The capital account records the net change in ownership of national assets, capturing investments, loans, and financial transfers between countries. In contrast, the current account tracks the trade balance, including exports, imports, and income from abroad such as dividends and remittances. Understanding the interplay between these accounts is essential for analyzing a country's overall economic health and international financial position.

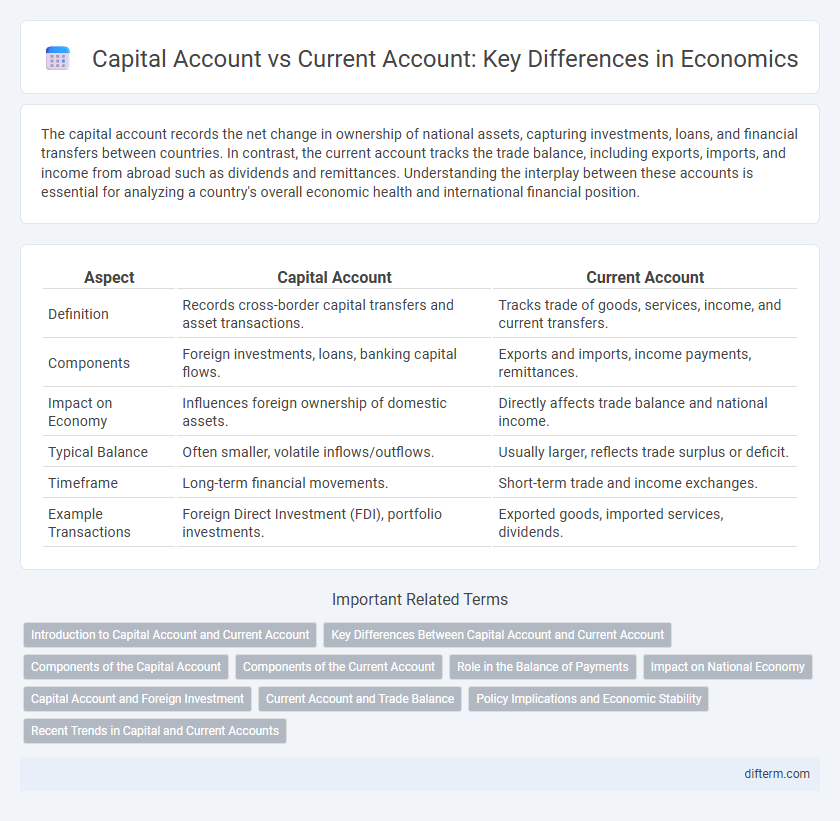

Table of Comparison

| Aspect | Capital Account | Current Account |

|---|---|---|

| Definition | Records cross-border capital transfers and asset transactions. | Tracks trade of goods, services, income, and current transfers. |

| Components | Foreign investments, loans, banking capital flows. | Exports and imports, income payments, remittances. |

| Impact on Economy | Influences foreign ownership of domestic assets. | Directly affects trade balance and national income. |

| Typical Balance | Often smaller, volatile inflows/outflows. | Usually larger, reflects trade surplus or deficit. |

| Timeframe | Long-term financial movements. | Short-term trade and income exchanges. |

| Example Transactions | Foreign Direct Investment (FDI), portfolio investments. | Exported goods, imported services, dividends. |

Introduction to Capital Account and Current Account

The capital account records a country's cross-border investments, including transactions involving foreign direct investment, portfolio investment, and changes in reserve assets. The current account tracks the trade balance, net income from abroad, and current transfers, reflecting the flow of goods, services, income, and unilateral transfers. Both accounts together form the balance of payments, providing a comprehensive picture of a nation's economic transactions with the rest of the world.

Key Differences Between Capital Account and Current Account

The capital account records cross-border transactions involving ownership of assets, such as investments and loans, reflecting changes in a country's financial position. The current account tracks trade in goods and services, income earnings, and current transfers, highlighting the flow of goods and income between nations. Key differences lie in their nature: the capital account deals with financial assets and liabilities, while the current account focuses on trade and income transactions.

Components of the Capital Account

The capital account primarily records transactions involving the transfer of ownership of fixed assets, capital transfers, and the acquisition or disposal of non-produced, non-financial assets such as patents and trademarks. It includes items like debt forgiveness, inheritances, migrants' transfers, and the purchase or sale of intangible assets contributing to a country's financial position. The capital account is distinct from the current account, which tracks trade in goods and services, income, and current transfers, emphasizing the importance of asset exchange in economic balance.

Components of the Current Account

The current account comprises three primary components: the trade balance, net primary income, and net secondary income. The trade balance records exports and imports of goods and services, reflecting a country's international trade performance. Net primary income includes earnings on investments and compensation of employees, while net secondary income covers unilateral transfers such as remittances and foreign aid.

Role in the Balance of Payments

The capital account records cross-border transfers of fixed assets and financial instruments, reflecting foreign investments, loans, and asset purchases, while the current account tracks trade flows, net income from abroad, and current transfers. These two accounts together form the balance of payments, providing a comprehensive picture of a country's economic transactions with the rest of the world. Imbalances in the current account are often offset by corresponding movements in the capital account, maintaining overall balance in international financial flows.

Impact on National Economy

The capital account records cross-border ownership of assets and investments, influencing foreign direct investment inflows that drive economic growth and infrastructure development. The current account tracks trade balance, net income, and transfer payments, affecting currency stability and trade competitiveness. Imbalances in either account can lead to currency volatility, affect foreign reserves, and ultimately impact a country's economic stability and growth prospects.

Capital Account and Foreign Investment

The capital account records cross-border transactions involving ownership of assets, including foreign direct investment (FDI) and portfolio investments, which influence a country's financial stability and growth potential. Foreign investment flows through the capital account play a vital role in financing infrastructure projects, technology transfers, and job creation, thereby attracting multinational corporations seeking new markets and resources. Understanding capital account dynamics helps policymakers manage exchange rates, control inflation pressures, and maintain a favorable balance of payments position.

Current Account and Trade Balance

The current account reflects a country's net trade in goods and services, primary income, and secondary income flows, providing a comprehensive measure of its international economic transactions. The trade balance, a key component of the current account, represents the difference between exports and imports of goods and services, influencing currency valuation and economic policy decisions. Persistent trade deficits or surpluses within the current account can indicate underlying competitiveness issues or structural economic shifts impacting long-term growth.

Policy Implications and Economic Stability

Capital account and current account balances provide critical insights for policymakers aiming to maintain economic stability. Persistent current account deficits may indicate underlying economic vulnerabilities, necessitating policies that promote export competitiveness and reduce external debt reliance, while capital account openness requires regulatory frameworks to mitigate volatile capital flows impacting financial stability. Coordinated management of both accounts supports sustainable growth by balancing external financing needs with resilience against external shocks.

Recent Trends in Capital and Current Accounts

Recent trends indicate a growing surplus in the capital account, driven by increased foreign direct investment inflows and portfolio investments in emerging markets. Conversely, many economies experience a widening current account deficit due to higher import demand and fluctuating commodity prices. Central banks are adjusting monetary policies to manage exchange rates and maintain economic stability amid these shifts.

capital account vs current account Infographic

difterm.com

difterm.com