Ricardian Equivalence suggests that consumers anticipate future taxes resulting from government deficits, prompting them to save rather than increase spending when the government borrows. Fiscal Illusion occurs when individuals underestimate the future tax burden of government debt, leading to higher consumption and support for increased public spending. Understanding the interplay between Ricardian Equivalence and Fiscal Illusion is crucial for crafting effective fiscal policies that balance government intervention with private sector behavior.

Table of Comparison

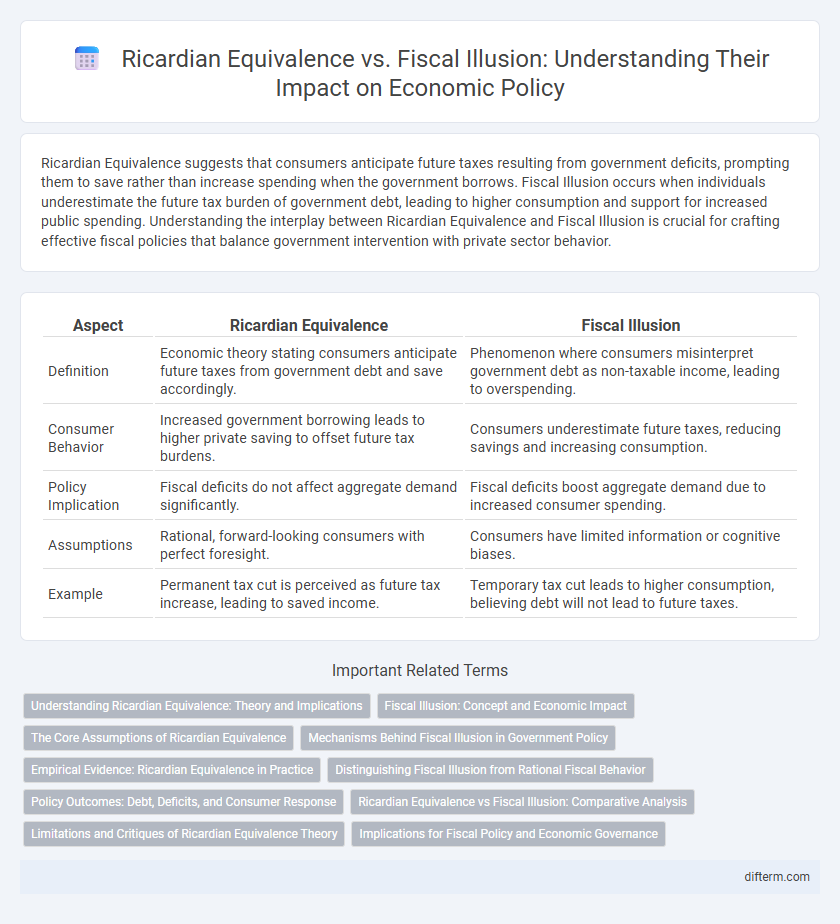

| Aspect | Ricardian Equivalence | Fiscal Illusion |

|---|---|---|

| Definition | Economic theory stating consumers anticipate future taxes from government debt and save accordingly. | Phenomenon where consumers misinterpret government debt as non-taxable income, leading to overspending. |

| Consumer Behavior | Increased government borrowing leads to higher private saving to offset future tax burdens. | Consumers underestimate future taxes, reducing savings and increasing consumption. |

| Policy Implication | Fiscal deficits do not affect aggregate demand significantly. | Fiscal deficits boost aggregate demand due to increased consumer spending. |

| Assumptions | Rational, forward-looking consumers with perfect foresight. | Consumers have limited information or cognitive biases. |

| Example | Permanent tax cut is perceived as future tax increase, leading to saved income. | Temporary tax cut leads to higher consumption, believing debt will not lead to future taxes. |

Understanding Ricardian Equivalence: Theory and Implications

Ricardian Equivalence posits that consumers anticipate future taxes required to pay off government debt, leading them to save rather than spend stimulus funds, which neutralizes fiscal policy effects. This theory challenges typical Keynesian views by suggesting government borrowing does not influence aggregate demand, as households adjust their behavior accordingly. Understanding this concept is crucial for evaluating fiscal policy effectiveness and differentiating it from fiscal illusion, where taxpayers underestimate future liabilities, resulting in increased government spending's apparent stimulus impact.

Fiscal Illusion: Concept and Economic Impact

Fiscal illusion occurs when taxpayers misunderstand government budget constraints, leading to distorted perceptions of the true cost of public spending. This misperception often results in higher government deficits and increased public debt, as voters underestimate future tax liabilities. The economic impact includes inefficient allocation of resources, excessive fiscal expansion, and potential long-term macroeconomic instability.

The Core Assumptions of Ricardian Equivalence

The core assumptions of Ricardian Equivalence include perfectly rational consumers who fully anticipate future taxes resulting from government borrowing, perfect capital markets allowing unlimited borrowing and lending, and intergenerational altruism where current generations care about the welfare of future ones. These assumptions imply that consumers increase savings to offset government deficits, rendering fiscal policy ineffective in altering aggregate demand. Contrarily, fiscal illusion suggests that taxpayers misperceive government debt, leading to increased consumption despite rising deficits.

Mechanisms Behind Fiscal Illusion in Government Policy

Fiscal illusion in government policy arises when taxpayers underestimate the true cost of public spending due to complex taxation and deficit financing methods, leading to increased government expenditure without proportional taxpayer resistance. Mechanisms such as deficit financing obscure the immediate tax burden, creating an illusion of lower current taxation and encouraging higher consumption and public debt. Unlike Ricardian Equivalence, which assumes rational agents anticipate future taxes, fiscal illusion exploits informational asymmetries and myopic behavior to sustain fiscal expansion.

Empirical Evidence: Ricardian Equivalence in Practice

Empirical evidence on Ricardian Equivalence reveals mixed outcomes, with studies indicating partial offsets between government debt increases and private saving behaviors in developed economies. Research using panel data from OECD countries demonstrates that households often do not fully internalize future tax liabilities implied by government borrowing, contrasting with the strict Ricardian view. Fiscal illusion arises as behavioral biases and myopia lead to underestimation of the true cost of government deficits, causing deviations from Ricardian Equivalence in real-world fiscal policy responses.

Distinguishing Fiscal Illusion from Rational Fiscal Behavior

Fiscal illusion arises when taxpayers underestimate the true cost of government spending due to opaque tax structures or borrowing, leading to inflated public demand for services. Ricardian equivalence posits that individuals anticipate future taxes resulting from government debt and thus adjust their savings to offset fiscal deficits, reflecting rational fiscal behavior. Distinguishing fiscal illusion from Ricardian equivalence involves analyzing whether taxpayers perceive government budgets transparently or are misled by short-term fiscal practices that mask the long-term burden.

Policy Outcomes: Debt, Deficits, and Consumer Response

Ricardian Equivalence posits that consumers anticipate future taxes due to government debt, leading to unchanged consumption despite fiscal deficits, while Fiscal Illusion suggests consumers underestimate debt implications, increasing current spending. Policymakers relying on Ricardian Equivalence expect debt issuance to have minimal effect on aggregate demand, whereas Fiscal Illusion predicts deficits stimulate immediate consumption and economic activity. Empirical evidence on these theories influences debt management strategies and deficit financing policies by shaping assumptions about consumer behavior and fiscal sustainability.

Ricardian Equivalence vs Fiscal Illusion: Comparative Analysis

Ricardian Equivalence suggests that consumers anticipate future taxes from government debt and increase savings accordingly, neutralizing fiscal stimulus effects, whereas Fiscal Illusion argues that voters underestimate government debt impacts, leading to higher public spending and debt. Empirical studies show mixed evidence, with Ricardian Equivalence holding in economies with highly informed agents and stable institutions, while Fiscal Illusion is prevalent in countries facing political opacity and myopic fiscal behavior. Understanding the conditions under which each theory dominates informs policy design to improve debt sustainability and optimize fiscal interventions.

Limitations and Critiques of Ricardian Equivalence Theory

Ricardian Equivalence faces limitations due to unrealistic assumptions such as perfect foresight, rational behavior, and infinite planning horizons, which rarely hold in real economies. Critics argue that it overlooks liquidity constraints, myopia among consumers, and the political economy dynamics influencing fiscal policy. Empirical evidence often contradicts Ricardian Equivalence, suggesting that government borrowing can affect aggregate demand and interest rates, challenging the theory's practical applicability.

Implications for Fiscal Policy and Economic Governance

Ricardian Equivalence implies that government borrowing does not affect overall demand since rational consumers anticipate future tax liabilities, leading to neutral fiscal policy effects. In contrast, Fiscal Illusion suggests that voters underestimate the long-term costs of debt, allowing governments to increase spending without immediate political costs, which may result in higher deficits and debt accumulation. Policymakers must consider these contrasting implications to design sustainable fiscal strategies and improve economic governance by aligning public perception with actual fiscal constraints.

Ricardian Equivalence vs Fiscal Illusion Infographic

difterm.com

difterm.com