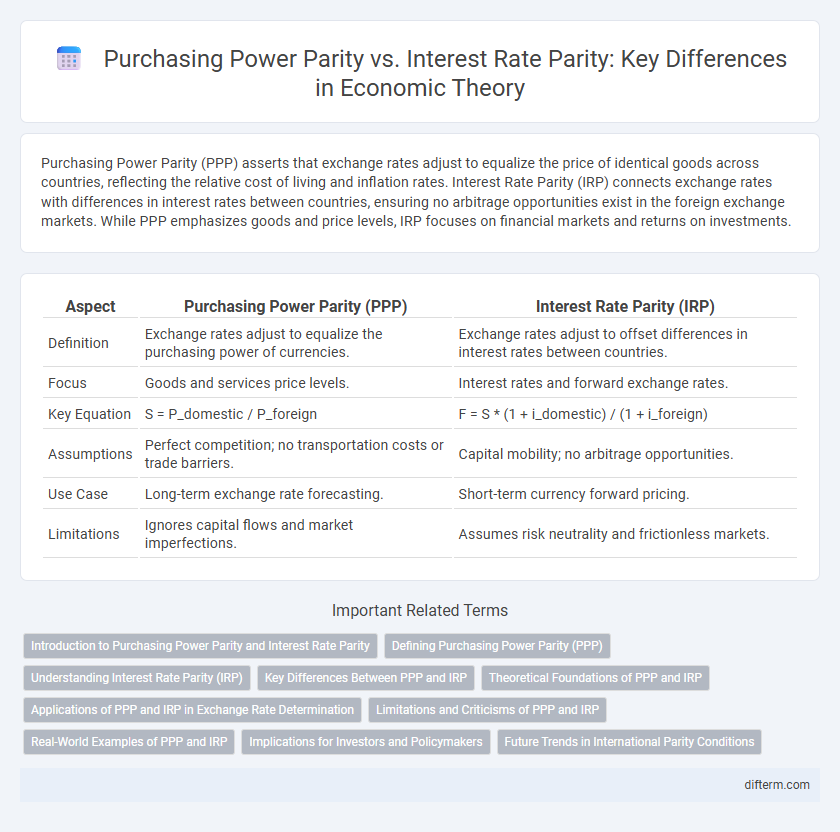

Purchasing Power Parity (PPP) asserts that exchange rates adjust to equalize the price of identical goods across countries, reflecting the relative cost of living and inflation rates. Interest Rate Parity (IRP) connects exchange rates with differences in interest rates between countries, ensuring no arbitrage opportunities exist in the foreign exchange markets. While PPP emphasizes goods and price levels, IRP focuses on financial markets and returns on investments.

Table of Comparison

| Aspect | Purchasing Power Parity (PPP) | Interest Rate Parity (IRP) |

|---|---|---|

| Definition | Exchange rates adjust to equalize the purchasing power of currencies. | Exchange rates adjust to offset differences in interest rates between countries. |

| Focus | Goods and services price levels. | Interest rates and forward exchange rates. |

| Key Equation | S = P_domestic / P_foreign | F = S * (1 + i_domestic) / (1 + i_foreign) |

| Assumptions | Perfect competition; no transportation costs or trade barriers. | Capital mobility; no arbitrage opportunities. |

| Use Case | Long-term exchange rate forecasting. | Short-term currency forward pricing. |

| Limitations | Ignores capital flows and market imperfections. | Assumes risk neutrality and frictionless markets. |

Introduction to Purchasing Power Parity and Interest Rate Parity

Purchasing Power Parity (PPP) explains exchange rate determination by comparing the relative price levels of a fixed basket of goods between countries, implying that exchange rates adjust to equalize purchasing power. Interest Rate Parity (IRP) focuses on the relationship between interest rates and exchange rate movements, asserting that the difference in national interest rates should be offset by the expected change in exchange rates to prevent arbitrage opportunities. Both PPP and IRP serve as fundamental economic theories for understanding currency valuation and international financial equilibrium.

Defining Purchasing Power Parity (PPP)

Purchasing Power Parity (PPP) is an economic theory stating that in the long run, exchange rates should adjust so that identical goods cost the same in different countries when priced in a common currency. PPP helps compare the relative value of currencies by eliminating price level differences between nations. This concept plays a crucial role in assessing currency undervaluation or overvaluation, influencing international trade and investment decisions.

Understanding Interest Rate Parity (IRP)

Interest Rate Parity (IRP) theory explains the relationship between interest rates and exchange rates, ensuring arbitrage opportunities vanish in the forex market. By linking the spot exchange rate, forward exchange rate, and domestic and foreign interest rates, IRP predicts that the forward exchange rate adjusts to offset interest rate differentials. This equilibrium condition helps investors assess currency risk and guides central banks in formulating monetary policies.

Key Differences Between PPP and IRP

Purchasing Power Parity (PPP) compares the relative price levels of a basket of goods between two countries to determine exchange rate equilibrium, emphasizing inflation rate differences. Interest Rate Parity (IRP) focuses on the relationship between interest rates and expected changes in exchange rates, ensuring no arbitrage opportunities in the foreign exchange market. The key difference lies in PPP addressing long-term equilibrium based on price levels, while IRP deals with short-term equilibrium influenced by interest rate differentials.

Theoretical Foundations of PPP and IRP

Purchasing Power Parity (PPP) theory asserts that exchange rates adjust to equalize the price levels of identical goods and services in different countries, emphasizing the law of one price as a fundamental economic principle. Interest Rate Parity (IRP) theory explains the relationship between interest rates and exchange rates to prevent arbitrage opportunities, based on the premise that investors require equal returns on equivalent-risk assets across countries. Both PPP and IRP serve as foundational concepts in international finance, linking currency valuation to price levels and interest rate differentials, respectively.

Applications of PPP and IRP in Exchange Rate Determination

Purchasing Power Parity (PPP) is applied in exchange rate determination by assessing relative price levels between countries to predict long-term currency value adjustments, ensuring that identical goods cost the same across borders. Interest Rate Parity (IRP) influences short-term exchange rates by equating the returns on investments across countries through the relationship between interest rate differentials and forward exchange rates. Together, PPP provides fundamental valuation benchmarks while IRP facilitates arbitrage-free conditions in the foreign exchange markets.

Limitations and Criticisms of PPP and IRP

Purchasing Power Parity (PPP) often faces criticism for its limited applicability in the short term due to price stickiness and market imperfections, which cause exchange rates to deviate from fundamental values. Interest Rate Parity (IRP) may fail under conditions of capital controls, transaction costs, or differing risk premiums across countries, undermining its assumption of perfect capital mobility. Both theories struggle to account for factors like speculative flows, political risks, and asymmetric information, which can lead to persistent deviations from predicted parity conditions.

Real-World Examples of PPP and IRP

Purchasing Power Parity (PPP) is evident in the comparison of Big Mac prices across countries, illustrating how currency values adjust to equalize purchasing capacity, such as the price differences between the U.S. and Switzerland. Interest Rate Parity (IRP) manifests in the foreign exchange market where investors arbitrate between differences in interest rates and forward exchange rates, a practical example being the USD-EUR interest and forward rate relationship exploited by multinational banks. Both concepts critically influence international finance decisions, with PPP highlighting long-term currency valuation trends while IRP drives short-term capital flows and hedging strategies.

Implications for Investors and Policymakers

Purchasing Power Parity (PPP) and Interest Rate Parity (IRP) provide critical frameworks for assessing exchange rate movements and investment returns, with PPP emphasizing long-term currency value adjustments based on inflation differentials, while IRP focuses on short-term capital flow equilibrium via interest rate differentials. For investors, understanding PPP helps in forecasting currency depreciation or appreciation, which informs decisions on foreign investments and hedging strategies, whereas IRP guides the assessment of arbitrage opportunities and the risk-return trade-off in cross-border lending and borrowing. Policymakers leverage insights from both parities to design monetary and fiscal policies that stabilize exchange rates, control inflation, and influence capital flow by adjusting interest rates, thereby fostering a conducive environment for sustainable economic growth.

Future Trends in International Parity Conditions

Future trends in international parity conditions indicate increasing complexity as global financial integration intensifies, influencing both Purchasing Power Parity (PPP) and Interest Rate Parity (IRP). Advances in technology and the rise of digital currencies are reshaping how exchange rates adjust to price differentials and interest rate differentials across countries. Economists predict more dynamic and sometimes short-lived deviations from PPP and IRP due to rapid capital flows, central bank policies, and evolving trade patterns.

Purchasing Power Parity vs Interest Rate Parity Infographic

difterm.com

difterm.com