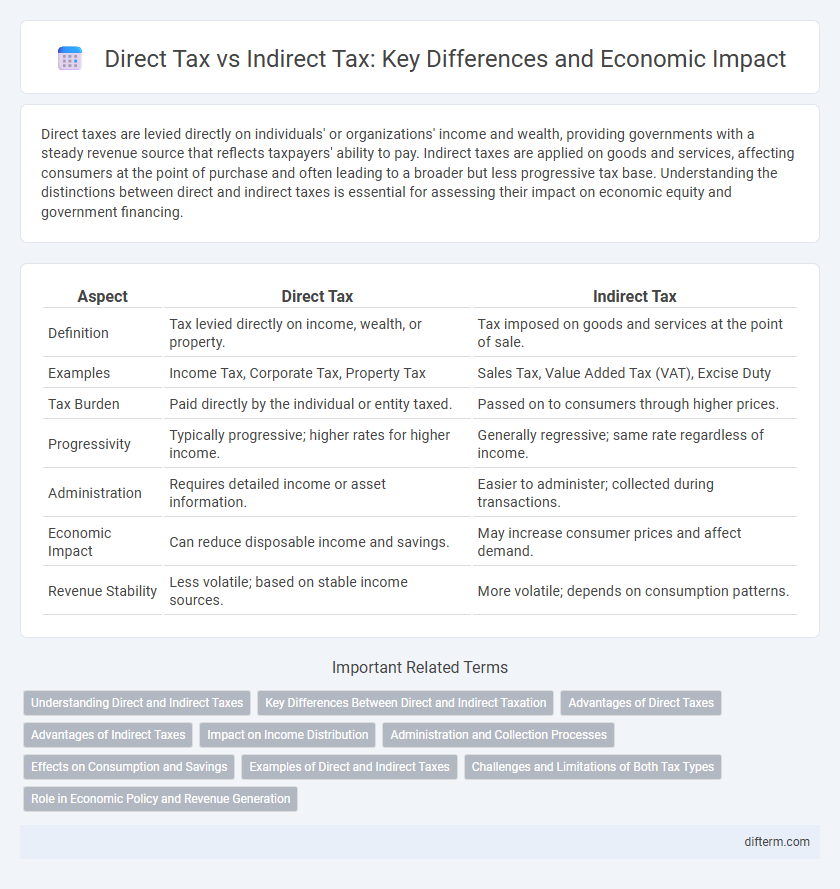

Direct taxes are levied directly on individuals' or organizations' income and wealth, providing governments with a steady revenue source that reflects taxpayers' ability to pay. Indirect taxes are applied on goods and services, affecting consumers at the point of purchase and often leading to a broader but less progressive tax base. Understanding the distinctions between direct and indirect taxes is essential for assessing their impact on economic equity and government financing.

Table of Comparison

| Aspect | Direct Tax | Indirect Tax |

|---|---|---|

| Definition | Tax levied directly on income, wealth, or property. | Tax imposed on goods and services at the point of sale. |

| Examples | Income Tax, Corporate Tax, Property Tax | Sales Tax, Value Added Tax (VAT), Excise Duty |

| Tax Burden | Paid directly by the individual or entity taxed. | Passed on to consumers through higher prices. |

| Progressivity | Typically progressive; higher rates for higher income. | Generally regressive; same rate regardless of income. |

| Administration | Requires detailed income or asset information. | Easier to administer; collected during transactions. |

| Economic Impact | Can reduce disposable income and savings. | May increase consumer prices and affect demand. |

| Revenue Stability | Less volatile; based on stable income sources. | More volatile; depends on consumption patterns. |

Understanding Direct and Indirect Taxes

Direct taxes are imposed directly on individuals or organizations based on income, profits, or property, including income tax, corporate tax, and property tax. Indirect taxes are levied on goods and services, such as value-added tax (VAT), sales tax, and excise duty, paid by consumers at the point of purchase. Understanding the distinction between direct and indirect taxes is crucial for assessing tax incidence, compliance burdens, and their impact on economic behavior and government revenue.

Key Differences Between Direct and Indirect Taxation

Direct taxes are levied directly on individuals or entities' income, wealth, or property, reflecting the taxpayer's ability to pay and ensuring a progressive taxation system. Indirect taxes, such as sales tax, value-added tax (VAT), and excise duties, are imposed on goods and services, shifting the tax burden to the end consumer. Key differences include the incidence of tax collection, with direct taxes collected by authorities from the taxpayer, whereas indirect taxes are collected through intermediaries and embedded in the price of goods and services.

Advantages of Direct Taxes

Direct taxes promote equity by being based on an individual's ability to pay, ensuring a fair distribution of the tax burden. They provide a stable revenue source for governments due to their predictable nature and direct link to income or wealth. Direct taxes also encourage transparency and accountability, as taxpayers are clearly aware of their liabilities and the government's revenue collection.

Advantages of Indirect Taxes

Indirect taxes, such as sales tax and value-added tax (VAT), stimulate economic efficiency by being easier to administer and collect compared to direct taxes. These taxes broaden the tax base, ensuring steady government revenue even during fluctuating income levels. They also encourage consumer responsibility by influencing spending behavior without directly impacting personal income.

Impact on Income Distribution

Direct taxes, such as income and corporate taxes, directly affect individuals' and businesses' disposable income, often reducing income inequality by imposing higher rates on wealthier taxpayers. Indirect taxes, like sales and value-added taxes (VAT), tend to be regressive, disproportionately impacting lower-income households since they consume a larger share of their income on taxed goods and services. The balance between direct and indirect taxation significantly influences overall income distribution and economic equity.

Administration and Collection Processes

Direct taxes are collected directly from individuals or organizations by tax authorities, requiring detailed income reporting and complex administrative systems to ensure compliance. Indirect taxes, such as sales tax or VAT, are collected through intermediaries like retailers, simplifying collection but necessitating extensive monitoring of transactions and supply chains. The administration of direct taxes involves rigorous enforcement and auditing mechanisms, while indirect taxes rely heavily on point-of-sale systems and periodic filings to maintain revenue flow.

Effects on Consumption and Savings

Direct taxes, such as income tax, reduce disposable income directly, leading to decreased consumption and potentially increased savings as individuals adjust their spending habits. Indirect taxes, like sales tax or VAT, increase the price of goods and services, often discouraging consumption but leaving income levels unchanged, which can reduce savings by forcing consumers to allocate more income to taxed goods. Understanding these effects is critical for policymakers aiming to balance revenue generation with economic growth and household financial stability.

Examples of Direct and Indirect Taxes

Direct taxes include income tax, corporate tax, and property tax, which are paid directly to the government by individuals and organizations based on income or asset ownership. Indirect taxes, such as value-added tax (VAT), sales tax, and excise duties, are levied on goods and services, indirectly affecting consumers through higher prices. Understanding these examples highlights the distinction between taxes targeted at income or wealth (direct) versus consumption-based levies (indirect).

Challenges and Limitations of Both Tax Types

Direct taxes face challenges like tax evasion and difficulty in accurate income assessment, leading to revenue gaps and enforcement complexities. Indirect taxes, while easier to collect at point of sale, often suffer from regressive impacts, disproportionately affecting lower-income groups and contributing to inflationary pressures. Both tax types encounter issues in achieving equitable tax burdens and administrative efficiency within diverse economic environments.

Role in Economic Policy and Revenue Generation

Direct taxes, such as income and corporate taxes, serve as a stable source of government revenue and directly influence income distribution by targeting taxpayers based on their ability to pay. Indirect taxes, including sales and excise duties, are vital for broad-based revenue generation and consumption regulation, affecting prices and demand patterns across the economy. Both tax types are integral to economic policy, balancing revenue needs with objectives like equity, economic growth, and inflation control.

Direct Tax vs Indirect Tax Infographic

difterm.com

difterm.com