The Circular Flow Model illustrates the continuous movement of money, goods, and services between households and firms, emphasizing the interdependence of economic agents in a simplified economy. The Input-Output Model provides a detailed analysis of the interactions between different sectors of an economy, tracing the flow of inputs used to produce outputs across industries. Comparing both models reveals that the Circular Flow Model offers a broad overview of economic activity, while the Input-Output Model delivers granular insights essential for sector-specific economic planning and policy-making.

Table of Comparison

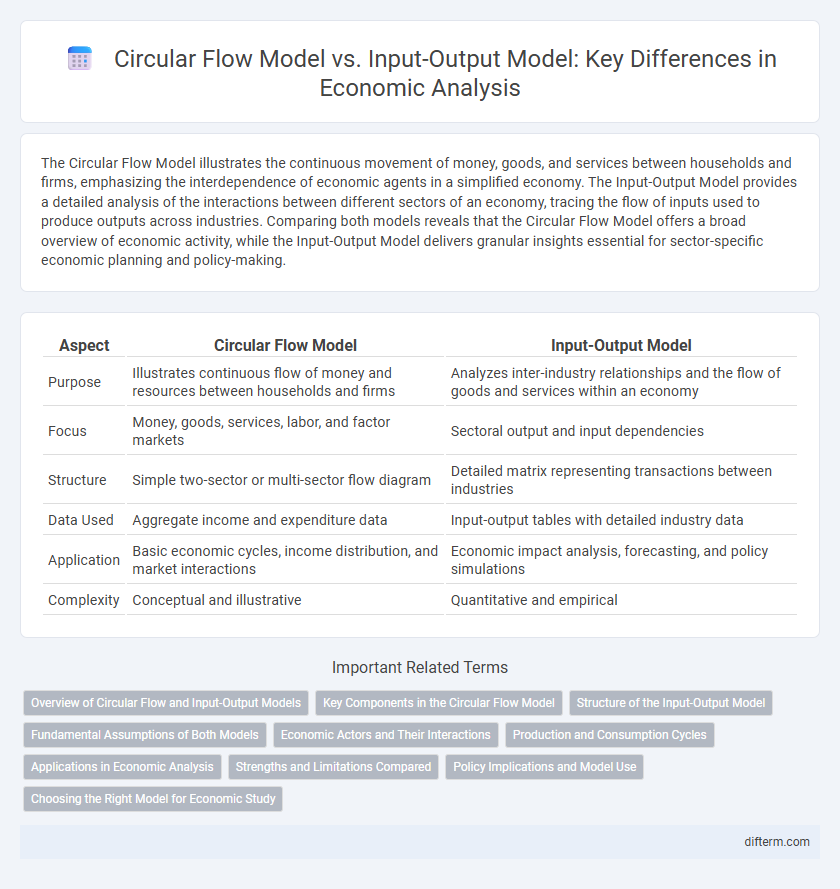

| Aspect | Circular Flow Model | Input-Output Model |

|---|---|---|

| Purpose | Illustrates continuous flow of money and resources between households and firms | Analyzes inter-industry relationships and the flow of goods and services within an economy |

| Focus | Money, goods, services, labor, and factor markets | Sectoral output and input dependencies |

| Structure | Simple two-sector or multi-sector flow diagram | Detailed matrix representing transactions between industries |

| Data Used | Aggregate income and expenditure data | Input-output tables with detailed industry data |

| Application | Basic economic cycles, income distribution, and market interactions | Economic impact analysis, forecasting, and policy simulations |

| Complexity | Conceptual and illustrative | Quantitative and empirical |

Overview of Circular Flow and Input-Output Models

The Circular Flow Model illustrates the continuous movement of money, goods, and services between households and firms, highlighting the interactions in product and factor markets within a simplified economy. The Input-Output Model, developed by Wassily Leontief, provides a detailed quantitative analysis of inter-industry relationships by mapping the inputs required by each sector to produce outputs, capturing the complexity of economic production systems. Both models serve as foundational frameworks for understanding economic flows, with the Circular Flow Model emphasizing aggregate exchanges and the Input-Output Model focusing on sectoral interdependencies and economic linkages.

Key Components in the Circular Flow Model

The Circular Flow Model highlights households, firms, product markets, and factor markets as its key components, emphasizing the continuous movement of goods, services, and resources. Households supply factors of production like labor and capital to firms, which in turn produce goods and services consumed by households. Money flows reciprocally through wages, rents, and consumer spending, illustrating the dynamic interdependence within an economy.

Structure of the Input-Output Model

The Input-Output Model is structured as a matrix capturing interdependencies among industries, displaying how the output from one sector serves as the input for another. This model quantifies the flow of goods and services in an economy through rows representing industry outputs and columns detailing inputs required from other sectors. Unlike the Circular Flow Model, which broadly illustrates economic transactions between households and firms, the Input-Output Model provides a detailed and quantifiable framework for analyzing sector-specific economic relationships and production processes.

Fundamental Assumptions of Both Models

The Circular Flow Model assumes a simplified economy with two main agents: households and firms, focusing on the continuous flow of goods, services, and money between these sectors within a closed system without government or foreign trade. The Input-Output Model assumes a detailed inter-industry structure where outputs from one industry become inputs for another, emphasizing the complex interdependencies and quantitative relationships among multiple sectors. Both models assume equilibrium conditions but differ in scope; the Circular Flow Model highlights macro-level flows while the Input-Output Model provides micro-level data on sectoral production and consumption linkages.

Economic Actors and Their Interactions

The Circular Flow Model illustrates the continuous movement of money, goods, and services between households and firms, emphasizing the reciprocal exchange in product and factor markets. The Input-Output Model expands this framework by detailing inter-industry transactions, quantifying how outputs from one economic actor serve as inputs for another, thus capturing complex supply chain relationships. Together, these models reveal the dynamic interactions between producers, consumers, and intermediaries within the economy, enabling precise analysis of economic dependencies and resource allocation.

Production and Consumption Cycles

The Circular Flow Model illustrates the continuous movement of goods, services, and money between households and firms, emphasizing the interaction of production and consumption cycles in a simplified economy. The Input-Output Model provides a detailed analysis of inter-industry relationships by quantifying the inputs required for each sector's output, enhancing understanding of production dependencies and consumption patterns. Both models highlight the critical role of production and consumption in driving economic activity but differ in complexity and scope of economic interactions represented.

Applications in Economic Analysis

The Circular Flow Model illustrates the continuous movement of money, goods, and services between households and firms, enabling analysis of aggregate economic activity and income distribution. The Input-Output Model provides a detailed matrix of inter-industry relationships, facilitating precise assessment of sectoral dependencies and impacts of changes in one industry on others. Both models serve as vital tools in economic policy development, with the Circular Flow aiding in understanding macroeconomic equilibrium and the Input-Output enabling targeted industry analysis and resource allocation.

Strengths and Limitations Compared

The Circular Flow Model excels in illustrating the continuous movement of money, goods, and services between households and firms, providing a simplified visualization of economic activity and interdependence. Its limitation lies in its abstract nature, lacking detail on sector-specific transactions and failing to capture complex inter-industry relationships. In contrast, the Input-Output Model offers detailed insights by quantifying the interrelations between different industries, allowing precise analysis of economic ripple effects, though its complexity and data intensity can limit practical use and timeliness in dynamic economic environments.

Policy Implications and Model Use

The Circular Flow Model offers a simplified framework highlighting the continuous movement of money, goods, and services between households and firms, aiding policymakers in understanding macroeconomic equilibrium and directing fiscal or monetary interventions. In contrast, the Input-Output Model provides a detailed analysis of inter-industry relationships and sectoral dependencies, enabling targeted policy measures that address specific supply chain disruptions or sectoral productivity enhancements. Governments and economic planners utilize the Input-Output Model to assess the ripple effects of policy changes on regional economies, whereas the Circular Flow Model supports broader economic stability assessments and aggregate demand-supply balance.

Choosing the Right Model for Economic Study

Selecting the right economic model depends on the study's scope and data complexity; the Circular Flow Model effectively illustrates basic economic exchanges between households and firms, emphasizing income and expenditure flows. In contrast, the Input-Output Model provides a detailed quantitative analysis of industry interdependencies, ideal for assessing sectoral impacts and supply chain linkages using extensive economic data. Researchers prioritize the Circular Flow Model for macroeconomic overviews and the Input-Output Model for granular policy evaluations and economic forecasting.

Circular Flow Model vs Input-Output Model Infographic

difterm.com

difterm.com