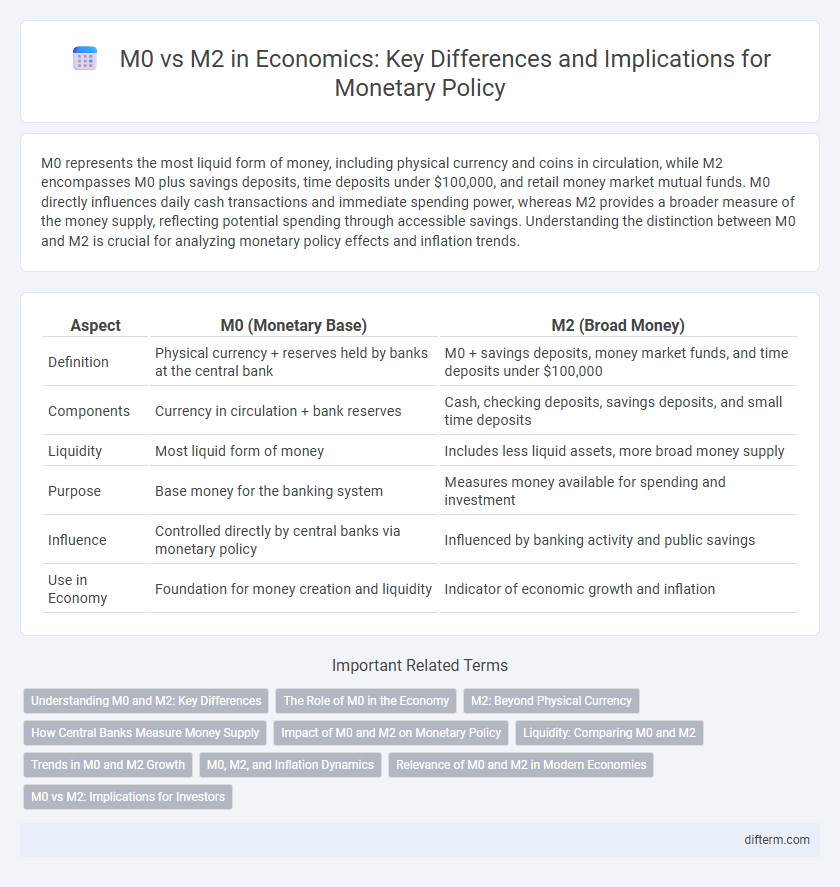

M0 represents the most liquid form of money, including physical currency and coins in circulation, while M2 encompasses M0 plus savings deposits, time deposits under $100,000, and retail money market mutual funds. M0 directly influences daily cash transactions and immediate spending power, whereas M2 provides a broader measure of the money supply, reflecting potential spending through accessible savings. Understanding the distinction between M0 and M2 is crucial for analyzing monetary policy effects and inflation trends.

Table of Comparison

| Aspect | M0 (Monetary Base) | M2 (Broad Money) |

|---|---|---|

| Definition | Physical currency + reserves held by banks at the central bank | M0 + savings deposits, money market funds, and time deposits under $100,000 |

| Components | Currency in circulation + bank reserves | Cash, checking deposits, savings deposits, and small time deposits |

| Liquidity | Most liquid form of money | Includes less liquid assets, more broad money supply |

| Purpose | Base money for the banking system | Measures money available for spending and investment |

| Influence | Controlled directly by central banks via monetary policy | Influenced by banking activity and public savings |

| Use in Economy | Foundation for money creation and liquidity | Indicator of economic growth and inflation |

Understanding M0 and M2: Key Differences

M0 represents the total physical currency in circulation plus reserves held by the central bank, serving as the base money supply. M2 includes M0 along with demand deposits, savings accounts, and other near-money assets, reflecting a broader measure of the money supply used to gauge economic liquidity. Understanding the distinction between M0 and M2 is crucial for analyzing monetary policy impacts and financial market conditions.

The Role of M0 in the Economy

M0, also known as the monetary base, represents the total of all physical currency in circulation plus reserves held by banks at the central bank, serving as the foundation for broader money aggregates like M2. Its role in the economy is crucial for liquidity provision, acting as the bedrock for bank lending and facilitating daily transactions. Central banks manipulate M0 through monetary policy operations to influence inflation, interest rates, and overall economic stability.

M2: Beyond Physical Currency

M2 encompasses M0, integrating physical currency with savings deposits, money market funds, and other near-money assets to offer a comprehensive measure of money supply. This broader scope of M2 reflects liquidity accessible for spending and investment more accurately than M0 alone. Central banks and economists prioritize M2 when analyzing economic activity and inflation potential due to its inclusion of all forms of readily spendable money.

How Central Banks Measure Money Supply

Central banks measure money supply by categorizing it into different aggregates such as M0 and M2, where M0 represents the total of all physical currency in circulation and bank reserves. M2 includes M0 plus savings deposits, time deposits, and non-institutional money-market funds, providing a broader view of money available in the economy. These metrics help gauge liquidity, inform monetary policy decisions, and monitor inflationary pressures.

Impact of M0 and M2 on Monetary Policy

M0, representing the most liquid money supply including cash and reserves, directly influences central banks' ability to control short-term interest rates and liquidity in the economy. M2, encompassing M0 plus savings deposits, time deposits, and retail money market funds, provides a broader measure of money supply that affects inflation expectations and long-term economic growth. Central banks monitor both M0 and M2 to design effective monetary policies that balance economic stimulation with inflation control.

Liquidity: Comparing M0 and M2

M0 represents the most liquid form of money, consisting of physical currency and coins in circulation, providing immediate spending power. M2 encompasses M0 plus savings deposits, money market accounts, and other near-money assets, offering a broader measure of liquidity with slightly less immediacy. The comparison highlights M0's role in daily transactions while M2 reflects the overall money supply accessible for economic activity with variable liquidity levels.

Trends in M0 and M2 Growth

Trends in M0 and M2 growth reveal distinct patterns in money supply dynamics, with M0 representing the most liquid forms of currency such as cash and reserves, while M2 includes M0 plus savings deposits, money market securities, and other near-money assets. Recent data indicates that M0 growth tends to react swiftly to central bank policies and liquidity needs during economic fluctuations, whereas M2 growth reflects broader economic health and consumer behavior over time, showing steady expansion during periods of economic stability. Analyzing these trends provides insights into inflationary pressures, monetary policy effectiveness, and future economic activity forecasts.

M0, M2, and Inflation Dynamics

M0 represents the most liquid forms of money, including physical currency and reserves, while M2 encompasses M0 plus savings deposits, money market securities, and other near-money assets. Inflation dynamics are closely tied to changes in M0 and M2, as increased M0 can lead to immediate spending power, influencing short-term price levels, whereas M2 growth affects broader economic inflation trends over time by expanding overall money supply. Monitoring shifts in both M0 and M2 provides critical insight into inflationary pressures and monetary policy effectiveness.

Relevance of M0 and M2 in Modern Economies

M0, representing the physical cash supply, plays a crucial role in daily transactions and serves as the foundation of a country's money base, reflecting immediate liquidity. M2, including M0 plus savings deposits, money market securities, and other time deposits, better captures the broader money supply and its influence on inflation, consumer spending, and economic growth. Central banks monitor both M0 and M2 to implement monetary policy effectively, ensuring economic stability and controlling money circulation in modern economies.

M0 vs M2: Implications for Investors

M0, representing the physical currency in circulation, directly impacts liquidity availability and short-term spending capacity, while M2 includes M0 plus savings deposits and money market funds, reflecting broader money supply and potential for lending growth. Investors should monitor M0 to gauge immediate cash flow and economic stimulus effectiveness, whereas M2 trends provide insights into overall economic health, inflation risks, and credit expansion. Understanding the divergence between M0 and M2 helps investors anticipate market liquidity conditions and adjust portfolio strategies accordingly.

M0 vs M2 Infographic

difterm.com

difterm.com