The Keynesian multiplier measures the effect of a change in autonomous spending on total economic output, highlighting fiscal policy's role in stimulating demand. In contrast, the monetary multiplier reflects the banking system's ability to expand the money supply through deposit creation and lending. Both multipliers influence economic activity but operate through different mechanisms: fiscal injections versus monetary expansions.

Table of Comparison

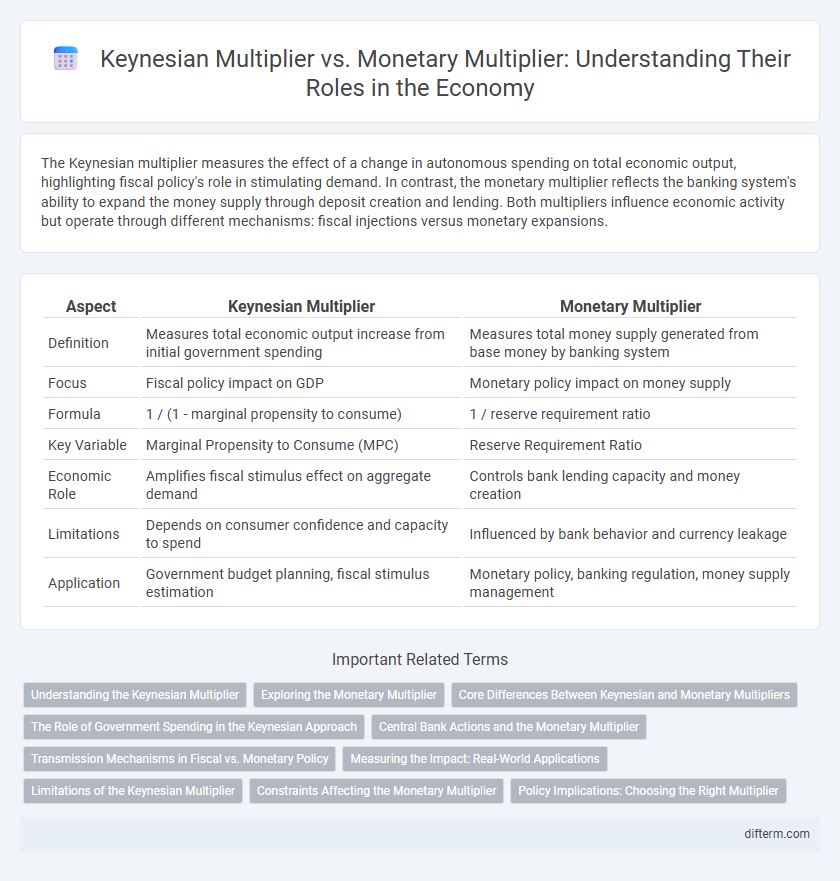

| Aspect | Keynesian Multiplier | Monetary Multiplier |

|---|---|---|

| Definition | Measures total economic output increase from initial government spending | Measures total money supply generated from base money by banking system |

| Focus | Fiscal policy impact on GDP | Monetary policy impact on money supply |

| Formula | 1 / (1 - marginal propensity to consume) | 1 / reserve requirement ratio |

| Key Variable | Marginal Propensity to Consume (MPC) | Reserve Requirement Ratio |

| Economic Role | Amplifies fiscal stimulus effect on aggregate demand | Controls bank lending capacity and money creation |

| Limitations | Depends on consumer confidence and capacity to spend | Influenced by bank behavior and currency leakage |

| Application | Government budget planning, fiscal stimulus estimation | Monetary policy, banking regulation, money supply management |

Understanding the Keynesian Multiplier

The Keynesian multiplier measures the total increase in economic output resulting from an initial increase in autonomous spending, highlighting the importance of fiscal policy in stimulating demand. It quantifies how government expenditure or investment inflows generate amplified effects on GDP through increased consumption and income. This contrasts with the monetary multiplier, which focuses on how changes in the money supply influence banking reserves and credit expansion.

Exploring the Monetary Multiplier

The monetary multiplier measures the impact of commercial banks' lending on the overall money supply, showing how initial deposits create a multiple increase in bank deposits through fractional reserve banking. Unlike the Keynesian multiplier, which focuses on changes in aggregate demand from fiscal policy, the monetary multiplier emphasizes the banking system's ability to expand money supply via credit creation. Understanding the monetary multiplier is crucial for evaluating central bank policies and their effectiveness in controlling inflation and stimulating economic growth.

Core Differences Between Keynesian and Monetary Multipliers

The Keynesian multiplier measures the effect of fiscal policy changes on aggregate demand, emphasizing government spending's impact on income and output through consumption increases. In contrast, the monetary multiplier focuses on the banking system's ability to expand the money supply based on reserve requirements and deposit creation. Core differences lie in their mechanisms: Keynesian multiplier operates via fiscal stimulus affecting real economy, while monetary multiplier deals with credit creation influencing money supply.

The Role of Government Spending in the Keynesian Approach

Government spending plays a crucial role in the Keynesian multiplier effect, where increased public expenditure directly boosts aggregate demand and stimulates economic growth. Unlike the monetary multiplier, which relies on the banking system's capacity to expand money supply through deposits and loans, the Keynesian approach emphasizes fiscal interventions to initiate demand-driven expansions. Empirical studies show that well-targeted government spending can have a multiplier greater than one, amplifying the impact on GDP compared to monetary policy alone.

Central Bank Actions and the Monetary Multiplier

The Keynesian multiplier measures the total increase in national income resulting from an initial increase in autonomous spending, emphasizing fiscal policy's role in stimulating economic activity. The monetary multiplier reflects the banking system's ability to expand the money supply based on central bank reserves and reserve requirements, highlighting the Central Bank's influence through monetary policy. Central Bank actions such as adjusting reserve ratios and open market operations directly affect the monetary multiplier by controlling liquidity and credit creation in the economy.

Transmission Mechanisms in Fiscal vs. Monetary Policy

The Keynesian multiplier illustrates how government spending boosts aggregate demand through direct fiscal injections, enhancing income and consumption with a magnified effect on economic growth. In contrast, the monetary multiplier operates via banking reserve ratios and money supply expansion, where central bank policies influence credit availability and interest rates to stimulate investment and consumption. Transmission mechanisms in fiscal policy work primarily through increased public expenditure affecting real economy demand, whereas monetary policy transmission relies on altering financial conditions to indirectly impact spending and investment decisions.

Measuring the Impact: Real-World Applications

The Keynesian multiplier measures the total increase in economic output resulting from an initial fiscal injection, emphasizing government spending's role in stimulating aggregate demand. The monetary multiplier quantifies the maximum potential increase in the money supply generated by banks through fractional reserve banking based on central bank reserves. Real-world applications reveal that fiscal multipliers are often more direct and immediate in influencing GDP growth, while monetary multipliers depend heavily on banking system responsiveness and prevailing interest rates.

Limitations of the Keynesian Multiplier

The Keynesian multiplier is limited by factors such as the marginal propensity to consume, which varies across income groups, reducing the predictability of spending increases. It assumes a fixed price level and idle resources, making it less effective during inflationary periods or full employment. In contrast, the monetary multiplier faces constraints from banking regulations and central bank policies, but the Keynesian multiplier's reliance on aggregate demand often neglects supply-side dynamics in real-world economies.

Constraints Affecting the Monetary Multiplier

Constraints affecting the monetary multiplier primarily include reserve requirements, currency holdings, and excess reserves, which limit the ability of banks to create money through lending. These constraints reduce the theoretical maximum impact of monetary policy on money supply expansion compared to the Keynesian multiplier, which focuses on fiscal stimulus effects on aggregate demand. Understanding these limitations helps explain why changes in monetary base do not always translate proportionally into broader money supply growth.

Policy Implications: Choosing the Right Multiplier

Keynesian multiplier measures the impact of fiscal policy on aggregate demand, emphasizing government spending and taxation adjustments to stimulate economic growth, while the monetary multiplier reflects the banking system's ability to expand the money supply through reserve requirements and lending. Policymakers must prioritize the Keynesian multiplier when addressing demand-side recessions to boost output and employment effectively, whereas the monetary multiplier plays a critical role in managing inflation and liquidity through monetary policy tools. Choosing the appropriate multiplier depends on the economic context, with fiscal interventions targeting fiscal gaps and monetary measures ensuring financial stability.

Keynesian multiplier vs monetary multiplier Infographic

difterm.com

difterm.com