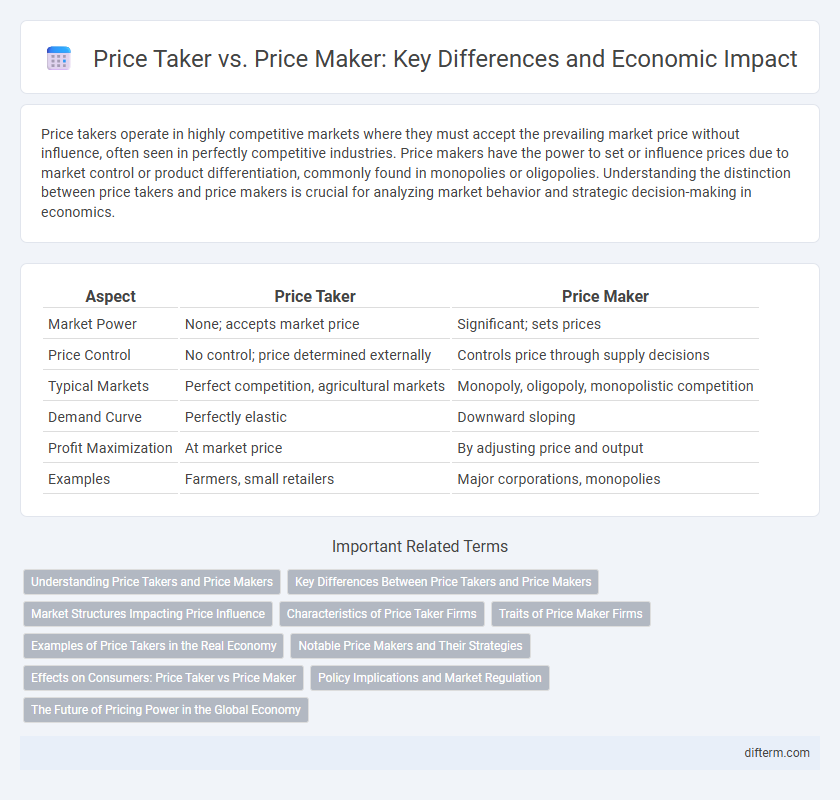

Price takers operate in highly competitive markets where they must accept the prevailing market price without influence, often seen in perfectly competitive industries. Price makers have the power to set or influence prices due to market control or product differentiation, commonly found in monopolies or oligopolies. Understanding the distinction between price takers and price makers is crucial for analyzing market behavior and strategic decision-making in economics.

Table of Comparison

| Aspect | Price Taker | Price Maker |

|---|---|---|

| Market Power | None; accepts market price | Significant; sets prices |

| Price Control | No control; price determined externally | Controls price through supply decisions |

| Typical Markets | Perfect competition, agricultural markets | Monopoly, oligopoly, monopolistic competition |

| Demand Curve | Perfectly elastic | Downward sloping |

| Profit Maximization | At market price | By adjusting price and output |

| Examples | Farmers, small retailers | Major corporations, monopolies |

Understanding Price Takers and Price Makers

Price takers operate in perfectly competitive markets where individual sellers accept the market price, lacking the power to influence it due to numerous competitors and homogeneous products. Price makers dominate imperfect markets, possessing the ability to set prices by controlling supply, product differentiation, or market share. Understanding the distinction between price takers and price makers is essential for analyzing market dynamics, firm behavior, and pricing strategies.

Key Differences Between Price Takers and Price Makers

Price takers operate in perfectly competitive markets where they accept the prevailing market price, having no influence over price changes due to the abundance of sellers and homogeneous products. Price makers, common in monopolistic or oligopolistic markets, possess the power to influence or set prices thanks to product differentiation, limited competition, or significant market share. The key distinction lies in market power: price takers maximize profit by adjusting output at given prices, whereas price makers strategically set prices to optimize profits considering demand elasticity.

Market Structures Impacting Price Influence

Price takers operate in perfectly competitive markets where numerous sellers offer identical products, limiting their ability to influence prices. Price makers exist in monopolistic or oligopolistic markets, where fewer firms control supply and can set prices above marginal cost. Market structure determines a firm's pricing power, impacting competitive dynamics and market efficiency.

Characteristics of Price Taker Firms

Price taker firms operate in perfectly competitive markets where they have no control over the market price and must accept the prevailing equilibrium price. These firms produce homogeneous products, face a large number of competitors, and have negligible market share, making individual output decisions incapable of influencing price. Their demand curve is perfectly elastic, reflecting the constant market price regardless of quantity supplied.

Traits of Price Maker Firms

Price maker firms possess significant market power, allowing them to influence market prices through their output decisions rather than accepting the prevailing market price. These firms often operate in imperfectly competitive markets such as monopolies or oligopolies, where product differentiation and barriers to entry limit consumer options. Their ability to set prices strategically often results in higher profit margins and the potential to control supply to maximize revenue.

Examples of Price Takers in the Real Economy

Price takers in the real economy include agricultural producers like wheat farmers who accept market prices determined by supply and demand without influence, retail investors in stock markets who cannot affect share prices, and small businesses in perfectly competitive markets offering standardized products. These entities operate in environments characterized by high competition and minimal pricing power, leading them to adjust output and sales volume based on prevailing market prices. Understanding their role helps explain pricing dynamics and market efficiency in sectors where individual influence on price is negligible.

Notable Price Makers and Their Strategies

Notable price makers include multinational corporations like Apple, Amazon, and Tesla, which leverage strong brand identity, innovation, and market dominance to set prices above competitive levels. These firms employ strategies such as product differentiation, exclusive technology, and economies of scale to maintain pricing power and influence market dynamics. Understanding their pricing tactics reveals how barriers to entry and consumer loyalty reinforce their control over market prices.

Effects on Consumers: Price Taker vs Price Maker

Price takers face fixed market prices, limiting their ability to influence costs, which typically leads to consistent consumer prices and increased market efficiency. Price makers control supply levels or product differentiation, enabling them to set higher prices that may reduce consumer surplus and limit purchasing options. This dynamic affects consumer welfare, with price takers fostering competitive pricing and price makers potentially creating market power-induced price inflation.

Policy Implications and Market Regulation

Price takers operate in perfectly competitive markets with no control over prices, necessitating policies that promote transparency and prevent collusion. Price makers possess market power to influence prices, requiring regulatory measures such as antitrust laws and price controls to prevent monopolistic exploitation. Effective market regulation balances these dynamics by fostering competition while protecting consumers from unfair pricing practices.

The Future of Pricing Power in the Global Economy

Price makers will increasingly leverage advanced data analytics and AI-driven market insights to enhance pricing power, shaping competitive advantages in the global economy. Price takers, constrained by market supply and demand forces, must focus on operational efficiency and innovation to survive in highly competitive sectors. Future pricing dynamics will be influenced by digital transformation, geopolitical shifts, and evolving consumer preferences, emphasizing the strategic importance of adaptive pricing models.

Price Taker vs Price Maker Infographic

difterm.com

difterm.com