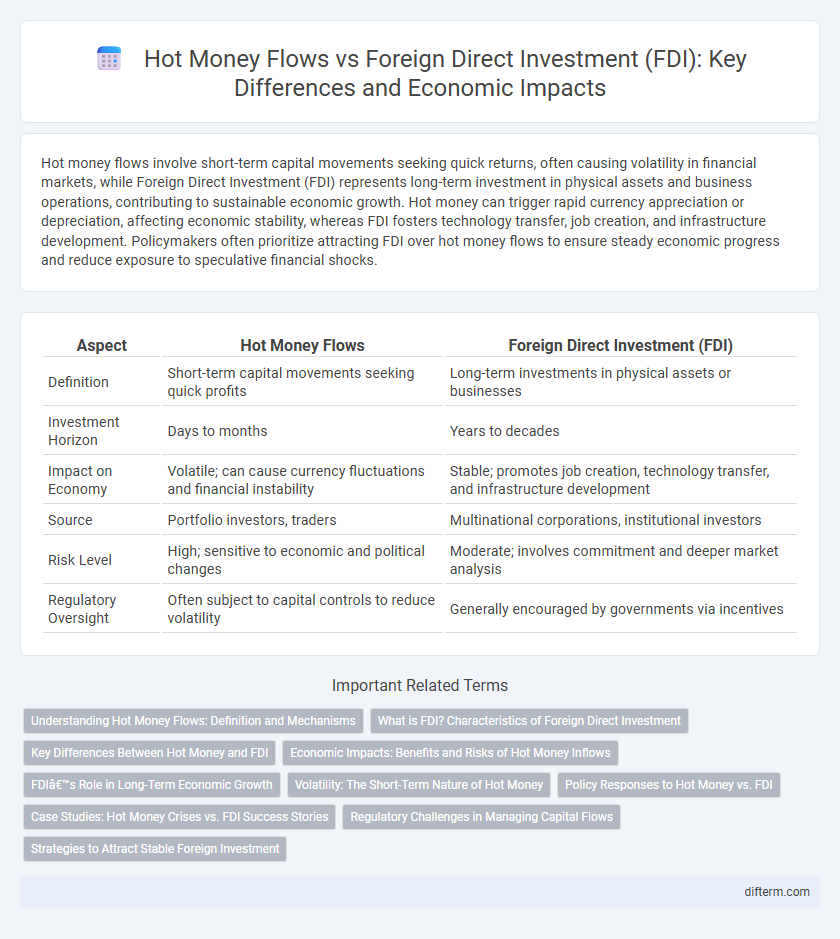

Hot money flows involve short-term capital movements seeking quick returns, often causing volatility in financial markets, while Foreign Direct Investment (FDI) represents long-term investment in physical assets and business operations, contributing to sustainable economic growth. Hot money can trigger rapid currency appreciation or depreciation, affecting economic stability, whereas FDI fosters technology transfer, job creation, and infrastructure development. Policymakers often prioritize attracting FDI over hot money flows to ensure steady economic progress and reduce exposure to speculative financial shocks.

Table of Comparison

| Aspect | Hot Money Flows | Foreign Direct Investment (FDI) |

|---|---|---|

| Definition | Short-term capital movements seeking quick profits | Long-term investments in physical assets or businesses |

| Investment Horizon | Days to months | Years to decades |

| Impact on Economy | Volatile; can cause currency fluctuations and financial instability | Stable; promotes job creation, technology transfer, and infrastructure development |

| Source | Portfolio investors, traders | Multinational corporations, institutional investors |

| Risk Level | High; sensitive to economic and political changes | Moderate; involves commitment and deeper market analysis |

| Regulatory Oversight | Often subject to capital controls to reduce volatility | Generally encouraged by governments via incentives |

Understanding Hot Money Flows: Definition and Mechanisms

Hot money flows refer to the rapid movement of capital across borders in search of short-term gains through interest rate differentials, currency speculation, or market timing. These flows are highly liquid and volatile, often triggered by changes in economic policies, interest rates, or geopolitical events, contrasting with Foreign Direct Investment (FDI), which involves long-term investments in physical assets or business operations. Understanding the mechanisms of hot money requires analyzing capital account liberalization, global interest rate trends, and investor risk appetite, which significantly impact exchange rates, financial stability, and economic growth in emerging markets.

What is FDI? Characteristics of Foreign Direct Investment

Foreign Direct Investment (FDI) refers to investment made by a company or individual from one country into business interests located in another country, typically involving ownership or control of a significant stake in the foreign enterprise. Key characteristics of FDI include long-term commitment, direct management control, transfer of technology and expertise, and contribution to economic development through job creation and infrastructure improvement. Unlike hot money flows, which are short-term and speculative, FDI represents stable capital inflows aimed at fostering sustainable growth in the host economy.

Key Differences Between Hot Money and FDI

Hot money flows consist of short-term capital movements driven by speculative motives and rapid shifts in investor sentiment, resulting in high volatility and increased financial market risk. Foreign direct investment (FDI) involves long-term capital commitment aimed at establishing a lasting interest in a foreign enterprise, contributing to sustainable economic growth through technology transfer and job creation. Unlike hot money, FDI provides stability, enhances productive capacity, and fosters economic development by promoting local infrastructure and human capital improvements.

Economic Impacts: Benefits and Risks of Hot Money Inflows

Hot money inflows provide short-term liquidity boosts to financial markets and can stimulate currency appreciation, potentially attracting further investments. However, these volatile capital movements increase the risk of sudden outflows, causing exchange rate instability and financial market disruptions. Unlike stable foreign direct investment (FDI), hot money lacks long-term commitment, which undermines sustainable economic growth and complicates monetary policy management.

FDI’s Role in Long-Term Economic Growth

Foreign direct investment (FDI) plays a critical role in fostering long-term economic growth by providing stable capital inflows, transferring technology, and enhancing productivity in the host country. Unlike hot money flows, which are short-term and volatile, FDI contributes to sustainable development by building infrastructure, creating jobs, and improving management practices. Empirical studies indicate that countries with higher FDI inflows experience accelerated GDP growth, increased export capacity, and improved human capital development.

Volatility: The Short-Term Nature of Hot Money

Hot money flows exhibit high volatility due to their short-term, speculative nature, causing rapid inflows and outflows that destabilize financial markets. In contrast, Foreign Direct Investment (FDI) represents long-term commitments with stable capital that supports sustainable economic growth. The unpredictable shifts in hot money can trigger exchange rate fluctuations and financial crises, whereas FDI fosters steady development and infrastructure improvement.

Policy Responses to Hot Money vs. FDI

Policymakers implement capital controls and macroprudential regulations to moderate hot money flows that can destabilize financial markets by causing rapid currency fluctuations and asset bubbles. In contrast, policy frameworks often encourage foreign direct investment (FDI) through incentives such as tax breaks, streamlined regulations, and investment protection agreements to foster long-term economic growth and technology transfer. Balancing these strategies helps maintain macroeconomic stability while attracting sustainable capital inflows.

Case Studies: Hot Money Crises vs. FDI Success Stories

Hot money flows, characterized by short-term capital movement, often trigger financial instability as seen in the 1997 Asian Financial Crisis, where rapid withdrawal exacerbated currency collapses. In contrast, Foreign Direct Investment (FDI) signifies long-term commitment, fostering sustainable economic growth exemplified by China's consistent FDI inflows driving infrastructure development and industrial expansion. Case studies highlight that economies dependent on hot money face volatility risks, while those leveraging FDI benefit from technological transfer, job creation, and stable capital formation.

Regulatory Challenges in Managing Capital Flows

Regulatory challenges in managing hot money flows versus foreign direct investment (FDI) stem from the volatile and short-term nature of hot money, which can rapidly enter or exit economies, causing financial instability. Policymakers must implement capital controls, macroprudential measures, and transparent reporting requirements to mitigate risks associated with sudden capital reversals. In contrast, FDI tends to be more stable and long-term, demanding regulatory frameworks that encourage investment protection and ease of doing business to sustain economic growth.

Strategies to Attract Stable Foreign Investment

Governments can enhance stable foreign investment by improving regulatory transparency and ensuring political stability, thereby building investor confidence for long-term commitments. Offering tax incentives and establishing special economic zones with streamlined approval processes attract Foreign Direct Investment (FDI) while discouraging volatile hot money flows. Strengthening financial infrastructure and promoting local partnerships further anchor sustainable capital inflows that support economic development.

Hot money flows vs FDI (foreign direct investment) Infographic

difterm.com

difterm.com