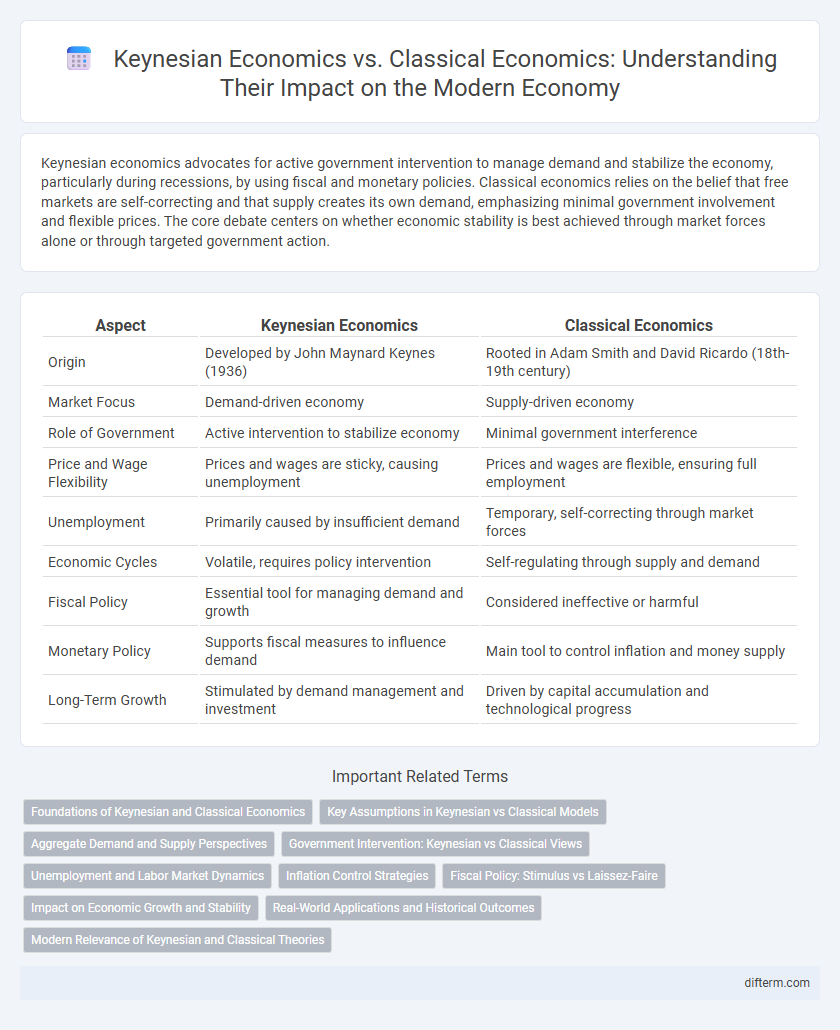

Keynesian economics advocates for active government intervention to manage demand and stabilize the economy, particularly during recessions, by using fiscal and monetary policies. Classical economics relies on the belief that free markets are self-correcting and that supply creates its own demand, emphasizing minimal government involvement and flexible prices. The core debate centers on whether economic stability is best achieved through market forces alone or through targeted government action.

Table of Comparison

| Aspect | Keynesian Economics | Classical Economics |

|---|---|---|

| Origin | Developed by John Maynard Keynes (1936) | Rooted in Adam Smith and David Ricardo (18th-19th century) |

| Market Focus | Demand-driven economy | Supply-driven economy |

| Role of Government | Active intervention to stabilize economy | Minimal government interference |

| Price and Wage Flexibility | Prices and wages are sticky, causing unemployment | Prices and wages are flexible, ensuring full employment |

| Unemployment | Primarily caused by insufficient demand | Temporary, self-correcting through market forces |

| Economic Cycles | Volatile, requires policy intervention | Self-regulating through supply and demand |

| Fiscal Policy | Essential tool for managing demand and growth | Considered ineffective or harmful |

| Monetary Policy | Supports fiscal measures to influence demand | Main tool to control inflation and money supply |

| Long-Term Growth | Stimulated by demand management and investment | Driven by capital accumulation and technological progress |

Foundations of Keynesian and Classical Economics

Keynesian economics is founded on the belief that aggregate demand drives economic performance and that active government intervention is necessary to manage business cycles and stimulate growth. Classical economics rests on the principles of self-regulating markets, where supply and demand naturally achieve equilibrium without external interference. The foundational divergence lies in Keynesian emphasis on short-term demand management versus Classical focus on long-term market equilibrium and laissez-faire policies.

Key Assumptions in Keynesian vs Classical Models

Keynesian economics assumes that aggregate demand drives economic output and employment, highlighting market imperfections and price rigidities that prevent self-correction during recessions. In contrast, Classical economics relies on the assumption of flexible prices and wages, positing that markets naturally clear and full employment is the norm through supply-side mechanisms. These differing assumptions lead Keynesians to advocate for active government intervention, while Classical theorists support minimal state involvement in the economy.

Aggregate Demand and Supply Perspectives

Keynesian economics emphasizes the role of aggregate demand as the primary driver of economic output and employment, advocating for active government intervention to manage demand fluctuations. Classical economics, in contrast, assumes aggregate supply is self-regulating, with markets naturally returning to full employment equilibrium without external interference. The Keynesian approach stresses demand-side policies to address recessions, while the classical perspective prioritizes supply-side factors and long-term growth driven by production capacity.

Government Intervention: Keynesian vs Classical Views

Keynesian economics advocates for active government intervention through fiscal policies to stabilize economic fluctuations and promote full employment, emphasizing demand-side management. In contrast, Classical economics supports minimal government involvement, relying on free-market mechanisms and flexible prices to self-correct and achieve long-term equilibrium. The Keynesian approach encourages counter-cyclical spending during downturns, whereas Classical theory trusts market forces to restore balance without external interference.

Unemployment and Labor Market Dynamics

Keynesian economics asserts that unemployment results from inadequate aggregate demand, advocating for active government intervention to stimulate job creation and stabilize labor markets during economic downturns. In contrast, Classical economics relies on the self-correcting nature of labor markets, where wage flexibility and supply-demand equilibrium naturally restore full employment without government interference. Empirical data shows Keynesian policies effectively reduce cyclical unemployment, while Classical models emphasize long-term labor market adjustments.

Inflation Control Strategies

Keynesian economics advocates for active government intervention through fiscal policies to control inflation by managing aggregate demand, supporting increased public spending or taxation adjustments during economic fluctuations. Classical economics emphasizes self-regulating markets where inflation is controlled by long-term supply and demand equilibrium without extensive government interference, relying on flexible prices and wages. Inflation targeting in Keynesian theory often involves demand-side management, whereas classical models focus on supply-side factors and monetary stability to achieve price stability.

Fiscal Policy: Stimulus vs Laissez-Faire

Keynesian economics advocates for active fiscal policy, using government stimulus to boost aggregate demand during economic downturns and reduce unemployment. Classical economics supports laissez-faire principles, emphasizing minimal government intervention and reliance on market self-correction to maintain economic equilibrium. Empirical studies show fiscal stimulus can shorten recessions, whereas laissez-faire approaches prioritize long-term market stability and efficiency.

Impact on Economic Growth and Stability

Keynesian economics advocates for active government intervention through fiscal policy to stimulate demand during economic downturns, promoting short-term economic growth and reducing unemployment. Classical economics emphasizes self-regulating markets and minimal government interference, asserting that free markets naturally achieve equilibrium and long-term growth. Keynesian models tend to enhance economic stability by addressing demand-side fluctuations, while classical approaches rely on supply-side factors and market adjustments to maintain growth.

Real-World Applications and Historical Outcomes

Keynesian economics advocates for active government intervention and fiscal stimulus during economic downturns, as evidenced by the New Deal policies during the Great Depression, which helped reduce unemployment and revive demand. Classical economics emphasizes self-regulating markets and limited government interference, a principle reflected in the laissez-faire approach before the 1930s and during the 1980s deregulation era, promoting long-term growth but risking short-term instability. Empirical data shows Keynesian policies often stabilize recessions quickly, while classical approaches support sustained growth but may delay recovery during severe crises.

Modern Relevance of Keynesian and Classical Theories

Keynesian economics emphasizes government intervention to stabilize economic fluctuations and boost demand, proving highly relevant in addressing modern recessions and financial crises. Classical economics, with its focus on free markets and self-regulating mechanisms, remains foundational for understanding long-term growth and supply-side policies. The integration of both theories guides contemporary economic policies by balancing short-term stimulus with long-term market efficiency.

Keynesian economics vs Classical economics Infographic

difterm.com

difterm.com