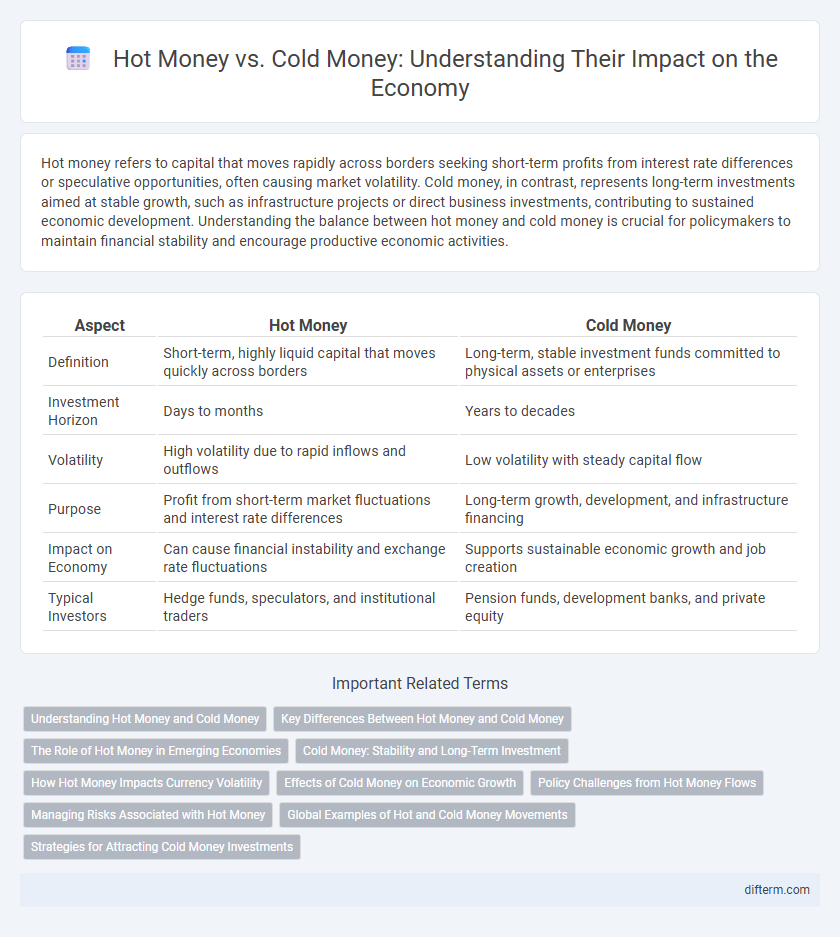

Hot money refers to capital that moves rapidly across borders seeking short-term profits from interest rate differences or speculative opportunities, often causing market volatility. Cold money, in contrast, represents long-term investments aimed at stable growth, such as infrastructure projects or direct business investments, contributing to sustained economic development. Understanding the balance between hot money and cold money is crucial for policymakers to maintain financial stability and encourage productive economic activities.

Table of Comparison

| Aspect | Hot Money | Cold Money |

|---|---|---|

| Definition | Short-term, highly liquid capital that moves quickly across borders | Long-term, stable investment funds committed to physical assets or enterprises |

| Investment Horizon | Days to months | Years to decades |

| Volatility | High volatility due to rapid inflows and outflows | Low volatility with steady capital flow |

| Purpose | Profit from short-term market fluctuations and interest rate differences | Long-term growth, development, and infrastructure financing |

| Impact on Economy | Can cause financial instability and exchange rate fluctuations | Supports sustainable economic growth and job creation |

| Typical Investors | Hedge funds, speculators, and institutional traders | Pension funds, development banks, and private equity |

Understanding Hot Money and Cold Money

Hot money refers to capital that moves quickly across borders to seek short-term profits from interest rate differentials or speculative gains, often leading to increased market volatility. Cold money, in contrast, is long-term investment capital aimed at stable growth and sustained economic development, typically less sensitive to market fluctuations. Understanding the dynamics of hot and cold money helps policymakers manage liquidity, currency stability, and investment flows in the global economy.

Key Differences Between Hot Money and Cold Money

Hot money refers to capital that moves quickly across borders seeking short-term financial gains, characterized by high liquidity and volatility, often impacting exchange rates and financial markets drastically. Cold money, by contrast, denotes long-term investment capital committed to stable assets like real estate or infrastructure, offering lower risk and contributing to sustained economic growth. The key differences lie in investment horizon, risk tolerance, and the influence each exerts on market stability and economic development.

The Role of Hot Money in Emerging Economies

Hot money plays a significant role in emerging economies by rapidly flowing across borders in search of short-term high returns, often driven by interest rate differentials and speculative opportunities. These capital inflows can boost liquidity and stimulate economic growth but also lead to increased volatility and risk of sudden outflows, impacting exchange rates and financial stability. Policymakers in emerging markets must balance attracting hot money for economic development with managing the potential destabilizing effects on their financial systems.

Cold Money: Stability and Long-Term Investment

Cold money refers to capital invested with the intention of long-term stability and sustained economic growth, often channeled into assets like real estate, infrastructure, and government bonds. This type of investment minimizes market volatility by providing steady funding that supports productive sectors and economic development over time. Unlike hot money, cold money reduces liquidity risk and fosters confidence among investors seeking durable financial returns.

How Hot Money Impacts Currency Volatility

Hot money, characterized by rapid capital flows seeking short-term gains, significantly increases currency volatility by causing abrupt fluctuations in exchange rates. These speculative movements amplify market uncertainty and can undermine economic stability, as sudden capital inflows or outflows disrupt the balance of payments. Central banks often struggle to manage the volatility induced by hot money, leading to challenges in maintaining currency value and monetary policy effectiveness.

Effects of Cold Money on Economic Growth

Cold money, characterized by long-term investments and low liquidity, fosters stable economic growth by providing consistent capital for infrastructure projects and business expansions. Its steady inflow reduces market volatility and encourages sustainable development, improving investor confidence and stimulating innovation. The presence of cold money enhances financial stability, facilitating productive investments that contribute to higher GDP growth rates over time.

Policy Challenges from Hot Money Flows

Hot money flows, characterized by rapid movement of capital across borders chasing short-term returns, create significant policy challenges including exchange rate volatility and financial market instability. Governments face difficulty in implementing effective monetary policies as sudden inflows or outflows can distort interest rates and asset prices, undermining economic stability. Managing hot money involves balancing capital controls and open market policies to mitigate speculative risks without deterring long-term investments.

Managing Risks Associated with Hot Money

Managing risks associated with hot money involves closely monitoring capital flows to prevent sudden withdrawals that can destabilize financial markets. Implementing capital controls and enhancing foreign exchange reserves provide buffers against volatility caused by speculative inflows and outflows. Strengthening regulatory frameworks and promoting transparency help mitigate the impact of hot money on exchange rates and interest rate fluctuations.

Global Examples of Hot and Cold Money Movements

Hot money flows rapidly across borders, seeking short-term gains in emerging markets such as Brazil and India, which often results in volatile currency fluctuations and stock market instability. Cold money, exemplified by long-term investments in infrastructure projects in countries like Germany and Japan, provides steady capital support and fosters sustainable economic growth. The contrasting dynamics between hot money's quick entry and exit and cold money's patient, stability-focused approach highlight their significant impact on global economic cycles and financial markets.

Strategies for Attracting Cold Money Investments

Governments and corporations implement stable regulatory frameworks and long-term economic policies to attract cold money investments, which prioritize security and steady returns over quick gains. Offering tax incentives, transparent governance, and infrastructural development enhances investor confidence and encourages the inflow of cold money capital. Creating favorable conditions for pension funds, insurance companies, and sovereign wealth funds ensures sustained and reliable economic growth fueled by cold money investments.

Hot Money vs Cold Money Infographic

difterm.com

difterm.com