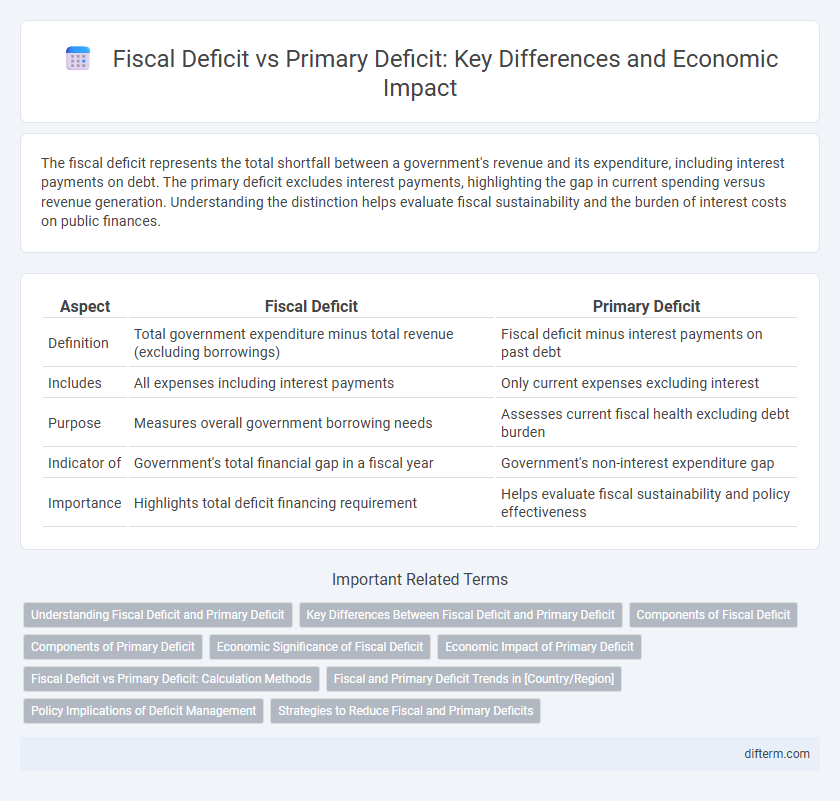

The fiscal deficit represents the total shortfall between a government's revenue and its expenditure, including interest payments on debt. The primary deficit excludes interest payments, highlighting the gap in current spending versus revenue generation. Understanding the distinction helps evaluate fiscal sustainability and the burden of interest costs on public finances.

Table of Comparison

| Aspect | Fiscal Deficit | Primary Deficit |

|---|---|---|

| Definition | Total government expenditure minus total revenue (excluding borrowings) | Fiscal deficit minus interest payments on past debt |

| Includes | All expenses including interest payments | Only current expenses excluding interest |

| Purpose | Measures overall government borrowing needs | Assesses current fiscal health excluding debt burden |

| Indicator of | Government's total financial gap in a fiscal year | Government's non-interest expenditure gap |

| Importance | Highlights total deficit financing requirement | Helps evaluate fiscal sustainability and policy effectiveness |

Understanding Fiscal Deficit and Primary Deficit

Fiscal deficit measures the total shortfall in government revenue compared to its total expenditure, including interest payments on past debt, providing a comprehensive view of the government's borrowing needs. Primary deficit, on the other hand, excludes interest payments, reflecting the gap between current expenditure and revenue, indicating borrowing solely for current fiscal activities. Understanding the difference between fiscal deficit and primary deficit is crucial for assessing fiscal sustainability and the government's ability to manage debt effectively.

Key Differences Between Fiscal Deficit and Primary Deficit

Fiscal deficit represents the total borrowing requirement of the government, calculated as the difference between total expenditure and total revenue, including interest payments on past debt. Primary deficit excludes interest payments, reflecting the gap between current fiscal operations and revenue generation, highlighting the government's borrowing needs without debt servicing costs. The key difference lies in interest payment inclusion, with fiscal deficit indicating overall fiscal health, while primary deficit focuses on current fiscal management and sustainability.

Components of Fiscal Deficit

Fiscal deficit comprises the total government borrowing required to meet its expenditure when revenue is insufficient, including both interest payments and primary expenditures. Primary deficit excludes interest payments, focusing solely on the gap between current government revenues and non-interest expenditures. Key components of the fiscal deficit include revenue deficit, capital expenditure, and interest payments, which collectively determine the borrowing requirements of the government.

Components of Primary Deficit

The primary deficit measures the difference between a government's fiscal deficit and interest payments on outstanding debt, focusing on the current year's revenue and expenditure. Key components of the primary deficit include capital expenditure, revenue expenditure excluding interest, and revenue receipts, which influence the government's borrowing requirement. Monitoring these components helps assess fiscal discipline by isolating borrowing needs beyond debt servicing costs.

Economic Significance of Fiscal Deficit

Fiscal deficit represents the total shortfall between the government's total revenue and total expenditure, including interest payments on debt, reflecting the overall borrowing requirement. Its economic significance lies in indicating the government's borrowing needs, which can influence inflation, interest rates, and fiscal sustainability. Unlike the primary deficit, which excludes interest payments and focuses on current fiscal policy, the fiscal deficit provides a comprehensive picture of the government's financial health and long-term economic impact.

Economic Impact of Primary Deficit

The primary deficit represents the fiscal gap excluding interest payments on existing debt, directly influencing a government's capacity to finance development projects without increasing borrowings. A high primary deficit can signal poor fiscal discipline, leading to rising debt burdens and potential inflationary pressures that undermine economic growth. Controlling the primary deficit is crucial for maintaining investor confidence and ensuring sustainable economic development.

Fiscal Deficit vs Primary Deficit: Calculation Methods

Fiscal deficit is calculated as the difference between total government expenditures, including interest payments, and total revenues excluding borrowings. Primary deficit measures the fiscal deficit excluding interest payments, highlighting the current year's borrowing needs for non-interest expenditures. Both metrics are essential for assessing a government's financial health, with fiscal deficit indicating overall borrowing requirements and primary deficit focusing on the sustainability of fiscal policy without debt servicing costs.

Fiscal and Primary Deficit Trends in [Country/Region]

Fiscal deficit in [Country/Region] reflects the government's total borrowing requirement, encompassing both revenue shortfalls and interest payments, while the primary deficit isolates the gap excluding interest obligations, highlighting core fiscal health. Recent trends indicate a fluctuating fiscal deficit averaging around X% of GDP, driven by increased public spending and revenue volatility, whereas the primary deficit shows a relatively stable pattern at Y% of GDP, suggesting manageable non-interest expenditures. Monitoring these deficits is crucial for assessing fiscal sustainability and guiding economic policy adjustments in [Country/Region].

Policy Implications of Deficit Management

Fiscal deficit represents the total shortfall of the government's revenue compared to its expenditures, including interest payments on debt, while the primary deficit excludes these interest payments, reflecting the current fiscal stance excluding past borrowings. Policymakers analyze the primary deficit to assess sustainable fiscal policy, as persistent primary deficits signal borrowing to fund ongoing programs rather than debt servicing, potentially exacerbating debt levels and affecting credit ratings. Effective deficit management requires balancing growth-supportive spending with fiscal consolidation to maintain investor confidence and ensure long-term economic stability.

Strategies to Reduce Fiscal and Primary Deficits

Implementing targeted expenditure rationalization and enhancing tax revenue collection are critical strategies to reduce fiscal and primary deficits effectively. Prioritizing efficient public investment and controlling non-essential subsidies can help curb the fiscal deficit without compromising economic growth. Strengthening fiscal discipline through transparent budgeting and timely fiscal reports ensures sustainable deficit management and debt stabilization.

Fiscal deficit vs primary deficit Infographic

difterm.com

difterm.com