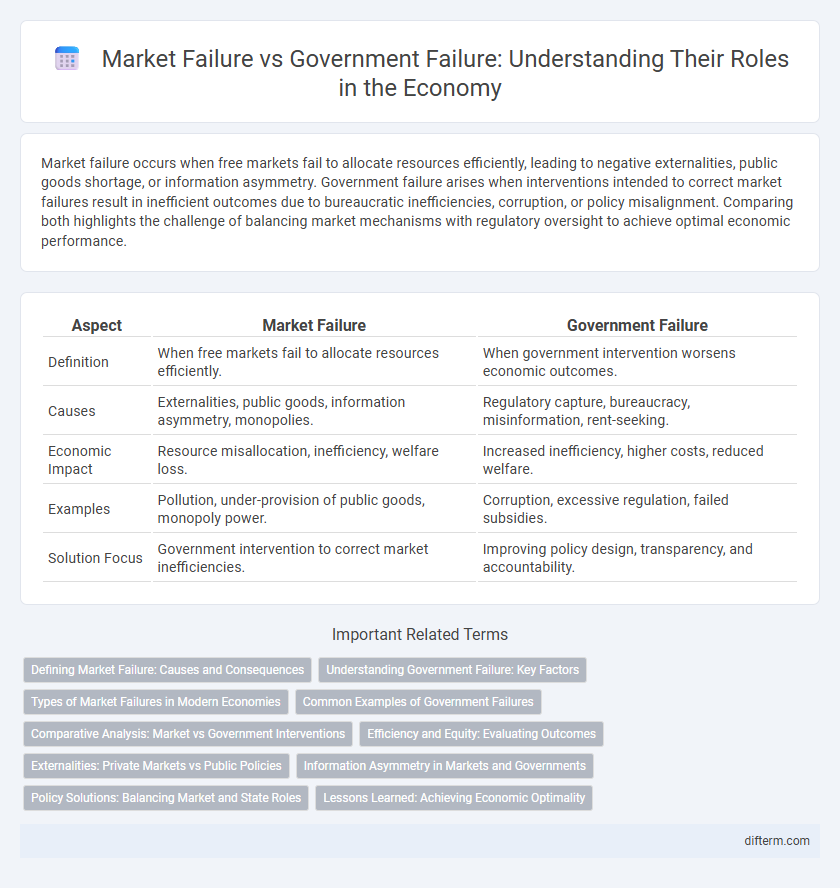

Market failure occurs when free markets fail to allocate resources efficiently, leading to negative externalities, public goods shortage, or information asymmetry. Government failure arises when interventions intended to correct market failures result in inefficient outcomes due to bureaucratic inefficiencies, corruption, or policy misalignment. Comparing both highlights the challenge of balancing market mechanisms with regulatory oversight to achieve optimal economic performance.

Table of Comparison

| Aspect | Market Failure | Government Failure |

|---|---|---|

| Definition | When free markets fail to allocate resources efficiently. | When government intervention worsens economic outcomes. |

| Causes | Externalities, public goods, information asymmetry, monopolies. | Regulatory capture, bureaucracy, misinformation, rent-seeking. |

| Economic Impact | Resource misallocation, inefficiency, welfare loss. | Increased inefficiency, higher costs, reduced welfare. |

| Examples | Pollution, under-provision of public goods, monopoly power. | Corruption, excessive regulation, failed subsidies. |

| Solution Focus | Government intervention to correct market inefficiencies. | Improving policy design, transparency, and accountability. |

Defining Market Failure: Causes and Consequences

Market failure occurs when the allocation of goods and services by a free market is not efficient, leading to a net social welfare loss. Key causes include externalities, public goods, information asymmetries, and market power distortions. Consequences of market failure encompass resource misallocation, reduced economic efficiency, and potential welfare loss, often prompting government intervention to restore equilibrium.

Understanding Government Failure: Key Factors

Government failure occurs when public sector intervention in the economy results in inefficient allocation of resources, often due to information asymmetry, bureaucratic inefficiencies, and regulatory capture. Key factors include misaligned incentives among policymakers, incomplete or inaccurate data guiding decisions, and political pressures that prioritize short-term gains over long-term economic welfare. Understanding these elements is essential to designing policies that minimize unintended negative consequences and improve overall market outcomes.

Types of Market Failures in Modern Economies

Market failures in modern economies primarily include public goods, externalities, information asymmetry, and market power. Public goods are non-excludable and non-rivalrous, leading to under-provision by private markets. Negative externalities like pollution cause social costs not reflected in market prices, while information asymmetry results in inefficient resource allocation and adverse selection, and market power allows firms to set prices above competitive levels, reducing consumer welfare.

Common Examples of Government Failures

Government failures often stem from inefficient resource allocation, regulatory capture, and incentive misalignment. Examples include excessive bureaucracy in public services, subsidies that encourage market distortions, and protectionist trade policies that reduce competition. These failures can lead to wasted taxpayer money, reduced economic growth, and increased inequality.

Comparative Analysis: Market vs Government Interventions

Market failure occurs when free markets fail to allocate resources efficiently, resulting in externalities, public goods, or information asymmetry, while government failure arises from inefficient policies, bureaucratic inefficiencies, or unintended consequences of regulation. Market interventions, such as taxes, subsidies, or public provision, aim to correct externalities and improve social welfare, whereas government interventions risk distorting incentives, increasing costs, and causing resource misallocation. Comparative analysis highlights that while markets are effective in many contexts, well-designed government actions are essential in addressing specific failures, but poor governance can exacerbate inefficiencies.

Efficiency and Equity: Evaluating Outcomes

Market failure occurs when resources are allocated inefficiently, leading to suboptimal production and consumption levels that harm overall welfare. Government failure arises when interventions intended to correct market inefficiencies result in outcomes that reduce economic efficiency or equity. Evaluating these outcomes requires analyzing how well each addresses externalities, public goods, and information asymmetries while balancing equity considerations such as income distribution and access to essential services.

Externalities: Private Markets vs Public Policies

Externalities occur when private market transactions impose costs or benefits on third parties not reflected in market prices, leading to market failure. Public policies, such as taxes, subsidies, and regulations, aim to internalize these externalities by aligning private incentives with social welfare. However, poorly designed interventions can result in government failure, exacerbating inefficiencies rather than correcting them.

Information Asymmetry in Markets and Governments

Information asymmetry in markets arises when one party possesses more or better information than the other, leading to adverse selection and moral hazard, which contribute significantly to market failure. Governments attempt to correct these imbalances through regulations and transparency mandates but often face government failure due to bureaucratic inefficiencies, incomplete information, or regulatory capture. Both market failure and government failure underscore the critical role of accurate, accessible information in achieving efficient economic outcomes.

Policy Solutions: Balancing Market and State Roles

Effective policy solutions address both market and government failures by promoting efficient resource allocation through targeted interventions such as subsidies, taxes, and regulation while minimizing bureaucratic inefficiencies and corruption. Designing flexible frameworks that incorporate market mechanisms alongside public oversight can optimize economic outcomes and ensure equitable distribution of goods and services. Balancing roles involves implementing transparent accountability measures and adaptive policies responsive to dynamic economic conditions.

Lessons Learned: Achieving Economic Optimality

Market failure occurs when resource allocation leads to inefficient outcomes due to externalities or information asymmetries, while government failure arises from policy interventions that distort incentives or create unintended consequences. Achieving economic optimality requires balancing regulatory measures to correct market imperfections without imposing excessive burdens that hinder innovation or growth. Lessons learned emphasize designing adaptive policies grounded in empirical evidence to enhance welfare and minimize costs associated with both market and government failures.

Market Failure vs Government Failure Infographic

difterm.com

difterm.com