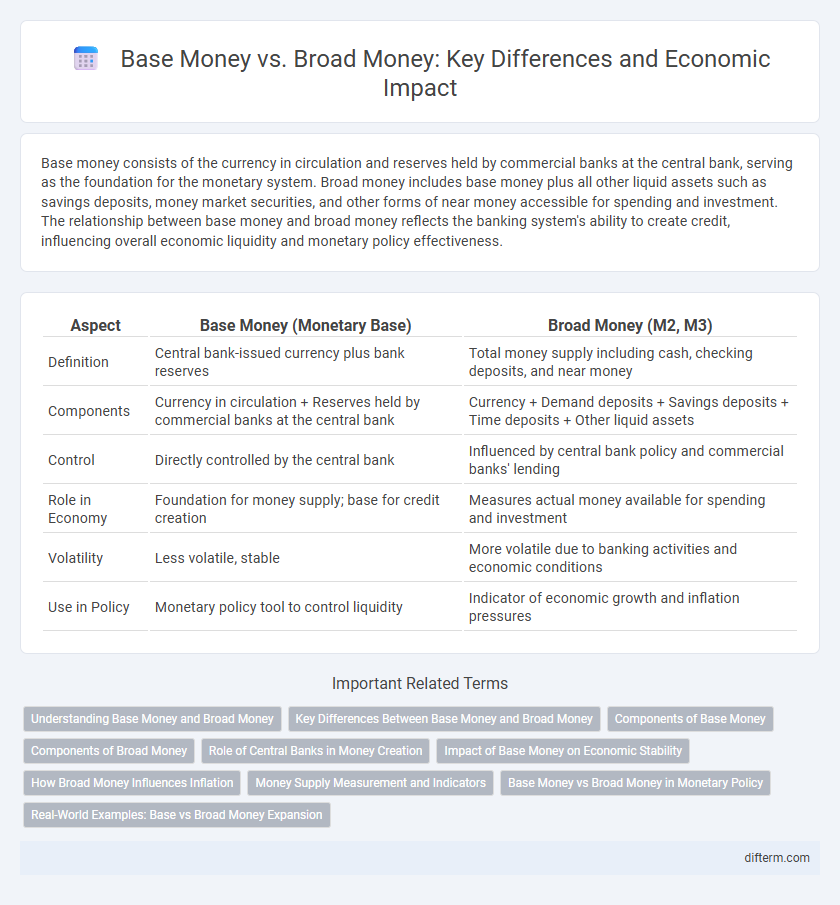

Base money consists of the currency in circulation and reserves held by commercial banks at the central bank, serving as the foundation for the monetary system. Broad money includes base money plus all other liquid assets such as savings deposits, money market securities, and other forms of near money accessible for spending and investment. The relationship between base money and broad money reflects the banking system's ability to create credit, influencing overall economic liquidity and monetary policy effectiveness.

Table of Comparison

| Aspect | Base Money (Monetary Base) | Broad Money (M2, M3) |

|---|---|---|

| Definition | Central bank-issued currency plus bank reserves | Total money supply including cash, checking deposits, and near money |

| Components | Currency in circulation + Reserves held by commercial banks at the central bank | Currency + Demand deposits + Savings deposits + Time deposits + Other liquid assets |

| Control | Directly controlled by the central bank | Influenced by central bank policy and commercial banks' lending |

| Role in Economy | Foundation for money supply; base for credit creation | Measures actual money available for spending and investment |

| Volatility | Less volatile, stable | More volatile due to banking activities and economic conditions |

| Use in Policy | Monetary policy tool to control liquidity | Indicator of economic growth and inflation pressures |

Understanding Base Money and Broad Money

Base money, also known as high-powered money, comprises currency in circulation and reserves held by commercial banks at the central bank, serving as the foundation of the monetary supply. Broad money includes base money plus all other liquid assets in the economy, such as checking and savings deposits, money market securities, and other near-money assets that facilitate spending and investment. Understanding the distinction between base money and broad money is crucial for analyzing monetary policy impact and liquidity conditions in the financial system.

Key Differences Between Base Money and Broad Money

Base money, also known as high-powered money, consists of currency in circulation plus reserves held by commercial banks at the central bank, serving as the foundation of a country's money supply. Broad money includes base money as well as all other liquid assets such as savings deposits, time deposits, and money market funds, representing the total money available within an economy. The key difference lies in liquidity and scope: base money is directly controlled by the central bank and is the most liquid form, while broad money encompasses various forms of money with different liquidity levels circulating in the financial system.

Components of Base Money

Base money, also known as high-powered money, comprises currency in circulation and the reserves held by commercial banks at the central bank. Currency in circulation includes physical notes and coins used by the public for transactions, while reserves consist of required and excess holdings that banks keep to meet regulatory requirements and manage liquidity. These components directly influence the money supply foundation, as base money serves as the monetary base from which the broader money aggregates expand through bank lending and deposit creation.

Components of Broad Money

Broad money consists of base money plus all liquid assets held by the public, including demand deposits, savings accounts, and time deposits. Components of broad money typically encompass currency in circulation, commercial bank deposits, and other near-money assets that can quickly be converted into cash. The distinction highlights the broader liquidity available in the economy beyond just physical currency and reserves held by the central bank.

Role of Central Banks in Money Creation

Central banks play a crucial role in the creation of base money, which consists of currency in circulation and reserves held by commercial banks. Broad money expands beyond this base, including deposits and other liquid assets created through commercial banks' lending activities fueled by central bank reserves. The interplay between base money and broad money underpins monetary policy implementation and overall economic liquidity.

Impact of Base Money on Economic Stability

Base money, consisting of currency in circulation and reserves held by banks at the central bank, directly influences liquidity in the financial system and serves as the foundation for broad money creation. Changes in base money affect interest rates and inflation, playing a critical role in maintaining economic stability by controlling money supply and steering monetary policy effectiveness. Excessive growth in base money can lead to inflationary pressures, while insufficient base money may cause liquidity shortages, impacting overall economic growth and stability.

How Broad Money Influences Inflation

Broad money, encompassing currency in circulation and various types of bank deposits, significantly impacts inflation by influencing demand levels in the economy. When broad money supply increases rapidly, it often leads to higher consumer spending and investment, pushing prices upward and fueling inflationary pressures. Central banks closely monitor broad money growth as a key indicator to implement monetary policies aimed at stabilizing inflation rates.

Money Supply Measurement and Indicators

Base money, also known as monetary base or M0, comprises physical currency in circulation plus reserves held by commercial banks at the central bank, serving as the foundation for the overall money supply. Broad money, such as M2 or M3, includes base money in addition to various types of deposits and liquid assets held by the public, providing a comprehensive measure of money available for spending and investment. Monitoring these indicators helps policymakers assess liquidity, inflationary pressures, and economic stability by understanding how central bank actions translate into money circulating within the economy.

Base Money vs Broad Money in Monetary Policy

Base money, also known as the monetary base, encompasses currency in circulation and reserves held by commercial banks at the central bank, serving as the foundation of a country's money supply. Broad money includes base money plus all other liquid assets such as savings accounts and time deposits, reflecting the total money available in the economy for spending and investment. Central banks utilize changes in base money to influence broad money through monetary policy tools like reserve requirements and open market operations, aiming to control inflation and stimulate economic growth.

Real-World Examples: Base vs Broad Money Expansion

In the United States, base money expansion surged during the 2008 financial crisis due to quantitative easing, with the Federal Reserve increasing reserves and currency in circulation dramatically. Conversely, broad money growth, encompassing bank deposits and liquid assets, expanded more gradually, reflecting credit conditions and lending activities in the economy. In contrast, China exhibited rapid broad money growth driven by extensive bank lending and shadow banking, while its base money increased at a slower pace, highlighting differences in monetary transmission mechanisms.

Base money vs Broad money Infographic

difterm.com

difterm.com