Public debt encompasses the total amount a government owes to its domestic and international creditors, while external debt specifically refers to the portion borrowed from foreign lenders. Managing public debt involves balancing fiscal policies to ensure sustainable growth, whereas external debt requires careful monitoring of exchange rates and foreign reserves. High levels of external debt can expose economies to currency risks and global market fluctuations, impacting overall financial stability.

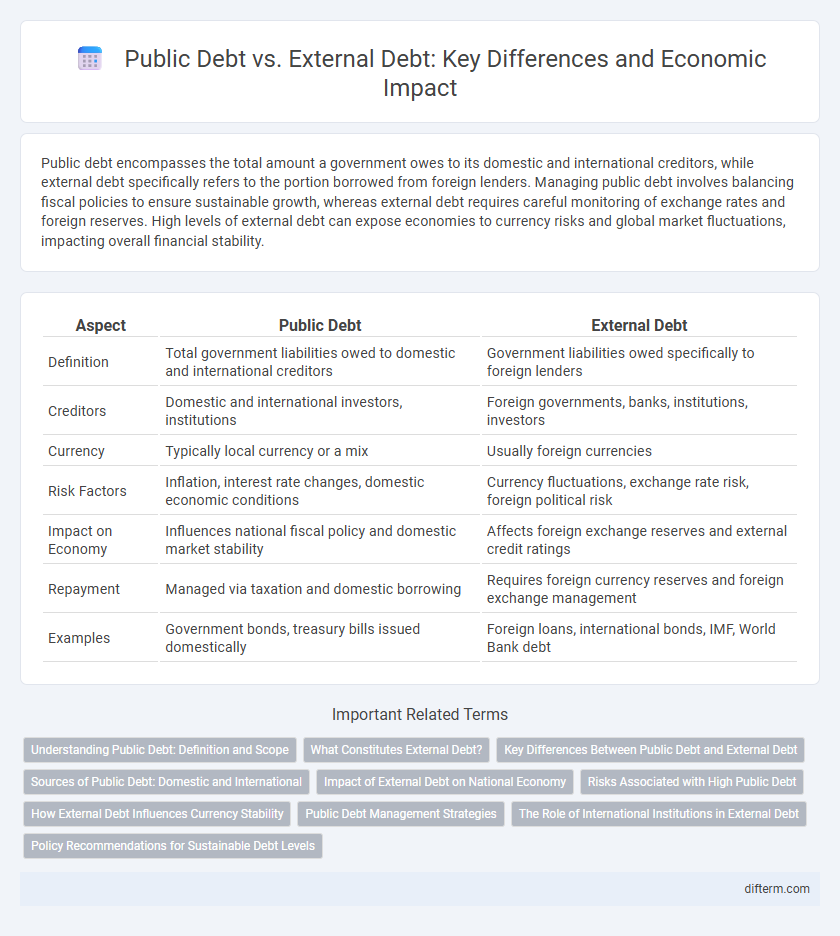

Table of Comparison

| Aspect | Public Debt | External Debt |

|---|---|---|

| Definition | Total government liabilities owed to domestic and international creditors | Government liabilities owed specifically to foreign lenders |

| Creditors | Domestic and international investors, institutions | Foreign governments, banks, institutions, investors |

| Currency | Typically local currency or a mix | Usually foreign currencies |

| Risk Factors | Inflation, interest rate changes, domestic economic conditions | Currency fluctuations, exchange rate risk, foreign political risk |

| Impact on Economy | Influences national fiscal policy and domestic market stability | Affects foreign exchange reserves and external credit ratings |

| Repayment | Managed via taxation and domestic borrowing | Requires foreign currency reserves and foreign exchange management |

| Examples | Government bonds, treasury bills issued domestically | Foreign loans, international bonds, IMF, World Bank debt |

Understanding Public Debt: Definition and Scope

Public debt refers to the total amount of money that a government owes to domestic and foreign creditors, encompassing both internal and external borrowings. It includes government bonds, securities, and loans issued within the country as well as obligations to foreign lenders, making it a comprehensive measure of a nation's financial liabilities. Understanding the distinction between public debt and external debt is crucial, as external debt specifically denotes the portion of public debt owed to non-resident creditors, affecting exchange rates and foreign reserves management.

What Constitutes External Debt?

External debt constitutes the portion of a country's total public debt that is borrowed from foreign lenders, including governments, international organizations, and private creditors. It includes loans, bonds, and other financial obligations denominated in foreign currencies, reflecting obligations owed outside the national borders. Monitoring external debt is crucial for assessing foreign exchange risks and a country's ability to meet its international financial commitments.

Key Differences Between Public Debt and External Debt

Public debt refers to the total amount of money the government owes to domestic and foreign creditors, while external debt specifically denotes the portion of public debt borrowed from foreign lenders. Public debt includes various instruments such as government bonds and securities issued within the country, whereas external debt comprises loans, bonds, and credits obtained from international financial institutions, foreign governments, and private foreign investors. The key difference lies in the debtor's exposure to foreign exchange risk and international market conditions, which primarily affect external debt sustainability and repayment terms.

Sources of Public Debt: Domestic and International

Public debt comprises obligations incurred by the government through domestic sources such as treasury bonds and savings bonds sold to local investors and financial institutions, as well as international sources including sovereign bonds issued in foreign markets and loans from multilateral organizations like the IMF and World Bank. Domestic public debt typically supports internal funding needs and can influence monetary policy, while international public debt affects external credit ratings and foreign exchange reserves. Effective management of both domestic and international public debt is crucial to maintaining economic stability and fiscal sustainability.

Impact of External Debt on National Economy

External debt significantly influences a nation's economy by affecting foreign exchange reserves, currency stability, and credit ratings, often leading to higher debt servicing costs that constrain fiscal policy and public investment. Elevated external debt levels can trigger capital flight, inflationary pressures, and reduced investor confidence, undermining economic growth and development. Effective external debt management is crucial to maintaining macroeconomic stability and ensuring sustainable long-term economic expansion.

Risks Associated with High Public Debt

High public debt increases the risk of fiscal insolvency, leading to higher borrowing costs and reduced investor confidence. Excessive public debt may crowd out private investment and constrain government spending on essential services or infrastructure. External debt exposure compounds these risks by subjecting economies to exchange rate volatility and sudden capital outflows, increasing vulnerability to external shocks and balance of payments crises.

How External Debt Influences Currency Stability

External debt significantly impacts currency stability by affecting a country's foreign exchange reserves and investor confidence. High levels of external debt increase vulnerability to exchange rate volatility, as repayment obligations demand foreign currency, which can deplete reserves and trigger depreciation. Sustained external debt pressures may lead to inflationary tendencies and reduced purchasing power, undermining overall economic stability.

Public Debt Management Strategies

Public debt management strategies prioritize optimizing the cost and risk of public debt portfolios by balancing domestic and external borrowing. Effective management involves diversifying sources, maturities, and currencies to reduce vulnerability to exchange rate fluctuations and external shocks. Strong institutional frameworks and transparent debt reporting enhance fiscal sustainability and investor confidence in public finance.

The Role of International Institutions in External Debt

International institutions such as the World Bank, International Monetary Fund (IMF), and regional development banks play a critical role in managing and restructuring external debt to ensure sustainability for developing countries. These organizations provide financial assistance, policy advice, and debt relief frameworks aimed at stabilizing economies burdened by high external debt. Their interventions help countries improve creditworthiness, access concessional financing, and implement reforms that promote economic growth while preventing debt crises.

Policy Recommendations for Sustainable Debt Levels

Maintaining sustainable debt levels requires implementing strict fiscal policies that prioritize reducing public debt while managing external debt through diversified funding sources and favorable terms. Governments should enhance transparency and accountability in borrowing practices to prevent excessive accumulation and ensure debt servicing capacity. Strengthening institutions to monitor debt metrics and promote economic growth supports long-term fiscal stability and reduces reliance on volatile external financing.

Public debt vs external debt Infographic

difterm.com

difterm.com