The fiscal multiplier measures the impact of government spending or tax changes on overall economic output, typically showing strong effects during recessions when resources are underutilized. The monetary multiplier, in contrast, gauges how changes in the money supply influence economic activity through interest rates and credit availability, often producing more gradual effects. Understanding the differing mechanisms and magnitudes of these multipliers helps policymakers design effective interventions to stimulate growth or control inflation.

Table of Comparison

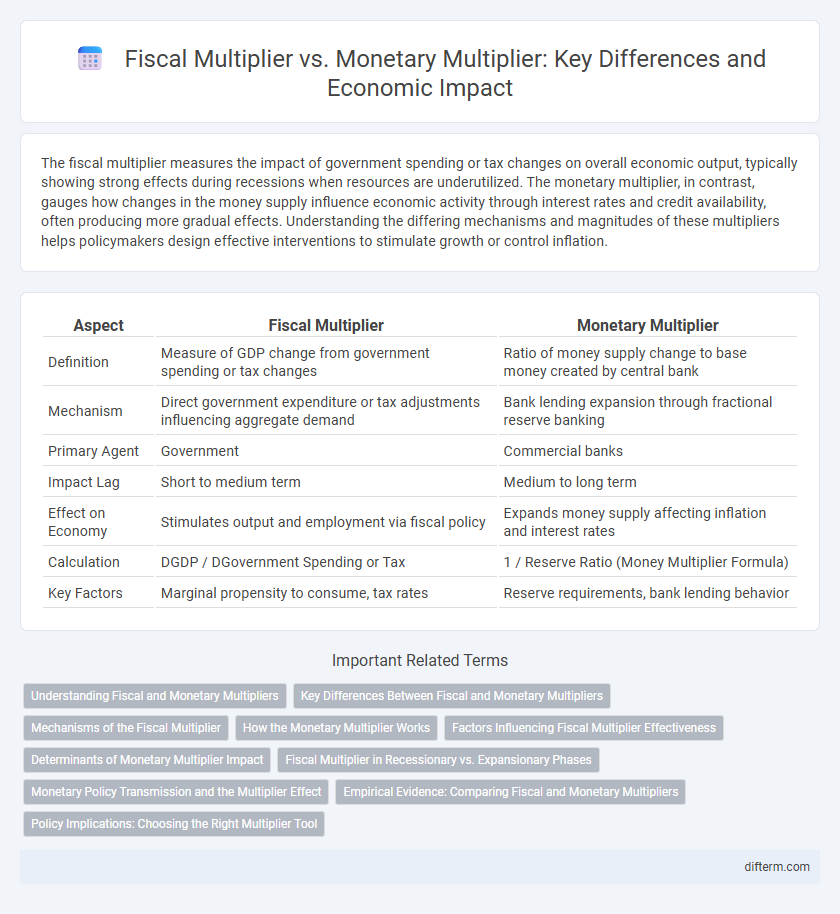

| Aspect | Fiscal Multiplier | Monetary Multiplier |

|---|---|---|

| Definition | Measure of GDP change from government spending or tax changes | Ratio of money supply change to base money created by central bank |

| Mechanism | Direct government expenditure or tax adjustments influencing aggregate demand | Bank lending expansion through fractional reserve banking |

| Primary Agent | Government | Commercial banks |

| Impact Lag | Short to medium term | Medium to long term |

| Effect on Economy | Stimulates output and employment via fiscal policy | Expands money supply affecting inflation and interest rates |

| Calculation | DGDP / DGovernment Spending or Tax | 1 / Reserve Ratio (Money Multiplier Formula) |

| Key Factors | Marginal propensity to consume, tax rates | Reserve requirements, bank lending behavior |

Understanding Fiscal and Monetary Multipliers

Fiscal multipliers measure the change in economic output generated by government spending or tax policies, typically ranging from 0.5 to 1.5 depending on economic conditions and fiscal stimulus type. Monetary multipliers reflect the impact of central bank actions, such as interest rate changes or quantitative easing, on aggregate demand and inflation, with effects varying according to liquidity preferences and financial market structure. Understanding the differential magnitudes and transmission mechanisms of fiscal versus monetary multipliers is crucial for designing effective macroeconomic stabilization policies.

Key Differences Between Fiscal and Monetary Multipliers

Fiscal multipliers measure the change in economic output caused by government spending or tax policies, directly influencing demand through public expenditures. Monetary multipliers, on the other hand, reflect the effect of changes in the money supply on economic activity, primarily impacting interest rates and credit availability. The key difference lies in fiscal policy's direct injection into the economy versus monetary policy's indirect influence via financial markets and banking systems.

Mechanisms of the Fiscal Multiplier

The fiscal multiplier operates through government spending and taxation changes that directly influence aggregate demand by increasing consumption and investment. Its mechanisms include the immediate injection of funds into the economy, which boosts income and encourages further spending, creating a ripple effect on overall economic output. Unlike the monetary multiplier, which depends on banking reserves and credit expansion, the fiscal multiplier's impact is more direct and often more predictable in stimulating short-term economic growth.

How the Monetary Multiplier Works

The monetary multiplier illustrates how an initial deposit in a banking system can expand the total money supply through repeated lending and deposit cycles, influenced by the reserve requirement set by central banks. This process allows banks to lend a portion of their deposits while holding back reserves, effectively multiplying the base money into a larger amount of broad money. The size of the monetary multiplier depends on factors such as reserve ratios and public cash holding preferences, directly impacting credit availability and economic liquidity.

Factors Influencing Fiscal Multiplier Effectiveness

The effectiveness of the fiscal multiplier is influenced by factors such as the state of the economy, with larger multipliers observed during recessions due to higher idle resources and increased marginal propensities to consume. Open economies tend to have lower fiscal multipliers because of import leakages, reducing the impact of government spending on domestic output. Additionally, the structure of the tax system and the type of fiscal intervention, such as government investment versus transfers, significantly affect the magnitude of the multiplier.

Determinants of Monetary Multiplier Impact

The monetary multiplier impact is primarily determined by the reserve ratio set by central banks, influencing how much banks can lend from deposits. Other key factors include the public's preference for holding cash versus deposits and the central bank's control over monetary base expansion. Variations in these determinants directly affect the effectiveness of monetary policy in stimulating economic activity.

Fiscal Multiplier in Recessionary vs. Expansionary Phases

Fiscal multipliers tend to be significantly larger during recessionary phases due to higher marginal propensities to consume and underutilized economic capacity, which amplify the impact of government spending on aggregate demand. In contrast, during expansionary phases, fiscal multipliers generally shrink as economies approach full employment, causing government spending to crowd out private investment and elevate interest rates. Understanding the varying magnitude of fiscal multipliers provides critical insights for calibrating fiscal policy effectiveness across different stages of the economic cycle.

Monetary Policy Transmission and the Multiplier Effect

Monetary policy transmission channels influence the monetary multiplier by altering interest rates, credit availability, and asset prices, which in turn affect aggregate demand and investment levels. The monetary multiplier effect often operates with variable lags due to changes in bank lending behavior and consumer spending patterns, differing from the more direct impact of fiscal multipliers. Understanding the distinct mechanisms in monetary policy transmission is crucial for assessing the overall impact of monetary interventions on economic output and inflation dynamics.

Empirical Evidence: Comparing Fiscal and Monetary Multipliers

Empirical evidence indicates that fiscal multipliers tend to be larger than monetary multipliers during economic recessions, with government spending generating a multiplier effect ranging from 1.5 to 2.5, while monetary policy multipliers often fall below 1. Studies conducted after the 2008 financial crisis show that fiscal stimulus has a more direct impact on aggregate demand and output compared to monetary interventions, especially when interest rates are near zero. Cross-country analyses reveal that fiscal multipliers vary based on the state of the economy, openness to trade, and monetary policy stance, emphasizing the contextual importance of policy coordination.

Policy Implications: Choosing the Right Multiplier Tool

Fiscal multipliers tend to be more effective in stimulating economic output during recessions when monetary policy faces liquidity traps or zero lower bound constraints. Monetary multipliers influence aggregate demand through interest rate adjustments, making them suitable for managing inflation and stabilizing growth in buoyant economies. Policymakers must assess the economic context and transmission mechanisms to choose the multiplier that maximizes stabilization while minimizing unintended side effects.

Fiscal multiplier vs Monetary multiplier Infographic

difterm.com

difterm.com