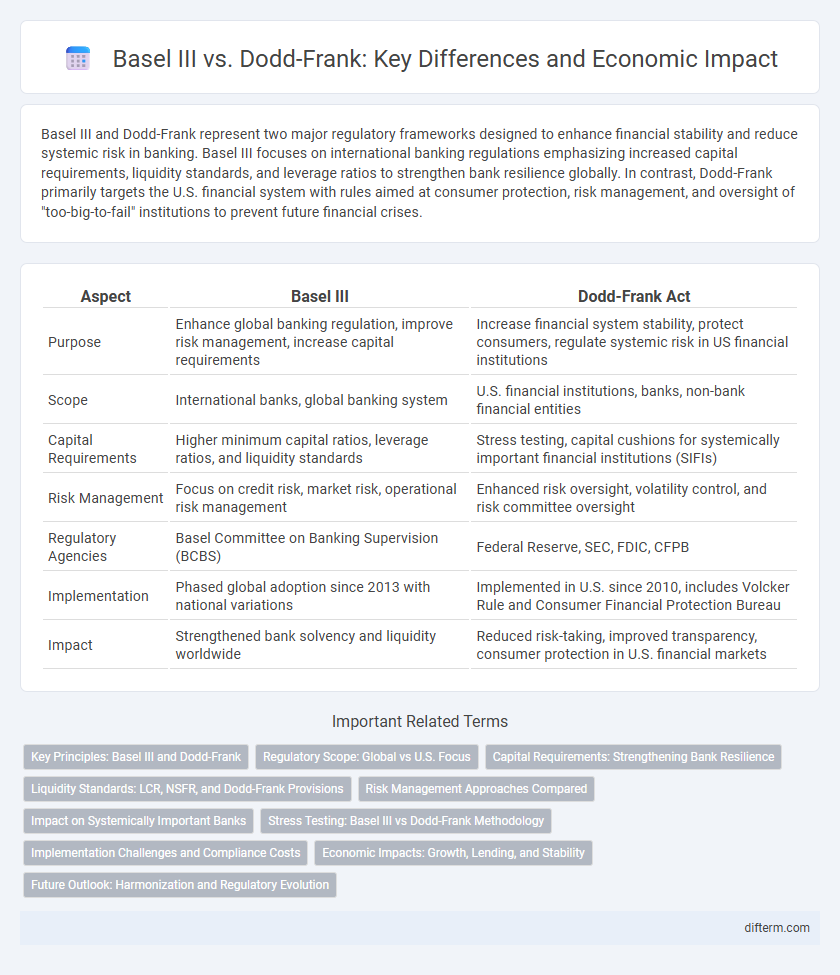

Basel III and Dodd-Frank represent two major regulatory frameworks designed to enhance financial stability and reduce systemic risk in banking. Basel III focuses on international banking regulations emphasizing increased capital requirements, liquidity standards, and leverage ratios to strengthen bank resilience globally. In contrast, Dodd-Frank primarily targets the U.S. financial system with rules aimed at consumer protection, risk management, and oversight of "too-big-to-fail" institutions to prevent future financial crises.

Table of Comparison

| Aspect | Basel III | Dodd-Frank Act |

|---|---|---|

| Purpose | Enhance global banking regulation, improve risk management, increase capital requirements | Increase financial system stability, protect consumers, regulate systemic risk in US financial institutions |

| Scope | International banks, global banking system | U.S. financial institutions, banks, non-bank financial entities |

| Capital Requirements | Higher minimum capital ratios, leverage ratios, and liquidity standards | Stress testing, capital cushions for systemically important financial institutions (SIFIs) |

| Risk Management | Focus on credit risk, market risk, operational risk management | Enhanced risk oversight, volatility control, and risk committee oversight |

| Regulatory Agencies | Basel Committee on Banking Supervision (BCBS) | Federal Reserve, SEC, FDIC, CFPB |

| Implementation | Phased global adoption since 2013 with national variations | Implemented in U.S. since 2010, includes Volcker Rule and Consumer Financial Protection Bureau |

| Impact | Strengthened bank solvency and liquidity worldwide | Reduced risk-taking, improved transparency, consumer protection in U.S. financial markets |

Key Principles: Basel III and Dodd-Frank

Basel III emphasizes enhanced capital adequacy, liquidity standards, and risk management to strengthen bank resilience during financial stress, requiring higher quality capital and stricter leverage ratios. Dodd-Frank targets systemic risk through comprehensive regulatory reforms, including the Volcker Rule to limit proprietary trading and increased oversight of derivatives markets. Both frameworks prioritize financial stability but differ in scope, with Basel III focusing on global banking standards and Dodd-Frank addressing broader systemic safeguards in the U.S. financial system.

Regulatory Scope: Global vs U.S. Focus

Basel III establishes a comprehensive, global regulatory framework aimed at strengthening bank capital requirements, liquidity, and risk management standards worldwide, promoting financial stability across international banking systems. Dodd-Frank, by contrast, focuses specifically on the U.S. financial sector, implementing stringent regulations targeting domestic banks, consumer protection, and systemic risk reduction after the 2008 financial crisis. While Basel III fosters harmonized global supervision, Dodd-Frank addresses unique regulatory challenges within the U.S. market, reflecting differing scopes and compliance requirements.

Capital Requirements: Strengthening Bank Resilience

Basel III establishes stricter capital requirements by mandating banks to maintain a minimum Common Equity Tier 1 (CET1) capital ratio of 4.5%, alongside additional buffers to enhance loss absorption capacity, aimed at improving financial system stability globally. The Dodd-Frank Act emphasizes stress testing and risk-based capital standards tailored to large, systemically important financial institutions (SIFIs) to prevent bank failures and mitigate systemic risks within the U.S. banking sector. Both frameworks prioritize capital adequacy but differ in scope and regulatory approach, with Basel III providing a global baseline and Dodd-Frank focusing on national implementation and oversight.

Liquidity Standards: LCR, NSFR, and Dodd-Frank Provisions

Basel III introduces the Liquidity Coverage Ratio (LCR) and Net Stable Funding Ratio (NSFR) to ensure banks maintain adequate short-term and long-term liquidity buffers, enhancing resilience against funding stress. The LCR requires banks to hold high-quality liquid assets covering net cash outflows over 30 days, while the NSFR mandates stable funding for all assets over a one-year horizon. Dodd-Frank provisions complement these standards by imposing additional liquidity risk management requirements and stress testing on systemically important financial institutions to safeguard U.S. financial stability.

Risk Management Approaches Compared

Basel III emphasizes enhanced capital requirements, leverage ratios, and liquidity standards to strengthen risk management in banks globally, promoting stability and reducing systemic risk. The Dodd-Frank Act focuses on comprehensive risk oversight through stress testing, the Volcker Rule restricting proprietary trading, and the creation of the Consumer Financial Protection Bureau to address consumer risks. Both frameworks aim to mitigate financial crises but differ in scope, with Basel III targeting international banking resilience and Dodd-Frank centering on U.S. market reforms and consumer protection.

Impact on Systemically Important Banks

Basel III imposes stricter capital and liquidity requirements on systemically important banks to enhance resilience against financial shocks, emphasizing higher quality capital and leverage ratios. Dodd-Frank complements this by implementing rigorous stress testing, enhanced supervisory oversight, and living wills for U.S. systemically important financial institutions to mitigate systemic risk and improve recovery mechanisms. Both frameworks aim to reduce the probability of bank failures and limit the potential for systemic contagion in global and U.S. financial markets.

Stress Testing: Basel III vs Dodd-Frank Methodology

Basel III stress testing methodology emphasizes forward-looking scenarios with a strong focus on capital adequacy and liquidity risk under extreme but plausible market conditions, ensuring banks maintain a robust capital buffer. Dodd-Frank stress tests, mandated by the Federal Reserve, require annual comprehensive evaluations of bank resilience using severe macroeconomic scenarios, including unemployment rates, GDP contraction, and market shocks, to assess capital sufficiency. Both frameworks utilize scenario analysis but differ in regulatory scope and specific risk factors, with Basel III targeting global systemic stability and Dodd-Frank focusing on U.S. financial system safety.

Implementation Challenges and Compliance Costs

Basel III requires banks to maintain higher capital reserves, causing substantial implementation challenges related to system upgrades and risk management alignment, while Dodd-Frank enforces stricter regulatory oversight and compliance demands, particularly for derivatives trading and consumer protection. The compliance costs under Basel III primarily stem from enhanced capital adequacy requirements and reporting standards, whereas Dodd-Frank's complexity drives expenses through mandatory stress testing and enhanced transparency protocols. Financial institutions face significant resource allocation to meet both frameworks' stringent demands, impacting profitability and operational flexibility.

Economic Impacts: Growth, Lending, and Stability

Basel III enhances financial stability by enforcing higher capital requirements and stricter liquidity standards, which can temper lending growth but reduce systemic risk in banking sectors globally. Dodd-Frank focuses on curbing risky lending practices and increasing transparency in the U.S. financial markets, aiming to prevent crises but sometimes constraining credit flow to businesses. Both regulatory frameworks influence economic growth differently: Basel III promotes long-term stability at the cost of short-term lending expansion, while Dodd-Frank prioritizes consumer protection and market discipline, affecting lending dynamics and economic resilience.

Future Outlook: Harmonization and Regulatory Evolution

Basel III and Dodd-Frank frameworks are progressively aligning as global financial regulators emphasize harmonization to enhance systemic risk management and transparency. Future regulatory evolution is expected to integrate stricter capital requirements, improved liquidity standards, and advanced stress testing methodologies across jurisdictions. This convergence aims to create a resilient international banking system while accommodating regional market differences and economic conditions.

Basel III vs Dodd-Frank Infographic

difterm.com

difterm.com