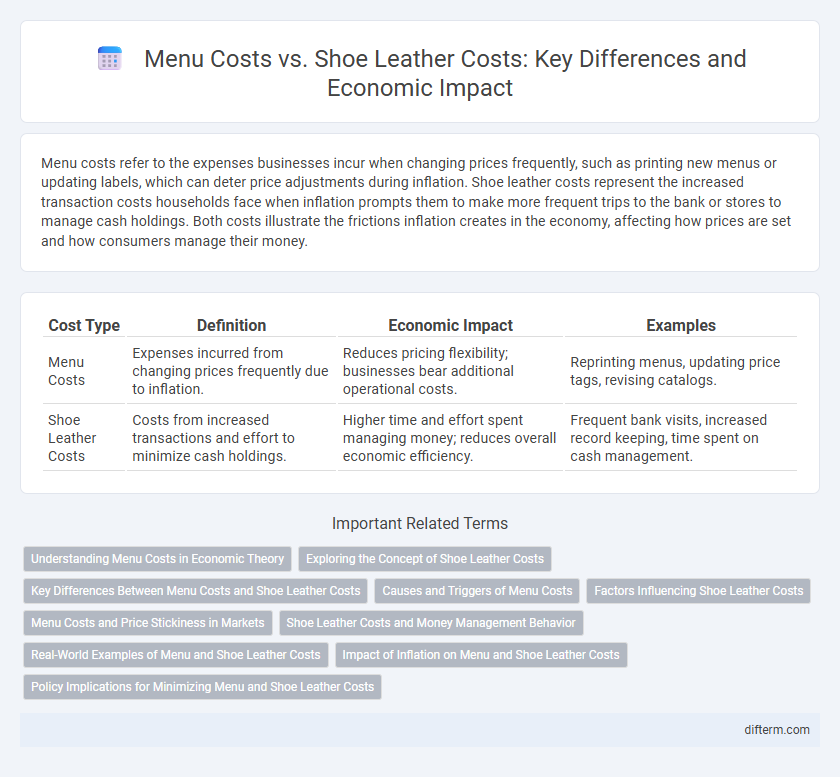

Menu costs refer to the expenses businesses incur when changing prices frequently, such as printing new menus or updating labels, which can deter price adjustments during inflation. Shoe leather costs represent the increased transaction costs households face when inflation prompts them to make more frequent trips to the bank or stores to manage cash holdings. Both costs illustrate the frictions inflation creates in the economy, affecting how prices are set and how consumers manage their money.

Table of Comparison

| Cost Type | Definition | Economic Impact | Examples |

|---|---|---|---|

| Menu Costs | Expenses incurred from changing prices frequently due to inflation. | Reduces pricing flexibility; businesses bear additional operational costs. | Reprinting menus, updating price tags, revising catalogs. |

| Shoe Leather Costs | Costs from increased transactions and effort to minimize cash holdings. | Higher time and effort spent managing money; reduces overall economic efficiency. | Frequent bank visits, increased record keeping, time spent on cash management. |

Understanding Menu Costs in Economic Theory

Menu costs in economic theory refer to the expenses businesses incur when changing prices, including printing new menus, updating pricing systems, and informing customers. These costs cause firms to adjust prices less frequently, contributing to price stickiness and affecting inflation dynamics. Understanding menu costs helps explain why prices do not always respond instantly to shifts in demand or supply, influencing overall market efficiency.

Exploring the Concept of Shoe Leather Costs

Shoe leather costs refer to the increased expenses and time consumers and businesses face due to frequent trips to the bank or financial institutions to avoid holding depreciating cash during high inflation periods. Unlike menu costs, which involve the direct monetary costs of changing prices, shoe leather costs represent the indirect economic burden linked to reducing cash holdings and adjusting spending behavior. Understanding shoe leather costs highlights the real-world implications of inflation on transaction inefficiency and resource allocation.

Key Differences Between Menu Costs and Shoe Leather Costs

Menu costs refer to the expenses businesses incur when changing prices frequently, such as printing new menus or updating labels, which can slow down price adjustments in inflationary environments. Shoe leather costs represent the increased transaction costs and inconvenience consumers face when they minimize cash holdings to avoid inflation erosion, leading to more frequent bank visits or digital transactions. The key difference lies in menu costs affecting businesses' pricing strategies, while shoe leather costs impact consumer behavior and cash management practices.

Causes and Triggers of Menu Costs

Menu costs arise primarily from the need to physically update prices due to inflation or changes in input costs, causing firms to allocate resources for reprinting menus, catalogs, or price labels. These costs are triggered by frequent price adjustments in volatile markets, where the expense of changing nominal prices can outweigh the benefits of aligning prices with current economic conditions. In contrast, shoe leather costs emerge when high inflation induces consumers to minimize cash holdings, increasing transactions and visits to banks or ATMs.

Factors Influencing Shoe Leather Costs

Shoe leather costs increase with higher inflation rates as frequent price changes force consumers to make more trips to the bank, raising time and effort spent on cash management. The availability of alternative payment methods like digital banking reduces shoe leather costs by minimizing physical cash handling. Economic uncertainty and fluctuating interest rates also amplify shoe leather costs by encouraging individuals to hold less cash and optimize liquidity frequently.

Menu Costs and Price Stickiness in Markets

Menu costs refer to the expenses businesses incur when changing prices, such as reprinting menus or updating systems, leading to price stickiness in markets. This price rigidity can delay adjustments to supply and demand shifts, causing inefficiencies in economic equilibrium. Firms often tolerate short-term profitability losses to avoid frequent menu cost expenditures, reinforcing stable price patterns despite fluctuating market conditions.

Shoe Leather Costs and Money Management Behavior

Shoe leather costs refer to the increased time and effort individuals spend managing cash holdings to minimize losses from inflation, often resulting in more frequent trips to the bank or ATM. These costs highlight the behavioral adjustments people make to avoid holding excessive money that rapidly loses value, influencing spending and saving patterns. Effective money management under high inflation conditions requires balancing ease of access to funds with minimizing the frequency of withdrawals, directly impacting economic decision-making and liquidity preference.

Real-World Examples of Menu and Shoe Leather Costs

Menu costs manifest in businesses frequently updating printed menus or price tags, such as restaurants reprinting seasonal menus or retailers adjusting pricing during inflationary periods. Shoe leather costs are evident when consumers make multiple bank visits or online transactions to minimize cash holdings during high inflation, as seen in hyperinflation scenarios like Zimbabwe. Real-world instances demonstrate how both menu and shoe leather costs contribute to inefficiencies during periods of volatile inflation, impacting operational expenses and consumer behavior.

Impact of Inflation on Menu and Shoe Leather Costs

Inflation drives up menu costs as businesses frequently update prices on menus, catalogs, and labels to reflect rising costs, resulting in higher operational expenses. Concurrently, inflation increases shoe leather costs by prompting consumers to make more frequent trips to banks or ATMs to withdraw smaller amounts of cash, reducing cash holdings due to diminishing purchasing power. The combined impact of inflation intensifies these costs, reducing overall economic efficiency and increasing transaction frictions for businesses and consumers alike.

Policy Implications for Minimizing Menu and Shoe Leather Costs

Effective monetary policies that stabilize inflation rates directly reduce menu costs by limiting the frequency of price adjustments in businesses. Encouraging digital payment systems and reducing reliance on cash minimizes shoe leather costs by decreasing the need for frequent trips to financial institutions. Central banks should prioritize inflation targeting and financial innovation to optimize overall economic efficiency by lowering both menu and shoe leather costs.

Menu Costs vs Shoe Leather Costs Infographic

difterm.com

difterm.com