A current account deficit occurs when a country imports more goods, services, and transfers than it exports, indicating a net outflow of domestic currency to foreign markets. A capital account deficit, on the other hand, reflects a net outflow of financial assets, such as investments and loans, signaling that domestic investors are purchasing more foreign assets than foreigners are investing locally. Understanding the distinction between these deficits is crucial for analyzing a country's overall economic health and external financial stability.

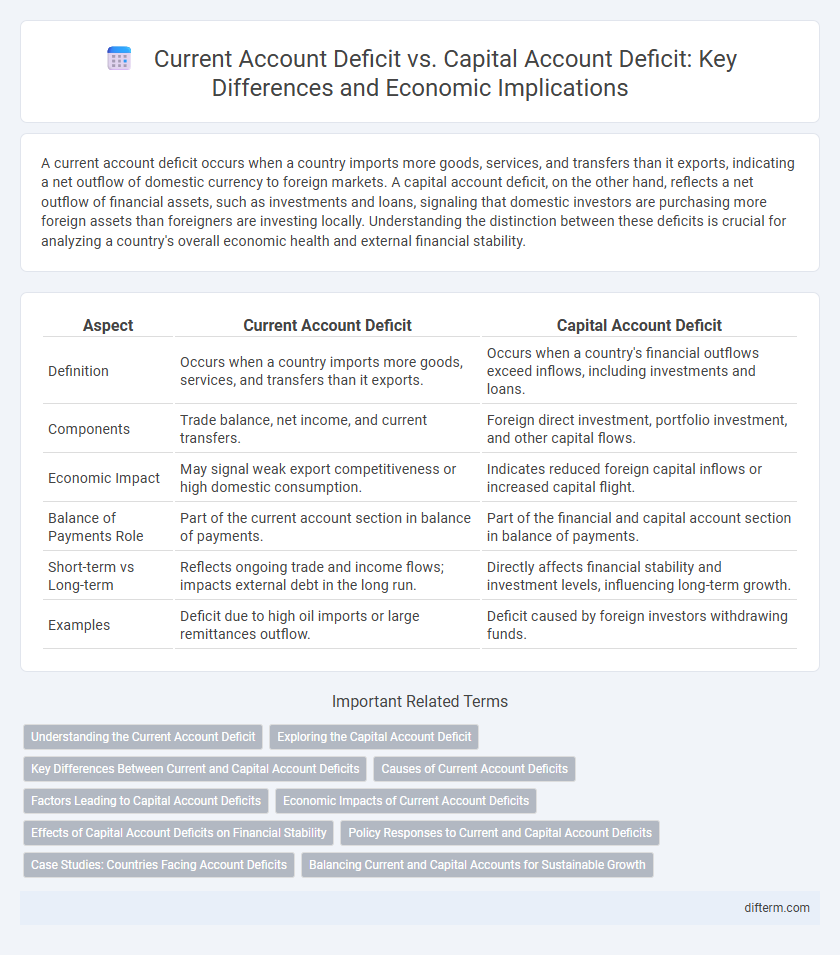

Table of Comparison

| Aspect | Current Account Deficit | Capital Account Deficit |

|---|---|---|

| Definition | Occurs when a country imports more goods, services, and transfers than it exports. | Occurs when a country's financial outflows exceed inflows, including investments and loans. |

| Components | Trade balance, net income, and current transfers. | Foreign direct investment, portfolio investment, and other capital flows. |

| Economic Impact | May signal weak export competitiveness or high domestic consumption. | Indicates reduced foreign capital inflows or increased capital flight. |

| Balance of Payments Role | Part of the current account section in balance of payments. | Part of the financial and capital account section in balance of payments. |

| Short-term vs Long-term | Reflects ongoing trade and income flows; impacts external debt in the long run. | Directly affects financial stability and investment levels, influencing long-term growth. |

| Examples | Deficit due to high oil imports or large remittances outflow. | Deficit caused by foreign investors withdrawing funds. |

Understanding the Current Account Deficit

The current account deficit occurs when a country's imports of goods, services, and income payments exceed its exports, reflecting net borrowing from abroad to finance domestic consumption or investment. Understanding the current account deficit is crucial as it signals the nation's reliance on foreign capital inflows, which can impact exchange rates, foreign debt levels, and economic stability. Unlike the capital account deficit, primarily related to financial asset transactions, the current account deficit directly measures the trade balance and income flows, influencing fiscal policy and economic growth strategies.

Exploring the Capital Account Deficit

A capital account deficit occurs when a country experiences more capital outflows than inflows, indicating that domestic investors are investing more abroad than foreign investors in the country. This contrasts with a current account deficit, which reflects a shortfall in trade balance, services, and income flows. Exploring the capital account deficit reveals underlying factors such as foreign direct investment trends, portfolio investments, and changes in reserve assets that impact a nation's economic stability and currency valuation.

Key Differences Between Current and Capital Account Deficits

The current account deficit arises when a country imports more goods, services, and transfers than it exports, reflecting imbalances in trade and income flows. In contrast, the capital account deficit occurs when capital outflows exceed inflows, indicating net investments and financial asset transactions abroad. Understanding these distinctions is essential to analyze a nation's external financial stability and its ability to finance its obligations through trade versus investment channels.

Causes of Current Account Deficits

Current account deficits primarily arise from structural economic imbalances such as persistent trade deficits due to high domestic consumption outpacing export revenue and low national savings rates. Other significant causes include currency overvaluation, which reduces export competitiveness, and increased foreign borrowing to finance consumption and investment. These factors collectively lead to a sustained outflow of funds exceeding inflows, resulting in a negative current account balance.

Factors Leading to Capital Account Deficits

Capital account deficits often arise from substantial foreign investments and increased external borrowing, resulting in significant outflows of capital. Economic instability, such as political uncertainty or high inflation rates, can exacerbate capital flight as investors seek safer assets abroad. Moreover, policy decisions like liberalizing capital controls may further intensify capital account deficits by facilitating the movement of funds out of the domestic economy.

Economic Impacts of Current Account Deficits

Current account deficits indicate a nation is importing more goods, services, and capital than it exports, often leading to increased foreign debt and potential currency depreciation. Persistent deficits can undermine investor confidence, reduce national savings, and limit economic growth prospects by increasing reliance on external financing. Economies experiencing sustained current account deficits risk diminished financial stability, higher interest rates, and vulnerability to sudden capital outflows impacting economic resilience.

Effects of Capital Account Deficits on Financial Stability

Capital account deficits can undermine financial stability by signaling excessive foreign borrowing, leading to increased vulnerability to sudden capital outflows and currency depreciation. Persistent capital account deficits may strain foreign exchange reserves, limiting a country's ability to manage external shocks effectively. Such deficits often heighten risks of balance of payments crises, posing challenges for sustainable economic growth and fiscal management.

Policy Responses to Current and Capital Account Deficits

Policy responses to current account deficits often include implementing fiscal consolidation, enhancing export competitiveness through trade reforms, and attracting foreign direct investment (FDI) to stabilize external balances. In contrast, addressing capital account deficits typically involves tightening capital controls, improving investor confidence via robust financial regulations, and maintaining adequate foreign exchange reserves to mitigate volatility. Effective coordination of monetary policy and exchange rate management is essential to balance both current and capital account deficits while promoting sustainable economic growth.

Case Studies: Countries Facing Account Deficits

Countries like India and Brazil exemplify challenges with current account deficits, primarily driven by high import bills and modest export growth, leading to persistent imbalances impacting foreign exchange reserves. In contrast, Argentina and Turkey frequently encounter capital account deficits due to capital flight and reduced foreign direct investment, triggering currency depreciation and inflationary pressures. Case studies reveal that managing account deficits requires tailored policies addressing structural economic weaknesses, external debt management, and investor confidence restoration.

Balancing Current and Capital Accounts for Sustainable Growth

Maintaining a balanced current account and capital account is crucial for sustainable economic growth, as persistent current account deficits can indicate excessive domestic consumption over savings, while capital account deficits reflect outflows of investment and financial resources. Effective policy measures promoting export competitiveness and attracting stable foreign direct investment help correct imbalances and stabilize external accounts. Sustainable growth hinges on aligning trade balances with capital flows to avoid excessive dependence on external borrowing and currency volatility.

Current account deficit vs Capital account deficit Infographic

difterm.com

difterm.com