Leading indicators provide early signals about the future direction of the economy by measuring factors like stock market performance, new business orders, and consumer confidence. Lagging indicators, such as unemployment rates and GDP growth, confirm trends after economic shifts have occurred, offering a retrospective view of economic health. Understanding the distinction between these indicators helps investors and policymakers make informed decisions to anticipate or respond to economic changes effectively.

Table of Comparison

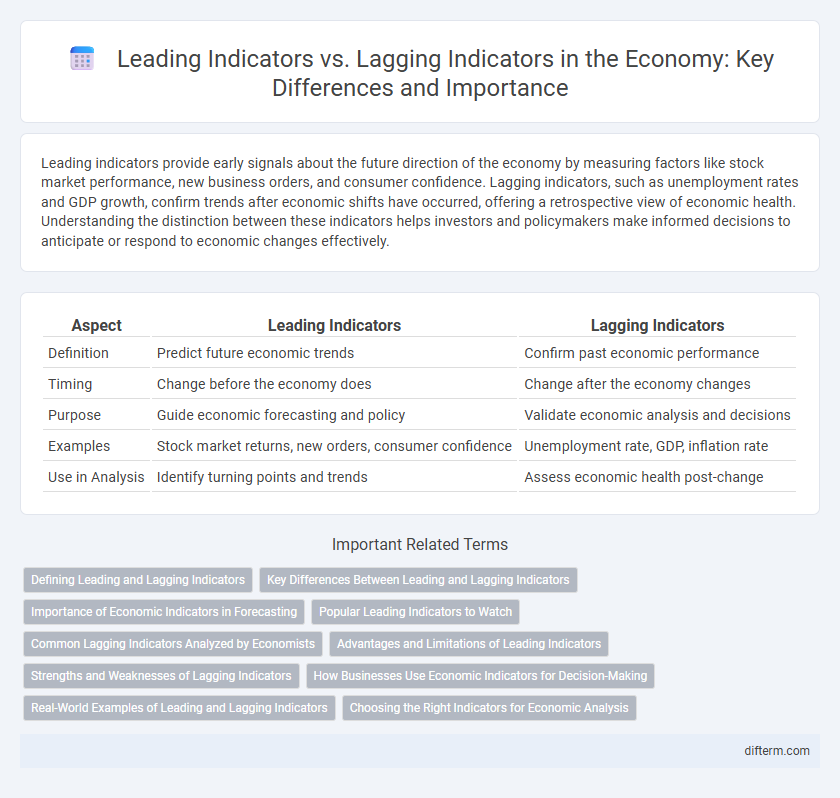

| Aspect | Leading Indicators | Lagging Indicators |

|---|---|---|

| Definition | Predict future economic trends | Confirm past economic performance |

| Timing | Change before the economy does | Change after the economy changes |

| Purpose | Guide economic forecasting and policy | Validate economic analysis and decisions |

| Examples | Stock market returns, new orders, consumer confidence | Unemployment rate, GDP, inflation rate |

| Use in Analysis | Identify turning points and trends | Assess economic health post-change |

Defining Leading and Lagging Indicators

Leading indicators are economic metrics that predict future trends, such as stock market performance and new housing starts, providing early signals of economic direction. Lagging indicators, like unemployment rates and gross domestic product (GDP) growth, reflect past economic activity and confirm established trends. Understanding the distinction between these indicators is crucial for accurate economic forecasting and informed policy-making.

Key Differences Between Leading and Lagging Indicators

Leading indicators, such as stock market performance and consumer sentiment, predict future economic activity by signaling upcoming trends before they occur. Lagging indicators, including unemployment rates and GDP growth, confirm past economic trends by reflecting changes after the broader economy has shifted. Understanding the key differences between these indicators is essential for accurate economic forecasting and policy decision-making.

Importance of Economic Indicators in Forecasting

Leading indicators, such as stock market performance and manufacturing orders, provide early signals of economic trends, enabling policymakers and investors to anticipate changes and make informed decisions. Lagging indicators, including unemployment rates and GDP growth, confirm patterns after they have fully materialized, offering a comprehensive view of economic health. The combined analysis of these economic indicators enhances forecasting accuracy, supports strategic planning, and mitigates risks in economic policymaking and financial markets.

Popular Leading Indicators to Watch

Popular leading indicators to watch include the stock market performance, new housing starts, and consumer confidence indexes, which signal future economic activity by predicting trends in spending and investment. The Purchasing Managers' Index (PMI) and weekly unemployment claims provide early insights into manufacturing health and labor market conditions. Monitoring these leading indicators enables analysts to anticipate economic shifts before they appear in lagging data like GDP growth or unemployment rates.

Common Lagging Indicators Analyzed by Economists

Common lagging indicators analyzed by economists include the unemployment rate, consumer price index (CPI), and corporate profits, all of which reflect economic conditions after changes have occurred. The unemployment rate provides insights into labor market health with a delay, while CPI measures inflation trends based on past price movements. Corporate profits reveal business performance, helping economists assess the economic cycle's later stages.

Advantages and Limitations of Leading Indicators

Leading indicators provide early signals of future economic activity, enabling policymakers and investors to anticipate market trends and adjust strategies proactively. Their advantages include the ability to forecast turning points in the economy, such as shifts in GDP growth or inflation rates, which supports timely decision-making. Limitations involve their susceptibility to false signals and volatility, as these indicators often react to short-term fluctuations that may not reflect long-term economic trends.

Strengths and Weaknesses of Lagging Indicators

Lagging indicators, such as unemployment rates and consumer price index, provide concrete data that confirm economic trends after they have occurred, offering reliable validation of economic performance. Their strength lies in accuracy and reduced volatility, which helps policymakers and analysts avoid premature decisions based on incomplete data. However, their main weakness is delayed responsiveness, making them less useful for predicting future economic conditions or initiating timely policy interventions.

How Businesses Use Economic Indicators for Decision-Making

Businesses utilize leading indicators such as stock market trends, new orders, and consumer sentiment surveys to anticipate economic shifts and adjust strategies proactively. Lagging indicators like unemployment rates, corporate profits, and GDP growth confirm trends and validate decisions made during earlier phases. By analyzing both types of indicators, businesses optimize inventory management, investment planning, and resource allocation to mitigate risks and capitalize on emerging opportunities.

Real-World Examples of Leading and Lagging Indicators

Leading indicators such as building permits and stock market returns provide early signals of economic shifts by predicting future activity, exemplified by a rise in building permits often preceding increased construction output. Lagging indicators like unemployment rates and corporate profits confirm trends after they have occurred, with unemployment typically rising only after an economic downturn has begun. Understanding the timing and application of leading and lagging economic indicators enables more accurate forecasting and responsive policy decisions.

Choosing the Right Indicators for Economic Analysis

Leading indicators such as stock market performance, new business orders, and consumer sentiment provide early signals of economic trends and potential turning points. Lagging indicators, including unemployment rates, GDP growth, and inflation, confirm the established direction of the economy after changes have occurred. Selecting the right mix of leading and lagging indicators enhances predictive accuracy and supports more informed economic decision-making.

Leading indicators vs Lagging indicators Infographic

difterm.com

difterm.com