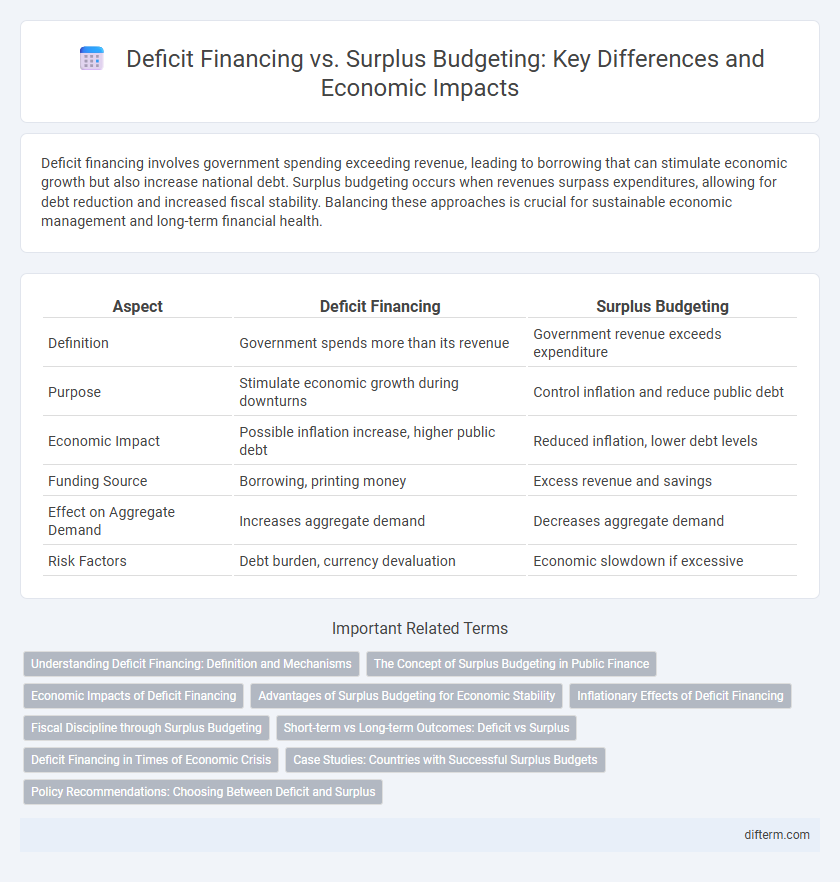

Deficit financing involves government spending exceeding revenue, leading to borrowing that can stimulate economic growth but also increase national debt. Surplus budgeting occurs when revenues surpass expenditures, allowing for debt reduction and increased fiscal stability. Balancing these approaches is crucial for sustainable economic management and long-term financial health.

Table of Comparison

| Aspect | Deficit Financing | Surplus Budgeting |

|---|---|---|

| Definition | Government spends more than its revenue | Government revenue exceeds expenditure |

| Purpose | Stimulate economic growth during downturns | Control inflation and reduce public debt |

| Economic Impact | Possible inflation increase, higher public debt | Reduced inflation, lower debt levels |

| Funding Source | Borrowing, printing money | Excess revenue and savings |

| Effect on Aggregate Demand | Increases aggregate demand | Decreases aggregate demand |

| Risk Factors | Debt burden, currency devaluation | Economic slowdown if excessive |

Understanding Deficit Financing: Definition and Mechanisms

Deficit financing occurs when a government spends more than its revenue, using borrowing or printing money to cover the shortfall, stimulating economic activity during downturns. Key mechanisms include issuing government bonds, obtaining loans from domestic or international sources, and leveraging central bank credit to inject liquidity. Understanding these processes highlights how deficit financing supports fiscal policy by boosting demand and addressing recessionary gaps in the economy.

The Concept of Surplus Budgeting in Public Finance

Surplus budgeting in public finance refers to a fiscal strategy where government revenue exceeds expenditures, creating a budget surplus that can be utilized for debt reduction or future investments. This approach contrasts with deficit financing, which involves spending beyond revenue, often funded by borrowing. Employing surplus budgets enhances fiscal sustainability by reducing public debt burdens and promoting economic stability.

Economic Impacts of Deficit Financing

Deficit financing injects additional funds into the economy, stimulating demand and potentially accelerating economic growth during downturns. However, sustained deficits can increase national debt, leading to higher interest rates and crowding out private investment. In contrast, surplus budgeting reduces government debt but may slow economic growth by limiting public expenditure.

Advantages of Surplus Budgeting for Economic Stability

Surplus budgeting enhances economic stability by reducing public debt and increasing government savings, which can be used for future investments or emergencies. It promotes fiscal discipline, helping to control inflation and maintain investor confidence by demonstrating responsible financial management. This approach also creates a buffer during economic downturns, allowing for counter-cyclical spending without exacerbating deficits.

Inflationary Effects of Deficit Financing

Deficit financing increases aggregate demand by injecting additional government spending into the economy without corresponding revenue, leading to demand-pull inflation. When the supply of goods and services does not keep pace with heightened demand, prices rise, eroding purchasing power. In contrast, surplus budgeting restrains inflation by reducing excess liquidity and cooling demand pressures in the market.

Fiscal Discipline through Surplus Budgeting

Surplus budgeting promotes fiscal discipline by ensuring government expenditures remain below revenues, reducing reliance on borrowing and minimizing fiscal deficits. This approach strengthens economic stability, curbs inflationary pressures, and enhances public confidence in financial management. Maintaining a surplus budget allows for creating reserves that can fund future investments or cushion economic downturns, supporting sustainable growth.

Short-term vs Long-term Outcomes: Deficit vs Surplus

Deficit financing typically stimulates short-term economic growth by increasing government spending, which boosts demand and reduces unemployment but may lead to higher inflation and public debt in the long term. Surplus budgeting, on the other hand, tends to create fiscal discipline and lower debt levels, promoting long-term economic stability and investor confidence while potentially slowing down immediate economic activity due to reduced government expenditure. Balancing these approaches requires careful consideration of economic cycles to optimize growth without compromising future financial sustainability.

Deficit Financing in Times of Economic Crisis

Deficit financing allows governments to inject much-needed capital into the economy during a downturn, stimulating growth by increasing public expenditure despite short-term debt accumulation. This approach helps counteract reduced private sector demand and unemployment by funding infrastructure projects and social programs, thereby boosting aggregate demand. However, persistent reliance on deficit financing can lead to inflation and rising interest rates, necessitating careful fiscal management.

Case Studies: Countries with Successful Surplus Budgets

Countries like Norway and Singapore exemplify successful surplus budgeting by consistently allocating excess revenues to sovereign wealth funds, thereby stabilizing their economies during downturns. Norway's Government Pension Fund Global, fueled by oil revenues, has grown to over $1.4 trillion, enabling sustainable fiscal management and reducing reliance on deficit financing. Singapore's prudent fiscal policies and diversified economy have led to continuous budget surpluses, fostering infrastructure development and long-term economic resilience.

Policy Recommendations: Choosing Between Deficit and Surplus

Policy recommendations for choosing between deficit financing and surplus budgeting depend on the economic context and fiscal goals. During economic downturns, deficit financing can stimulate growth by increasing government spending and investment, thereby boosting aggregate demand. Conversely, surplus budgeting is advisable in periods of economic expansion to reduce public debt, stabilize inflation, and create fiscal space for future downturns.

deficit financing vs surplus budgeting Infographic

difterm.com

difterm.com