The current account deficit measures the gap between a country's savings and its investment, reflecting the net trade balance plus net income and transfers, while the fiscal deficit represents the shortfall between government revenue and expenditure. A persistent current account deficit may indicate excessive borrowing from abroad or weak export competitiveness, whereas a fiscal deficit often signals unsustainable public finances and potential inflationary pressures. Understanding the interaction between these deficits is crucial for assessing overall economic health and policy effectiveness.

Table of Comparison

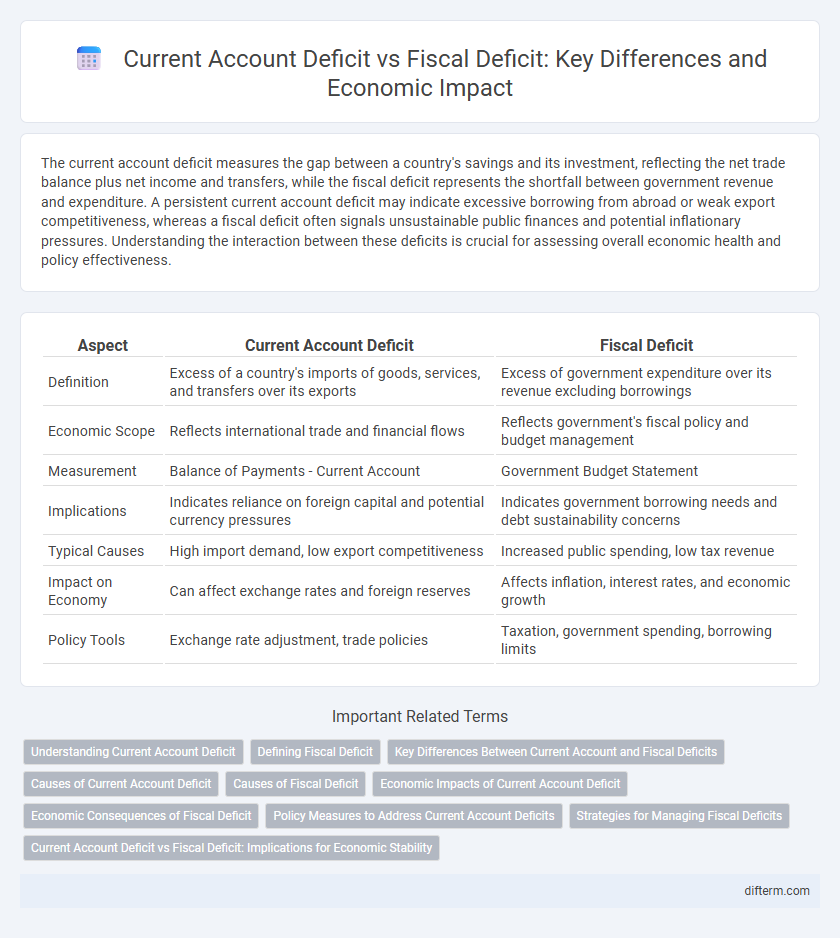

| Aspect | Current Account Deficit | Fiscal Deficit |

|---|---|---|

| Definition | Excess of a country's imports of goods, services, and transfers over its exports | Excess of government expenditure over its revenue excluding borrowings |

| Economic Scope | Reflects international trade and financial flows | Reflects government's fiscal policy and budget management |

| Measurement | Balance of Payments - Current Account | Government Budget Statement |

| Implications | Indicates reliance on foreign capital and potential currency pressures | Indicates government borrowing needs and debt sustainability concerns |

| Typical Causes | High import demand, low export competitiveness | Increased public spending, low tax revenue |

| Impact on Economy | Can affect exchange rates and foreign reserves | Affects inflation, interest rates, and economic growth |

| Policy Tools | Exchange rate adjustment, trade policies | Taxation, government spending, borrowing limits |

Understanding Current Account Deficit

The current account deficit occurs when a country's imports of goods, services, and transfers exceed its exports, indicating that it is a net borrower from the rest of the world. This deficit reflects the nation's external financial health and impacts exchange rates, foreign debt, and capital inflows. Understanding the current account deficit is crucial for assessing economic sustainability and the balance of payments dynamics compared to the fiscal deficit, which relates to government budget imbalances.

Defining Fiscal Deficit

Fiscal deficit represents the gap between a government's total revenue and total expenditure, excluding borrowings, highlighting the need for external financing. It measures how much the government is overspending relative to its income from taxes and other sources. This imbalance often leads to increased public debt and can influence inflation and interest rates within the economy.

Key Differences Between Current Account and Fiscal Deficits

The current account deficit measures a country's net trade in goods and services, along with net earnings and transfer payments, reflecting its foreign borrowing or lending status. In contrast, the fiscal deficit represents the gap between government revenue and expenditure, indicating domestic fiscal health and public debt levels. Key differences include their economic scope, with the current account focusing on external sector balance and the fiscal deficit addressing internal government budgetary performance.

Causes of Current Account Deficit

A current account deficit occurs when a country imports more goods, services, and capital than it exports, often driven by high domestic consumption, low national savings, and rising oil or raw material prices. Structural factors like weak export competitiveness and exchange rate policies can exacerbate the deficit. External shocks such as global economic downturns or fluctuating commodity prices also significantly impact the current account balance.

Causes of Fiscal Deficit

Fiscal deficit primarily arises from excessive government spending exceeding revenue, driven by increased public expenditure on subsidies, defense, and social welfare programs. Structural issues such as inefficient tax collection, lack of broad-based taxation, and rising interest payments on public debt further exacerbate the fiscal imbalance. Persistent fiscal deficits often result from expansionary fiscal policies aimed at stimulating economic growth during downturns without adequate revenue generation mechanisms.

Economic Impacts of Current Account Deficit

A current account deficit indicates that a country imports more goods, services, and capital than it exports, leading to increased foreign debt and vulnerability to exchange rate fluctuations. Persistent deficits can reduce national savings, increase reliance on foreign investment, and potentially trigger currency depreciation, which may drive up inflation and reduce investor confidence. The economic impacts often include higher interest rates and constraints on economic growth due to imbalances in external trade and financing.

Economic Consequences of Fiscal Deficit

Fiscal deficit occurs when government expenditures exceed revenues, leading to increased borrowing and higher public debt. This situation can cause inflationary pressures, crowd out private investment, and reduce economic growth over time. Persistent fiscal deficits undermine fiscal stability, resulting in higher interest rates and decreased investor confidence.

Policy Measures to Address Current Account Deficits

Policy measures to address current account deficits typically include exchange rate adjustments, export promotion initiatives, and import substitution strategies aimed at improving trade balances. Implementing fiscal consolidation can indirectly support reducing current account deficits by enhancing overall macroeconomic stability. Structural reforms targeting productivity, investment in competitive sectors, and strengthening foreign direct investment inflows also contribute to correcting external imbalances.

Strategies for Managing Fiscal Deficits

Fiscal deficit management strategies emphasize curbing government spending and enhancing revenue through tax reforms to ensure sustainable public finances. Implementing expenditure prioritization targets critical sectors while minimizing non-essential outlays to reduce borrowing needs. Structural reforms aimed at boosting economic growth complement fiscal consolidation efforts, facilitating long-term deficit reduction without stifling development.

Current Account Deficit vs Fiscal Deficit: Implications for Economic Stability

A current account deficit occurs when a country imports more goods, services, and capital than it exports, signaling reliance on foreign financing, while a fiscal deficit arises when government expenditures exceed revenues, increasing public debt. Persistent current account deficits can undermine economic stability by exposing the country to external shocks and currency depreciation, whereas fiscal deficits may lead to higher interest rates and inflation, affecting domestic economic growth. Balancing both deficits is crucial for sustaining long-term economic stability and preventing financial vulnerabilities in emerging and developed economies.

Current Account Deficit vs Fiscal Deficit Infographic

difterm.com

difterm.com