Shadow banking operates outside traditional regulatory frameworks, offering alternative credit and lending services without the safety nets that commercial banks provide. Commercial banking remains the backbone of the financial system, providing deposits, loans, and payment services under strict regulatory oversight to ensure stability and consumer protection. The interplay between shadow banking and commercial banking affects credit availability, financial innovation, and systemic risk in the economy.

Table of Comparison

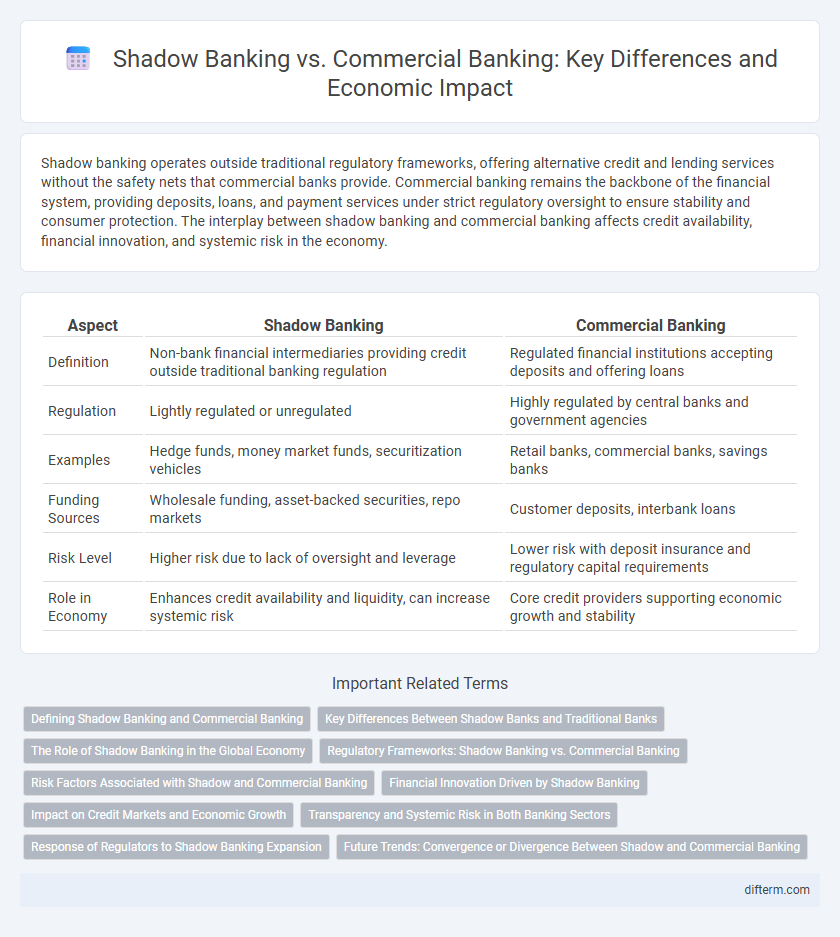

| Aspect | Shadow Banking | Commercial Banking |

|---|---|---|

| Definition | Non-bank financial intermediaries providing credit outside traditional banking regulation | Regulated financial institutions accepting deposits and offering loans |

| Regulation | Lightly regulated or unregulated | Highly regulated by central banks and government agencies |

| Examples | Hedge funds, money market funds, securitization vehicles | Retail banks, commercial banks, savings banks |

| Funding Sources | Wholesale funding, asset-backed securities, repo markets | Customer deposits, interbank loans |

| Risk Level | Higher risk due to lack of oversight and leverage | Lower risk with deposit insurance and regulatory capital requirements |

| Role in Economy | Enhances credit availability and liquidity, can increase systemic risk | Core credit providers supporting economic growth and stability |

Defining Shadow Banking and Commercial Banking

Shadow banking refers to non-bank financial intermediaries that provide services similar to traditional commercial banks but operate outside regular banking regulations, including entities like hedge funds, money market funds, and structured investment vehicles. Commercial banking involves regulated financial institutions that accept deposits, offer loans, and provide payment services to individuals and businesses under government oversight and deposit insurance schemes. The key distinction lies in regulatory frameworks, where shadow banking fills credit gaps with higher risk and less transparency compared to the more secure, regulated environment of commercial banks.

Key Differences Between Shadow Banks and Traditional Banks

Shadow banking operates outside conventional regulatory frameworks, engaging in credit intermediation activities like securitization and money market funding without accepting traditional deposits. Commercial banks provide regulated deposit-taking, loan issuance, and payment services, adhering to strict capital and liquidity requirements enforced by central banks. The key difference lies in regulatory oversight, risk exposure, and funding sources, with shadow banks typically assuming higher risks due to less stringent supervision.

The Role of Shadow Banking in the Global Economy

Shadow banking plays a critical role in the global economy by providing credit and liquidity outside traditional commercial banking systems, enabling more flexible financing for businesses and consumers. This sector often includes entities like hedge funds, private equity firms, and money market funds, which contribute to financial innovation but also pose regulatory challenges and systemic risks. The rapid growth of shadow banking highlights its importance in supplementing commercial banking, yet its opacity demands enhanced oversight to maintain financial stability.

Regulatory Frameworks: Shadow Banking vs. Commercial Banking

Shadow banking operates outside the purview of traditional regulatory frameworks that govern commercial banking, resulting in less oversight and potentially higher systemic risks. Commercial banks are subject to stringent regulations such as capital requirements, deposit insurance, and regular audits enforced by authorities like the Federal Reserve and FDIC. This regulatory disparity influences the risk profiles and market behaviors of both sectors, making shadow banking more opaque and susceptible to financial instability.

Risk Factors Associated with Shadow and Commercial Banking

Shadow banking involves non-bank financial intermediaries engaging in credit intermediation without direct regulatory oversight, which increases risks such as liquidity shortages, leverage buildup, and lack of transparency. Commercial banking faces risks including credit risk, market risk, and operational risk, but benefits from regulatory frameworks like capital adequacy requirements and deposit insurance that mitigate systemic threats. The higher leverage and opacity in shadow banking can amplify systemic risk, making it more vulnerable to financial contagion compared to the more regulated commercial banking sector.

Financial Innovation Driven by Shadow Banking

Shadow banking drives financial innovation by providing alternative credit channels outside traditional regulatory frameworks, enabling more flexible and diverse lending solutions. Unlike commercial banking, shadow banks utilize complex financial instruments and digital platforms to improve access to capital and reduce transaction costs. This innovation fosters economic growth but also raises concerns about transparency and systemic risk due to less stringent oversight.

Impact on Credit Markets and Economic Growth

Shadow banking significantly influences credit markets by providing alternative financing channels outside traditional regulatory frameworks, often increasing credit availability but raising systemic risk concerns. In contrast, commercial banking operates under strict regulations, promoting stable credit delivery essential for consistent economic growth. The interplay between both sectors shapes credit market dynamics, affecting liquidity, interest rates, and ultimately the pace of economic expansion.

Transparency and Systemic Risk in Both Banking Sectors

Shadow banking operates with less transparency due to limited regulatory oversight, increasing the difficulty of assessing associated systemic risks. Commercial banking maintains higher transparency through strict regulatory frameworks like the Basel III standards, enabling better risk management and depositor protection. The opacity in shadow banking amplifies the potential for systemic crises, whereas commercial banks' disclosure requirements help mitigate these risks by promoting market discipline and stability.

Response of Regulators to Shadow Banking Expansion

Regulators have intensified scrutiny on shadow banking due to its rapid growth and systemic risks, implementing stricter capital requirements and enhanced transparency measures to mitigate financial instability. Efforts include tighter oversight of non-bank financial intermediaries and extending regulatory frameworks akin to those applied to commercial banks. These measures aim to curb regulatory arbitrage and protect the economy from hidden vulnerabilities associated with shadow banking activities.

Future Trends: Convergence or Divergence Between Shadow and Commercial Banking

Future trends indicate a complex dynamic between shadow banking and commercial banking, with some experts predicting increased convergence due to regulatory advancements and technology adoption, while others foresee divergence driven by inherent differences in risk profiles and operational frameworks. Shadow banking's agility in digital innovation and alternative credit provision challenges traditional banking models, prompting commercial banks to integrate fintech solutions and explore new financial products. Regulatory landscapes will play a critical role in shaping this evolution, as policymakers strive to balance financial stability with fostering innovation, potentially leading to hybrid financial ecosystems.

Shadow banking vs Commercial banking Infographic

difterm.com

difterm.com