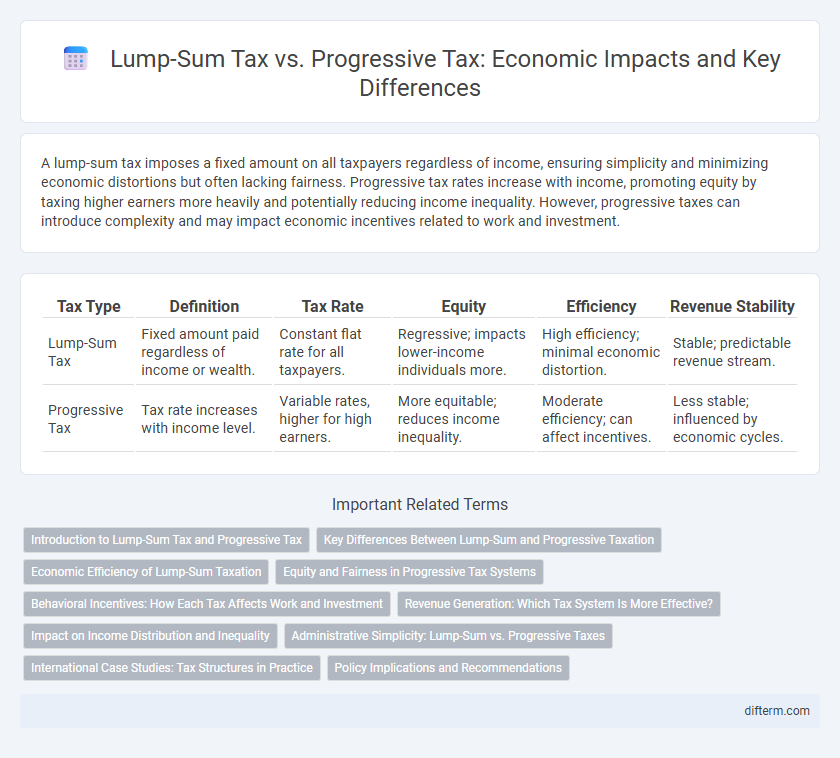

A lump-sum tax imposes a fixed amount on all taxpayers regardless of income, ensuring simplicity and minimizing economic distortions but often lacking fairness. Progressive tax rates increase with income, promoting equity by taxing higher earners more heavily and potentially reducing income inequality. However, progressive taxes can introduce complexity and may impact economic incentives related to work and investment.

Table of Comparison

| Tax Type | Definition | Tax Rate | Equity | Efficiency | Revenue Stability |

|---|---|---|---|---|---|

| Lump-Sum Tax | Fixed amount paid regardless of income or wealth. | Constant flat rate for all taxpayers. | Regressive; impacts lower-income individuals more. | High efficiency; minimal economic distortion. | Stable; predictable revenue stream. |

| Progressive Tax | Tax rate increases with income level. | Variable rates, higher for high earners. | More equitable; reduces income inequality. | Moderate efficiency; can affect incentives. | Less stable; influenced by economic cycles. |

Introduction to Lump-Sum Tax and Progressive Tax

Lump-sum tax imposes a fixed amount on all taxpayers regardless of income, ensuring simplicity and predictability in revenue collection without distorting economic decisions. Progressive tax rates increase with income, aiming to reduce income inequality by taxing higher earners at higher percentages, thereby generating more revenue from those with greater ability to pay. Both tax systems impact economic behavior and equity differently, influencing fiscal policy and income distribution.

Key Differences Between Lump-Sum and Progressive Taxation

Lump-sum tax requires a fixed amount from all taxpayers regardless of income, making it simple and administratively efficient but often criticized for being regressive. Progressive tax imposes higher rates on higher income brackets, enhancing equity by reducing income inequality and generating more government revenue from the wealthy. The key difference lies in their impact on taxpayers' behavior and economic fairness, with lump-sum taxes being non-distortionary and progressive taxes influencing work incentives.

Economic Efficiency of Lump-Sum Taxation

Lump-sum taxation maximizes economic efficiency by imposing a fixed tax amount regardless of income, eliminating distortions in labor supply and investment decisions. Unlike progressive taxes, lump-sum taxes do not create incentives for tax avoidance or reduced work effort, promoting optimal resource allocation. However, the efficiency gains come at the cost of equity concerns, as lump-sum taxes are regressive and impact low-income individuals disproportionately.

Equity and Fairness in Progressive Tax Systems

Progressive tax systems enhance equity by imposing higher tax rates on individuals with greater income, ensuring a fairer distribution of the tax burden. Unlike lump-sum taxes, which are flat and regressive, progressive taxes reduce income inequality by aligning tax liability with the taxpayer's ability to pay. This approach supports social justice by funding public services that disproportionately benefit lower-income groups.

Behavioral Incentives: How Each Tax Affects Work and Investment

Lump-sum taxes do not distort work or investment decisions since they are fixed amounts regardless of income, maintaining strong behavioral incentives for labor and capital accumulation. Progressive taxes increase marginal tax rates on higher incomes, potentially discouraging additional work effort and investment due to diminished returns on extra earnings. Economic studies show that higher progressive taxation can reduce labor supply elasticity and investment intensity, though the effect size varies with tax design and individual responsiveness.

Revenue Generation: Which Tax System Is More Effective?

Lump-sum taxes generate stable revenue since they charge a fixed amount regardless of income, reducing administrative costs and minimizing tax avoidance. Progressive taxes, however, yield higher revenue from wealthier individuals by increasing rates with income, enhancing redistributive effects and economic equity. Empirical studies show progressive taxation tends to maximize total revenue while promoting social welfare, especially in economies with significant income disparities.

Impact on Income Distribution and Inequality

Lump-sum taxes impose a fixed amount regardless of income, leading to a disproportionate burden on lower-income individuals and exacerbating income inequality. Progressive taxes increase tax rates with higher income brackets, effectively redistributing wealth and reducing income disparities. Empirical studies show that progressive taxation significantly lowers the Gini coefficient, indicating improved income equality compared to lump-sum tax systems.

Administrative Simplicity: Lump-Sum vs. Progressive Taxes

Lump-sum taxes offer significant administrative simplicity due to their fixed amount, eliminating complex income assessments and reducing compliance costs. Progressive taxes require detailed income tracking and calculations, increasing administrative burdens and potential errors. Simplified collection in lump-sum taxes minimizes government expenditures linked to tax enforcement and processing.

International Case Studies: Tax Structures in Practice

International case studies reveal diverse impacts of lump-sum and progressive tax systems on economic equity and growth. Countries like Switzerland employ lump-sum taxes to attract wealthy residents, boosting investment but raising concerns about social equity. In contrast, Scandinavian nations utilize progressive taxes to fund extensive social programs, achieving lower income inequality but facing debates over potential incentives for high earners.

Policy Implications and Recommendations

Lump-sum tax systems provide simplicity and predictability in revenue collection but may disproportionately burden lower-income households, limiting economic equity. Progressive tax policies enhance income redistribution and social welfare by imposing higher rates on wealthier individuals, encouraging economic balance. Policymakers should consider hybrid tax models that combine the efficiency of lump-sum taxes with the fairness of progressive rates to optimize revenue without exacerbating inequality.

lump-sum tax vs progressive tax Infographic

difterm.com

difterm.com