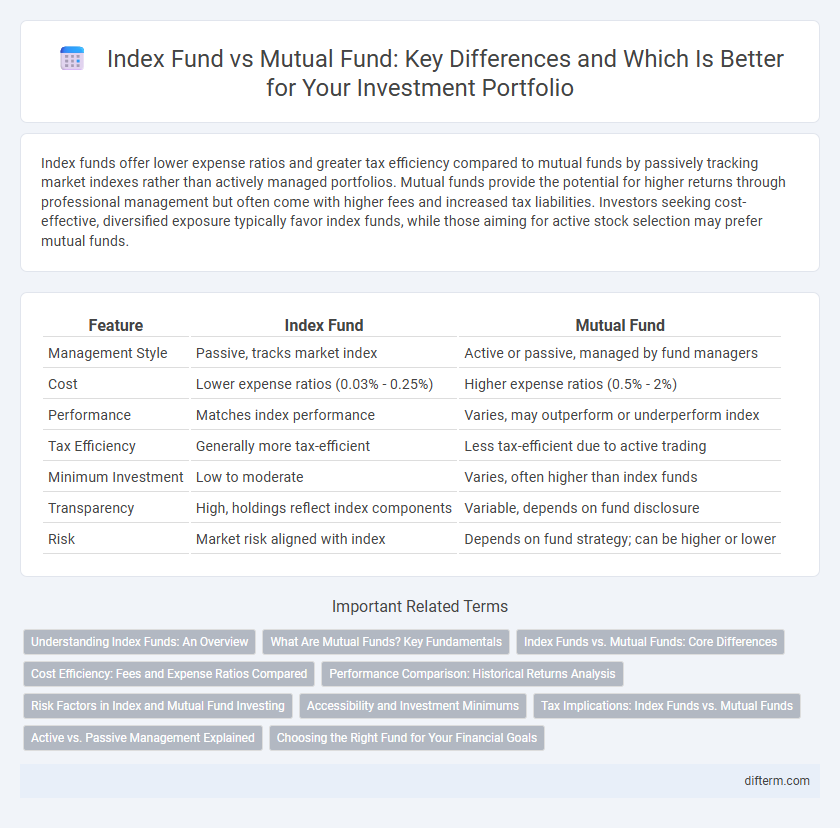

Index funds offer lower expense ratios and greater tax efficiency compared to mutual funds by passively tracking market indexes rather than actively managed portfolios. Mutual funds provide the potential for higher returns through professional management but often come with higher fees and increased tax liabilities. Investors seeking cost-effective, diversified exposure typically favor index funds, while those aiming for active stock selection may prefer mutual funds.

Table of Comparison

| Feature | Index Fund | Mutual Fund |

|---|---|---|

| Management Style | Passive, tracks market index | Active or passive, managed by fund managers |

| Cost | Lower expense ratios (0.03% - 0.25%) | Higher expense ratios (0.5% - 2%) |

| Performance | Matches index performance | Varies, may outperform or underperform index |

| Tax Efficiency | Generally more tax-efficient | Less tax-efficient due to active trading |

| Minimum Investment | Low to moderate | Varies, often higher than index funds |

| Transparency | High, holdings reflect index components | Variable, depends on fund disclosure |

| Risk | Market risk aligned with index | Depends on fund strategy; can be higher or lower |

Understanding Index Funds: An Overview

Index funds are investment vehicles designed to replicate the performance of a specific market index, such as the S&P 500, by holding a diversified portfolio of stocks that mirror the index components. They offer lower expense ratios compared to mutual funds due to their passive management style, reducing costs while providing broad market exposure. Investors benefit from predictable returns aligned with the overall market, making index funds a cost-effective choice for long-term wealth accumulation.

What Are Mutual Funds? Key Fundamentals

Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities, managed by professional fund managers. They offer liquidity, diversification, and professional management, with varying risk levels based on the fund's investment objective. Expense ratios and fees tend to be higher compared to index funds due to active management and trading costs.

Index Funds vs. Mutual Funds: Core Differences

Index funds passively track a market index like the S&P 500, offering lower expense ratios and tax efficiency compared to mutual funds, which are actively managed portfolios aiming to outperform the market. Mutual funds often involve higher fees and increased portfolio turnover, potentially leading to greater tax liabilities. Investors seeking diversified exposure with minimal cost prefer index funds, while those willing to pay for professional management and potential alpha may opt for mutual funds.

Cost Efficiency: Fees and Expense Ratios Compared

Index funds typically offer lower fees and expense ratios compared to mutual funds due to their passive management style, which minimizes operational costs. Mutual funds often incur higher expenses because of active portfolio management, research, and trading activities. Investors prioritizing cost efficiency generally benefit from index funds' lower fees, contributing to potentially higher net returns over time.

Performance Comparison: Historical Returns Analysis

Index funds typically deliver consistent market-matching returns by tracking specific market indices, offering lower expense ratios that enhance net performance over time compared to actively managed mutual funds. Historical data reveals that many mutual funds fail to outperform their benchmark indices after fees, with a majority underperforming over 10- and 15-year periods. Investors seeking cost-efficient, predictable growth often prefer index funds due to their demonstrated ability to provide competitive long-term returns with reduced management costs.

Risk Factors in Index and Mutual Fund Investing

Index funds typically exhibit lower risk due to their passive management and broad market diversification, minimizing the impact of individual stock volatility. Mutual funds, actively managed, carry higher risk levels stemming from fund manager decisions, market timing, and sector concentration. Investors should assess expense ratios, management styles, and market exposure to align risk tolerance with investment objectives.

Accessibility and Investment Minimums

Index funds typically offer lower investment minimums compared to mutual funds, making them more accessible to beginner investors. Mutual funds often require higher initial investments, which can be a barrier for those with limited capital. The lower cost and ease of entry in index funds facilitate broader participation in diversified portfolios.

Tax Implications: Index Funds vs. Mutual Funds

Index funds generally offer greater tax efficiency compared to mutual funds due to their lower portfolio turnover and passive management style, which results in fewer capital gains distributions. Mutual funds frequently generate higher taxable events because active trading within the fund triggers short-term capital gains, often taxed at higher ordinary income rates. Investors prioritizing tax cost minimization often favor index funds to enhance after-tax returns and reduce annual tax liabilities.

Active vs. Passive Management Explained

Index funds use passive management by tracking a market index, resulting in lower fees and consistent performance aligned with the index. Mutual funds typically employ active management, where fund managers make investment decisions aiming to outperform the market but often incur higher fees. Studies show passive index funds frequently outperform many actively managed mutual funds over the long term due to lower costs and reduced manager risk.

Choosing the Right Fund for Your Financial Goals

Selecting between index funds and mutual funds depends on your financial goals, risk tolerance, and investment horizon. Index funds typically offer lower fees and broad market exposure, making them suitable for long-term growth with minimal management costs. Mutual funds provide active management and potential for higher returns, ideal for investors seeking specialized strategies and willing to accept higher fees.

index fund vs mutual fund Infographic

difterm.com

difterm.com