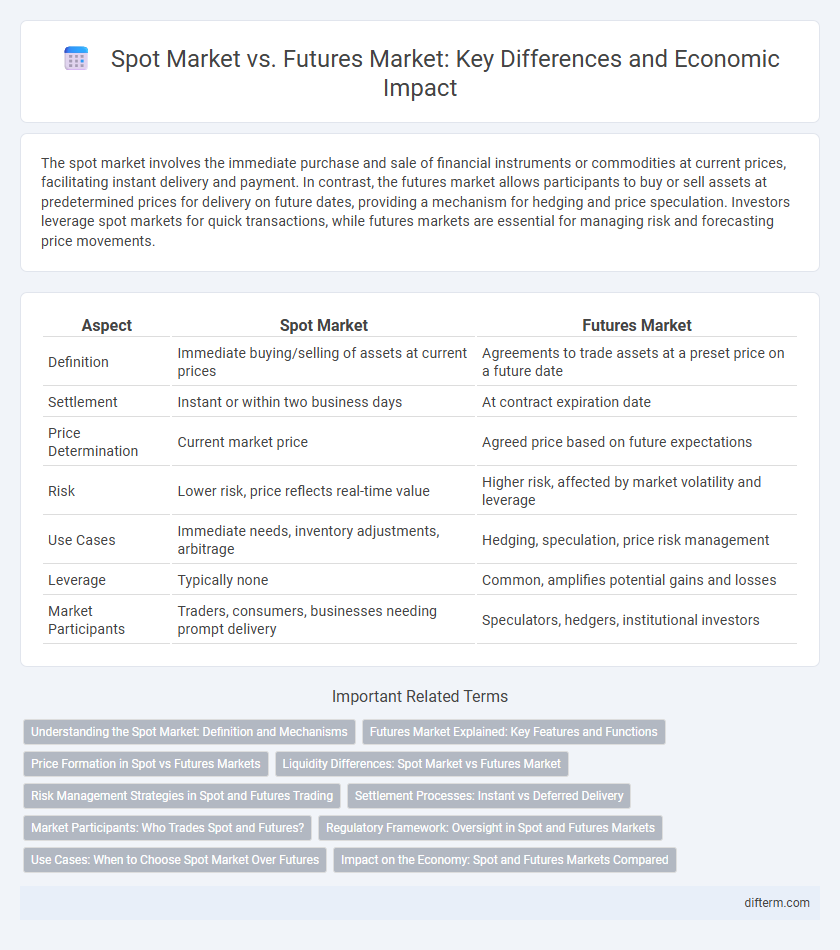

The spot market involves the immediate purchase and sale of financial instruments or commodities at current prices, facilitating instant delivery and payment. In contrast, the futures market allows participants to buy or sell assets at predetermined prices for delivery on future dates, providing a mechanism for hedging and price speculation. Investors leverage spot markets for quick transactions, while futures markets are essential for managing risk and forecasting price movements.

Table of Comparison

| Aspect | Spot Market | Futures Market |

|---|---|---|

| Definition | Immediate buying/selling of assets at current prices | Agreements to trade assets at a preset price on a future date |

| Settlement | Instant or within two business days | At contract expiration date |

| Price Determination | Current market price | Agreed price based on future expectations |

| Risk | Lower risk, price reflects real-time value | Higher risk, affected by market volatility and leverage |

| Use Cases | Immediate needs, inventory adjustments, arbitrage | Hedging, speculation, price risk management |

| Leverage | Typically none | Common, amplifies potential gains and losses |

| Market Participants | Traders, consumers, businesses needing prompt delivery | Speculators, hedgers, institutional investors |

Understanding the Spot Market: Definition and Mechanisms

The spot market facilitates the immediate purchase and sale of financial instruments or commodities, with transactions settled "on the spot" at current market prices. It operates through a transparent pricing mechanism driven by real-time supply and demand dynamics, enabling participants to exchange assets swiftly without contractual delays. This market contrasts with futures markets by emphasizing instant delivery and settlement, making it vital for liquidity and price discovery in financial ecosystems.

Futures Market Explained: Key Features and Functions

The futures market facilitates trading standardized contracts to buy or sell assets at a predetermined price and date, offering hedging and speculation opportunities. Key features include leverage, margin requirements, and marked-to-market settlements that manage risk and liquidity. Futures markets enhance price discovery and provide transparency for commodities, equities, and financial instruments.

Price Formation in Spot vs Futures Markets

Price formation in spot markets is driven primarily by immediate supply and demand dynamics, reflecting real-time asset value as transactions settle instantly. Futures markets base price determination on expected future supply, demand, and risk factors, incorporating elements like storage costs, interest rates, and market sentiment. The convergence of futures prices with spot prices as contract maturity approaches highlights the intrinsic linkage between the two markets' valuation mechanisms.

Liquidity Differences: Spot Market vs Futures Market

The spot market typically offers higher liquidity with immediate trades and real-time price discovery, enabling efficient asset exchange. Futures markets exhibit liquidity concentrated around popular contract expirations, often influenced by hedgers and speculators driving volume. Differences in market structure and participant behavior significantly impact liquidity depth and bid-ask spreads between spot and futures markets.

Risk Management Strategies in Spot and Futures Trading

Spot market trading involves immediate settlement of assets, exposing participants to price volatility and liquidity risks that require real-time monitoring and quick decision-making for effective risk management. Futures market trading allows investors to lock in prices for assets at a future date, reducing exposure to adverse price movements and enabling strategies like hedging and portfolio diversification. Utilizing stop-loss orders and margin management in futures trading further enhances risk mitigation by limiting potential losses and maintaining required capital reserves.

Settlement Processes: Instant vs Deferred Delivery

The spot market facilitates instant delivery and settlement of assets, enabling immediate exchange of goods or securities at current market prices. In contrast, the futures market involves deferred delivery, where contracts are settled at a specified future date, locking in prices to hedge against market volatility. This distinction affects liquidity, risk management, and price discovery in financial and commodity markets.

Market Participants: Who Trades Spot and Futures?

Spot market participants primarily include individual investors, businesses, and traders seeking immediate transaction settlement and real-time pricing for assets like commodities, currencies, and securities. Futures market traders consist mainly of hedgers, such as producers and consumers aiming to lock in prices to manage risk, and speculators who seek to profit from price fluctuations by leveraging contract positions. Institutional investors, commodity producers, and financial intermediaries actively engage in both markets to diversify strategies and optimize risk management.

Regulatory Framework: Oversight in Spot and Futures Markets

Regulatory oversight in the spot market primarily involves ensuring transparent and fair transactions for immediate asset exchanges, with agencies like the SEC and CFTC enforcing compliance and protecting investors. In contrast, the futures market operates under stricter regulatory frameworks due to its complexity and leverage, with entities such as the Commodity Futures Trading Commission (CFTC) and National Futures Association (NFA) imposing rigorous reporting, margin requirements, and position limits. Enhanced supervision in futures trading aims to mitigate systemic risk and prevent market manipulation, reflecting the critical role of regulatory bodies in maintaining market integrity.

Use Cases: When to Choose Spot Market Over Futures

The spot market is ideal for immediate delivery and cash transactions, making it suitable for businesses needing quick inventory replenishment or investors seeking instant asset ownership. It provides straightforward pricing based on current supply and demand, benefiting traders who want to capitalize on short-term price movements without exposure to contract expiration risks. Spot markets serve industries with volatile prices requiring immediate transactions, such as commodities, currencies, and equities.

Impact on the Economy: Spot and Futures Markets Compared

Spot markets provide immediate transaction settlements, enhancing liquidity and price transparency, which helps stabilize commodity prices and supports short-term economic planning. Futures markets allow for price risk management through contracts that lock in prices for future delivery, promoting investment and long-term production stability in sectors like agriculture and energy. The interplay between spot and futures markets impacts inflation rates, commodity availability, and financial market volatility, influencing overall economic growth and stability.

Spot market vs Futures market Infographic

difterm.com

difterm.com