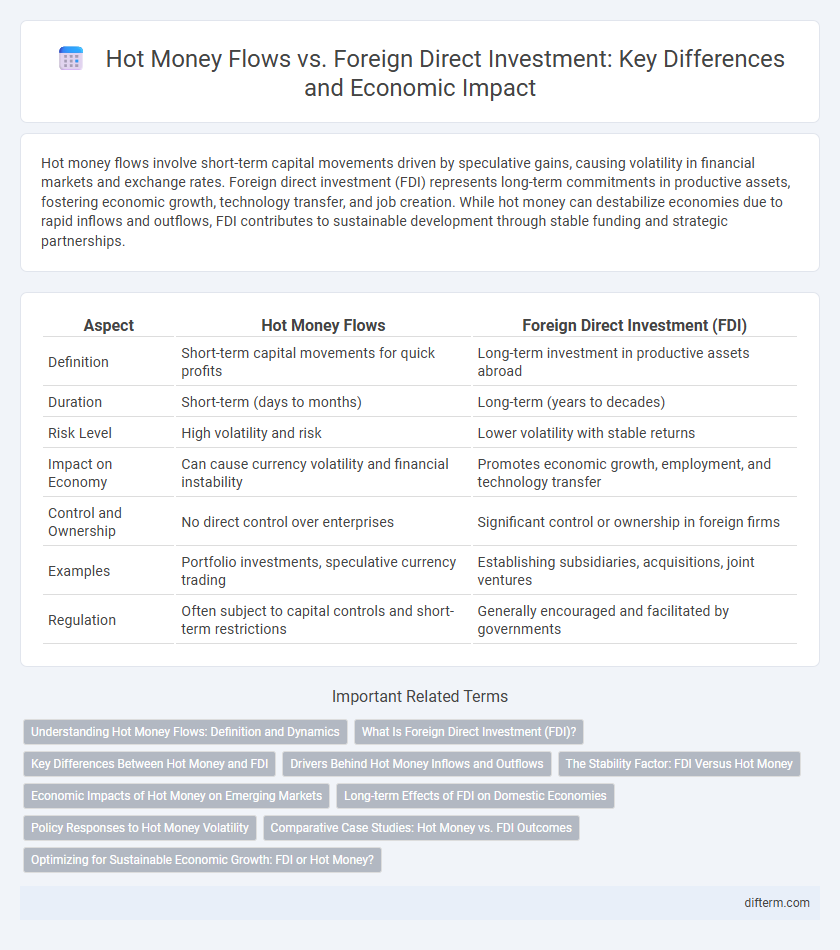

Hot money flows involve short-term capital movements driven by speculative gains, causing volatility in financial markets and exchange rates. Foreign direct investment (FDI) represents long-term commitments in productive assets, fostering economic growth, technology transfer, and job creation. While hot money can destabilize economies due to rapid inflows and outflows, FDI contributes to sustainable development through stable funding and strategic partnerships.

Table of Comparison

| Aspect | Hot Money Flows | Foreign Direct Investment (FDI) |

|---|---|---|

| Definition | Short-term capital movements for quick profits | Long-term investment in productive assets abroad |

| Duration | Short-term (days to months) | Long-term (years to decades) |

| Risk Level | High volatility and risk | Lower volatility with stable returns |

| Impact on Economy | Can cause currency volatility and financial instability | Promotes economic growth, employment, and technology transfer |

| Control and Ownership | No direct control over enterprises | Significant control or ownership in foreign firms |

| Examples | Portfolio investments, speculative currency trading | Establishing subsidiaries, acquisitions, joint ventures |

| Regulation | Often subject to capital controls and short-term restrictions | Generally encouraged and facilitated by governments |

Understanding Hot Money Flows: Definition and Dynamics

Hot money flows refer to the rapid movement of funds across borders seeking short-term profits from interest rate differentials or currency speculation, often leading to volatile capital movements. These flows can cause significant instability in emerging markets by triggering sudden exchange rate fluctuations and impacting liquidity conditions. Unlike foreign direct investment (FDI), which involves long-term capital commitments and physical asset acquisitions, hot money is highly liquid and reactive to market changes, influencing economic stability and monetary policy effectiveness.

What Is Foreign Direct Investment (FDI)?

Foreign Direct Investment (FDI) involves a company or individual from one country making a long-term investment into a business operating in another country, typically by acquiring assets or establishing ownership stakes of 10% or more. FDI contributes to economic growth by providing capital, technology transfer, and fostering management expertise within the host country. Unlike hot money flows, which are short-term and highly volatile investments primarily in financial assets, FDI reflects a more stable, long-term commitment to productive economic activities.

Key Differences Between Hot Money and FDI

Hot money flows refer to short-term capital moving rapidly across borders chasing high returns, primarily through financial instruments like stocks and bonds, while foreign direct investment (FDI) involves long-term investments in tangible assets such as factories, infrastructure, or businesses. Hot money is highly liquid, volatile, and sensitive to interest rate changes, often leading to economic instability, whereas FDI contributes to economic growth, technology transfer, and employment with more stable and sustained capital inflows. Understanding the divergent impacts and duration of these capital movements is crucial for policymakers aiming to balance financial stability and development.

Drivers Behind Hot Money Inflows and Outflows

Hot money inflows are primarily driven by short-term profit opportunities, interest rate differentials, and speculative gains in currency markets, making them highly sensitive to global financial volatility and policy changes. Foreign direct investment (FDI), by contrast, is motivated by long-term strategic goals such as market expansion, resource acquisition, and stable returns on capital, which foster sustained economic growth and infrastructure development. Outflows of hot money often occur due to sudden shifts in investor sentiment, geopolitical instability, or tightening monetary policies, causing abrupt capital flight that can destabilize emerging economies.

The Stability Factor: FDI Versus Hot Money

Foreign direct investment (FDI) offers long-term capital stability by creating tangible assets and local employment, thus fostering sustainable economic growth. In contrast, hot money flows are volatile, driven by rapid shifts in market sentiment and short-term profit opportunities, which can destabilize financial markets and cause sudden capital flight. Policymakers prioritize FDI to build resilient economies less vulnerable to speculative shocks inherent in hot money movements.

Economic Impacts of Hot Money on Emerging Markets

Hot money flows, characterized by short-term, speculative capital movements, often lead to volatility in exchange rates and asset prices within emerging markets, undermining financial stability. In contrast, foreign direct investment (FDI) provides long-term capital, technology transfer, and employment opportunities, fostering sustainable economic growth. The rapid influx and sudden withdrawal of hot money can trigger currency crises and inflationary pressures, whereas FDI contributes to infrastructure development and increases productivity.

Long-term Effects of FDI on Domestic Economies

Foreign direct investment (FDI) contributes to sustainable economic growth by promoting technology transfer, enhancing human capital, and strengthening institutional frameworks in domestic economies. Unlike hot money flows, which are short-term and volatile, FDI provides long-term capital that supports infrastructure development and job creation. The stability of FDI attracts further investment, fostering economic resilience and reducing vulnerability to external shocks.

Policy Responses to Hot Money Volatility

Policy responses to hot money volatility often include tightening capital controls, implementing macroprudential measures, and adjusting interest rates to manage short-term speculative inflows. Central banks may also use foreign exchange interventions and enhance regulatory frameworks to maintain financial stability amid sudden reversals of hot money. Coordinated international policy efforts aim to balance attracting foreign capital while minimizing risks from volatile portfolio investments.

Comparative Case Studies: Hot Money vs. FDI Outcomes

Hot money flows, characterized by short-term, speculative capital movements, often lead to market volatility and abrupt currency fluctuations, as seen in the 1997 Asian Financial Crisis. In contrast, foreign direct investment (FDI) provides stable, long-term capital fostering sustainable economic growth, technology transfer, and job creation, exemplified by China's economic transformation post-2000 due to massive FDI inflows. Comparative case studies reveal that economies heavily reliant on hot money experience financial instability, whereas those emphasizing FDI benefit from resilience and structural development.

Optimizing for Sustainable Economic Growth: FDI or Hot Money?

Foreign direct investment (FDI) provides long-term capital inflows that support sustainable economic growth through technology transfer, job creation, and infrastructure development. In contrast, hot money flows are short-term, highly volatile capital movements that can cause financial instability and disrupt monetary policy. Prioritizing FDI over hot money enhances economic resilience and fosters stable development.

Hot money flows vs foreign direct investment Infographic

difterm.com

difterm.com