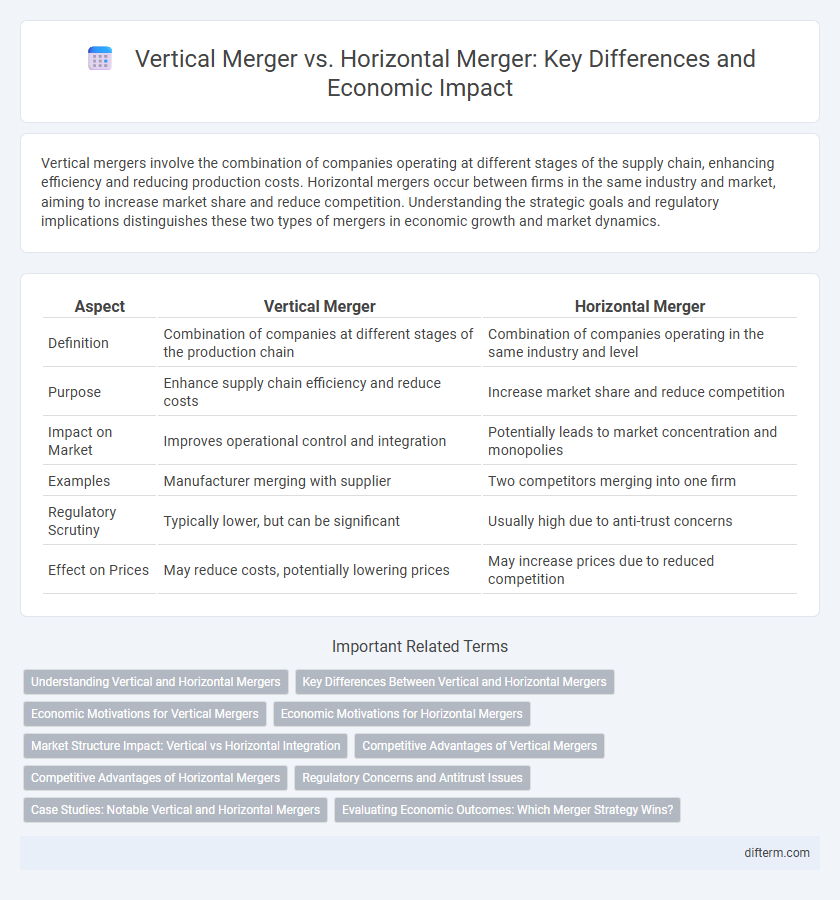

Vertical mergers involve the combination of companies operating at different stages of the supply chain, enhancing efficiency and reducing production costs. Horizontal mergers occur between firms in the same industry and market, aiming to increase market share and reduce competition. Understanding the strategic goals and regulatory implications distinguishes these two types of mergers in economic growth and market dynamics.

Table of Comparison

| Aspect | Vertical Merger | Horizontal Merger |

|---|---|---|

| Definition | Combination of companies at different stages of the production chain | Combination of companies operating in the same industry and level |

| Purpose | Enhance supply chain efficiency and reduce costs | Increase market share and reduce competition |

| Impact on Market | Improves operational control and integration | Potentially leads to market concentration and monopolies |

| Examples | Manufacturer merging with supplier | Two competitors merging into one firm |

| Regulatory Scrutiny | Typically lower, but can be significant | Usually high due to anti-trust concerns |

| Effect on Prices | May reduce costs, potentially lowering prices | May increase prices due to reduced competition |

Understanding Vertical and Horizontal Mergers

Vertical mergers occur between companies operating at different stages of the supply chain, aiming to enhance supply chain efficiency and reduce production costs, while horizontal mergers involve firms in the same industry and market, focusing on increasing market share and reducing competition. Vertical mergers help control inputs and distribution channels, resulting in improved coordination and lowered transaction costs. Horizontal mergers typically lead to economies of scale and greater market power, but may raise antitrust concerns due to potential monopolistic behavior.

Key Differences Between Vertical and Horizontal Mergers

Vertical mergers occur between companies operating at different stages of the supply chain, enhancing control over production and distribution, while horizontal mergers involve firms competing within the same industry to increase market share. Vertical mergers improve operational efficiencies and reduce transaction costs by integrating suppliers or distributors, whereas horizontal mergers focus on consolidating market power and achieving economies of scale. Key differences include the strategic purpose--vertical mergers aim at supply chain integration, and horizontal mergers target competitive advantage and market dominance.

Economic Motivations for Vertical Mergers

Vertical mergers occur when companies at different stages of the supply chain combine to enhance operational efficiency, reduce transaction costs, and secure supply chain stability. These mergers aim to eliminate bottlenecks, achieve better coordination of production processes, and increase market power through improved control over inputs or distribution channels. Economic motivations also include cost savings from reducing information asymmetries and strengthening competitive positioning against rivals in upstream or downstream markets.

Economic Motivations for Horizontal Mergers

Horizontal mergers are primarily driven by economic motivations such as increasing market share, achieving economies of scale, and enhancing competitive advantage by eliminating rivals. These mergers reduce competition within the same industry, allowing firms to exert greater pricing power and improve profit margins. Cost synergies, including consolidated operations and reduced overhead, further incentivize horizontal mergers to maximize shareholder value.

Market Structure Impact: Vertical vs Horizontal Integration

Vertical mergers reshape market structure by enhancing supply chain efficiency and reducing transaction costs, leading to increased control over production stages and potentially limiting competition through foreclosure of rivals. Horizontal mergers, by combining firms within the same industry at the same production stage, often consolidate market power, reduce the number of competitors, and can result in higher market concentration and potential monopolistic behavior. The contrasting impacts on market dynamics highlight that vertical integration tends to influence upstream and downstream coordination, while horizontal integration directly alters competitive intensity within the market segment.

Competitive Advantages of Vertical Mergers

Vertical mergers enhance competitive advantages by integrating supply chains, reducing transaction costs, and improving coordination between production stages. This integration creates barriers for new entrants and strengthens control over raw materials and distribution channels. Firms also gain price-setting power and can achieve higher efficiency through streamlined operations and reduced dependency on external suppliers.

Competitive Advantages of Horizontal Mergers

Horizontal mergers create competitive advantages by consolidating market share, reducing direct competition, and achieving economies of scale. These mergers enable firms to enhance pricing power, expand product offerings, and increase market influence within the same industry. The combined resources and customer bases often lead to improved innovation capacity and operational efficiency, strengthening the merged entity's position against rivals.

Regulatory Concerns and Antitrust Issues

Vertical mergers, involving companies at different stages of the supply chain, raise regulatory concerns related to potential foreclosure of competitors and market access restrictions. Horizontal mergers combine firms operating in the same industry, triggering antitrust scrutiny focused on reducing competition, increasing market concentration, and potential price manipulation. Regulatory agencies analyze both types to prevent monopolistic practices and protect consumer welfare by maintaining fair market dynamics.

Case Studies: Notable Vertical and Horizontal Mergers

The 2016 merger between AT&T and Time Warner exemplifies a vertical merger, combining content production with distribution to enhance market control and create operational synergies. In contrast, the 2015 acquisition of Heinz by Kraft Foods represents a horizontal merger, consolidating two major food processing companies to increase market share and reduce competition. These case studies highlight how vertical mergers focus on supply chain integration while horizontal mergers target industry consolidation.

Evaluating Economic Outcomes: Which Merger Strategy Wins?

Vertical mergers, combining companies at different stages of the supply chain, often lead to enhanced efficiency, reduced production costs, and improved market coordination, supporting long-term economic growth. Horizontal mergers, involving direct competitors, can create economies of scale and increase market power but risk reducing competition and consumer choice, potentially leading to higher prices. Economic outcomes favor vertical mergers when efficiency gains outweigh potential market dominance concerns, while horizontal mergers require stricter regulatory scrutiny to balance benefits and antitrust risks.

Vertical Merger vs Horizontal Merger Infographic

difterm.com

difterm.com