A liquidity trap occurs when low interest rates fail to stimulate borrowing and spending, causing monetary policy to become ineffective. In contrast, a credit crunch involves a sudden reduction in the availability of loans, leading to tight credit conditions that constrain business investment and consumer spending. Both scenarios hinder economic growth but stem from different issues--liquidity traps relate to demand deficiencies, while credit crunches focus on supply-side credit restrictions.

Table of Comparison

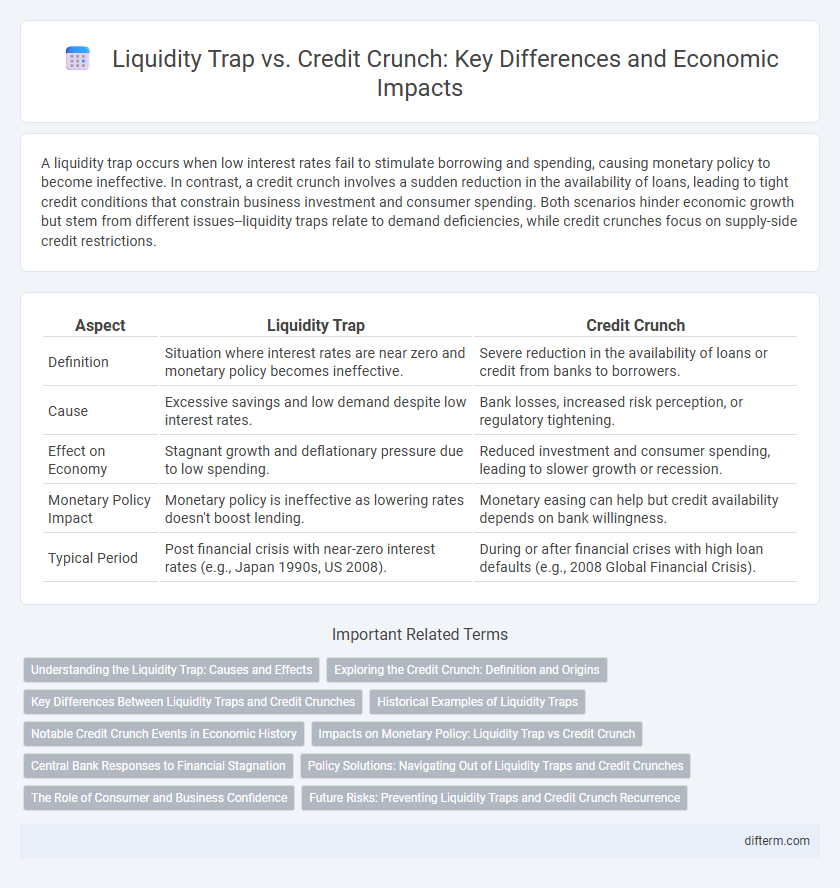

| Aspect | Liquidity Trap | Credit Crunch |

|---|---|---|

| Definition | Situation where interest rates are near zero and monetary policy becomes ineffective. | Severe reduction in the availability of loans or credit from banks to borrowers. |

| Cause | Excessive savings and low demand despite low interest rates. | Bank losses, increased risk perception, or regulatory tightening. |

| Effect on Economy | Stagnant growth and deflationary pressure due to low spending. | Reduced investment and consumer spending, leading to slower growth or recession. |

| Monetary Policy Impact | Monetary policy is ineffective as lowering rates doesn't boost lending. | Monetary easing can help but credit availability depends on bank willingness. |

| Typical Period | Post financial crisis with near-zero interest rates (e.g., Japan 1990s, US 2008). | During or after financial crises with high loan defaults (e.g., 2008 Global Financial Crisis). |

Understanding the Liquidity Trap: Causes and Effects

A liquidity trap occurs when interest rates are near zero, and monetary policy becomes ineffective as consumers and businesses hoard cash instead of spending or investing. This situation often arises during deep recessions or deflationary periods, causing demand stagnation despite ample liquidity in the financial system. The effects include prolonged economic slowdown, limited credit expansion, and increased challenges for central banks to stimulate growth through traditional interest rate cuts.

Exploring the Credit Crunch: Definition and Origins

A credit crunch occurs when banks significantly reduce the availability of loans despite demand from consumers and businesses, leading to a sharp contraction in credit markets. Originating from factors such as asset price collapses, rising defaults, and tightening regulatory measures, this phenomenon restricts access to capital, stalling economic growth and investment. Key historical examples include the 2007-2008 financial crisis, where widespread loan refusals exacerbated economic downturns worldwide.

Key Differences Between Liquidity Traps and Credit Crunches

Liquidity traps occur when interest rates are near zero and monetary policy loses effectiveness as consumers and businesses hoard cash instead of spending or investing, despite low borrowing costs. Credit crunches involve a sudden tightening of lending standards by banks, leading to restricted access to credit even if borrowers desire loans, often triggered by financial instability or increased risk aversion. The key difference lies in liquidity traps facing diminished demand for loans amid low rates, while credit crunches stem from supply-side constraints limiting credit availability.

Historical Examples of Liquidity Traps

Historical examples of liquidity traps include Japan's Lost Decade in the 1990s and the Great Depression in the 1930s United States, where despite near-zero interest rates, consumer spending and investment remained stagnant. Central banks struggled to stimulate the economy as monetary policy became ineffective, leading to prolonged economic stagnation. These periods highlight the challenges in escaping liquidity traps, contrasting with credit crunches characterized by tightened lending and reduced credit availability.

Notable Credit Crunch Events in Economic History

Notable credit crunch events include the 2008 global financial crisis, triggered by the collapse of Lehman Brothers and widespread mortgage-backed securities defaults that froze credit markets worldwide. The 1997 Asian Financial Crisis also caused severe credit restrictions as affected countries faced currency devaluations and capital flight, leading to sharp economic contractions. These credit crunches contrast with liquidity traps where monetary policy loses effectiveness despite ample liquidity in the economy.

Impacts on Monetary Policy: Liquidity Trap vs Credit Crunch

In a liquidity trap, monetary policy loses effectiveness as interest rates approach zero and people prefer holding cash over bonds, limiting central banks' ability to stimulate spending. In contrast, a credit crunch restricts access to credit due to tightened lending standards, causing a sharp decline in investment and consumer spending despite available liquidity. Both scenarios hinder economic recovery but require distinct policy responses: unconventional tools like quantitative easing in liquidity traps and regulatory adjustments to restore lending confidence during credit crunches.

Central Bank Responses to Financial Stagnation

Central banks respond to liquidity traps by implementing ultra-low interest rates and quantitative easing to stimulate borrowing and spending despite near-zero yields. In contrast, during a credit crunch, central banks often increase liquidity through emergency lending facilities and relaxed regulatory requirements to restore confidence and unfreeze credit markets. Both strategies aim to counteract financial stagnation but target different mechanisms affecting money flow and credit availability.

Policy Solutions: Navigating Out of Liquidity Traps and Credit Crunches

Monetary policies such as aggressive interest rate cuts and quantitative easing aim to alleviate liquidity traps by encouraging borrowing and spending when traditional tools lose effectiveness. In contrast, credit crunches require regulatory reforms and targeted fiscal interventions to restore banks' lending capacity and bolster credit flow to businesses and consumers. Central banks and governments must coordinate these strategies to ensure financial stability and stimulate economic recovery.

The Role of Consumer and Business Confidence

Consumer and business confidence significantly influence the dynamics of liquidity traps and credit crunches by affecting spending and borrowing behaviors. In a liquidity trap, low confidence leads to reduced demand despite low interest rates, causing monetary policy to lose effectiveness. Conversely, during a credit crunch, waning confidence prompts tighter lending standards and diminished credit availability, further constraining economic activity.

Future Risks: Preventing Liquidity Traps and Credit Crunch Recurrence

Implementing proactive monetary policies that maintain low interest rates and ensure adequate central bank liquidity can mitigate future liquidity traps by encouraging lending and investment. Strengthening financial regulations and enhancing credit risk assessment frameworks reduces the likelihood of credit crunches by promoting healthier bank balance sheets and preventing abrupt credit freezes. Continuous monitoring of economic indicators such as M2 money supply growth and bank capital adequacy ratios is essential to detect early signs of financial distress and enable timely interventions.

Liquidity Trap vs Credit Crunch Infographic

difterm.com

difterm.com