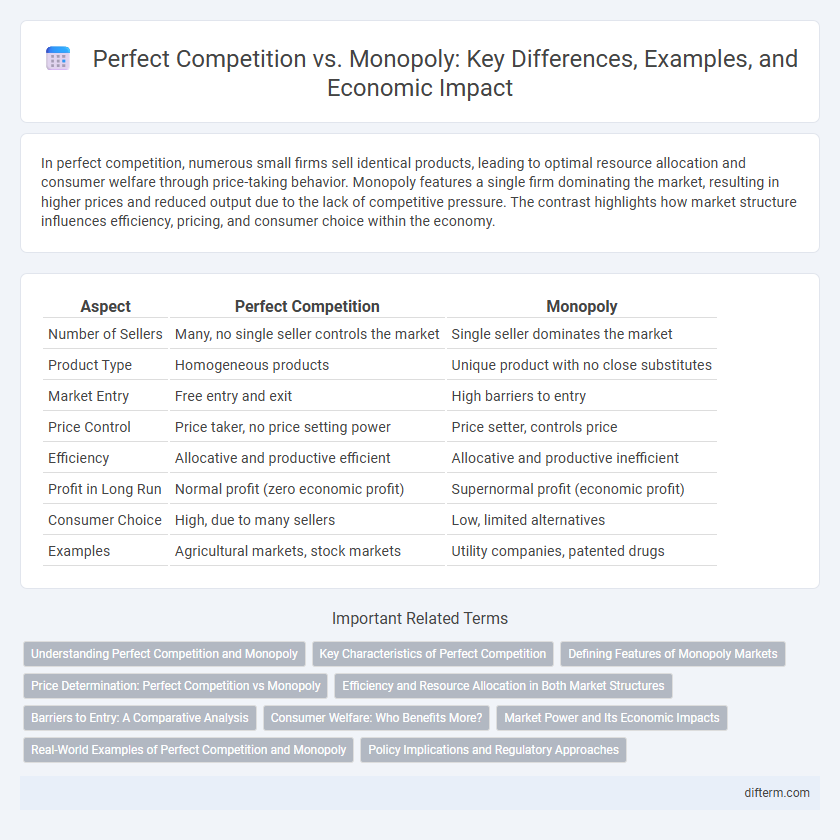

In perfect competition, numerous small firms sell identical products, leading to optimal resource allocation and consumer welfare through price-taking behavior. Monopoly features a single firm dominating the market, resulting in higher prices and reduced output due to the lack of competitive pressure. The contrast highlights how market structure influences efficiency, pricing, and consumer choice within the economy.

Table of Comparison

| Aspect | Perfect Competition | Monopoly |

|---|---|---|

| Number of Sellers | Many, no single seller controls the market | Single seller dominates the market |

| Product Type | Homogeneous products | Unique product with no close substitutes |

| Market Entry | Free entry and exit | High barriers to entry |

| Price Control | Price taker, no price setting power | Price setter, controls price |

| Efficiency | Allocative and productive efficient | Allocative and productive inefficient |

| Profit in Long Run | Normal profit (zero economic profit) | Supernormal profit (economic profit) |

| Consumer Choice | High, due to many sellers | Low, limited alternatives |

| Examples | Agricultural markets, stock markets | Utility companies, patented drugs |

Understanding Perfect Competition and Monopoly

Perfect competition features numerous small firms selling identical products, ensuring no single entity controls market prices, leading to optimal resource allocation and maximum consumer welfare. In contrast, a monopoly consists of a single firm dominating the market with unique products, allowing price-setting power that often results in higher prices and restricted output. Understanding these market structures is essential for analyzing economic efficiency and the impact of market power on consumer choice and innovation.

Key Characteristics of Perfect Competition

Perfect competition features numerous small firms competing in a market with identical products, ensuring no single firm can influence prices. Firms have perfect information, enabling consumers to make well-informed choices, and there are no barriers to entry or exit, allowing free market fluidity. Prices are determined solely by supply and demand, resulting in allocative and productive efficiency.

Defining Features of Monopoly Markets

Monopoly markets are defined by a single seller controlling the entire supply of a product or service with no close substitutes, leading to significant market power and price-making ability. Barriers to entry such as high startup costs, regulatory restrictions, and exclusive rights prevent potential competitors from entering the market. This lack of competition often results in reduced consumer choice, higher prices, and inefficiencies compared to perfectly competitive markets where many sellers offer identical products.

Price Determination: Perfect Competition vs Monopoly

In perfect competition, price determination occurs through the intersection of market demand and supply, resulting in prices equal to marginal cost, ensuring allocative efficiency. In contrast, a monopoly sets prices above marginal cost to maximize profits, leading to higher prices and reduced output compared to competitive markets. This price-setting power in monopolies often results in consumer welfare loss and market inefficiencies.

Efficiency and Resource Allocation in Both Market Structures

Perfect competition maximizes allocative and productive efficiency by ensuring resources flow to their most valued uses through numerous firms competing freely, leading to prices equaling marginal cost. Monopoly results in allocative inefficiency as the single firm restricts output and sets prices above marginal cost, causing deadweight loss and misallocation of resources. Resource allocation under perfect competition aligns closely with consumer preferences, while monopolies often create market distortions that lead to suboptimal distribution and usage of resources.

Barriers to Entry: A Comparative Analysis

Barriers to entry in perfect competition are minimal, allowing new firms to freely enter the market, which results in numerous competitors and efficient resource allocation. In contrast, monopolies maintain high barriers to entry through factors such as significant capital requirements, control over essential resources, and government regulations, which prevent potential competitors from entering the market. These entry barriers enable monopolies to sustain market power, restrict output, and set prices above competitive levels, leading to reduced consumer welfare.

Consumer Welfare: Who Benefits More?

Perfect competition maximizes consumer welfare by offering a wide variety of goods at lower prices due to many firms competing, leading to allocative and productive efficiency. In contrast, monopolies restrict output to raise prices, resulting in higher profits but reduced consumer surplus and potential deadweight loss. Therefore, consumers benefit more in perfectly competitive markets where price equals marginal cost, ensuring optimal resource allocation and maximum total welfare.

Market Power and Its Economic Impacts

Perfect competition features numerous firms with no single entity able to influence market prices, leading to efficient resource allocation and consumer benefits through lower prices and higher output. In contrast, monopolies possess significant market power, enabling them to set higher prices, restrict output, and generate economic inefficiencies like deadweight loss. This market power distortion often results in reduced consumer surplus and limits innovation by reducing competitive pressure.

Real-World Examples of Perfect Competition and Monopoly

In real-world markets, agriculture exemplifies perfect competition with numerous farmers selling identical products like wheat, ensuring price-taking behavior. In contrast, utility companies such as electricity providers often operate as monopolies, controlling supply and setting prices without direct competition. These examples highlight the stark contrast in market dynamics and pricing power between perfect competition and monopoly structures.

Policy Implications and Regulatory Approaches

Perfect competition promotes efficient resource allocation with minimal need for intervention, whereas monopolies often require regulatory oversight to prevent market abuses and protect consumer welfare. Antitrust policies and price controls are common strategies to curb monopolistic power and encourage competitive behaviors. Policymakers must balance promoting innovation and preventing market distortions through targeted regulations.

Perfect Competition vs Monopoly Infographic

difterm.com

difterm.com