Value Added Tax (VAT) is a consumption tax levied at each stage of production based on the value added, enhancing transparency and reducing tax evasion compared to Sales Tax, which is imposed only at the point of sale to the final consumer. VAT's multi-stage collection process ensures that tax is paid on all inputs, creating a chain of credits that businesses can offset, while Sales Tax relies on retailers to collect taxes, potentially leading to cascading effects. Economies with VAT systems often experience more stable and predictable revenue streams, supporting public financing needs more effectively than jurisdictions using Sales Tax alone.

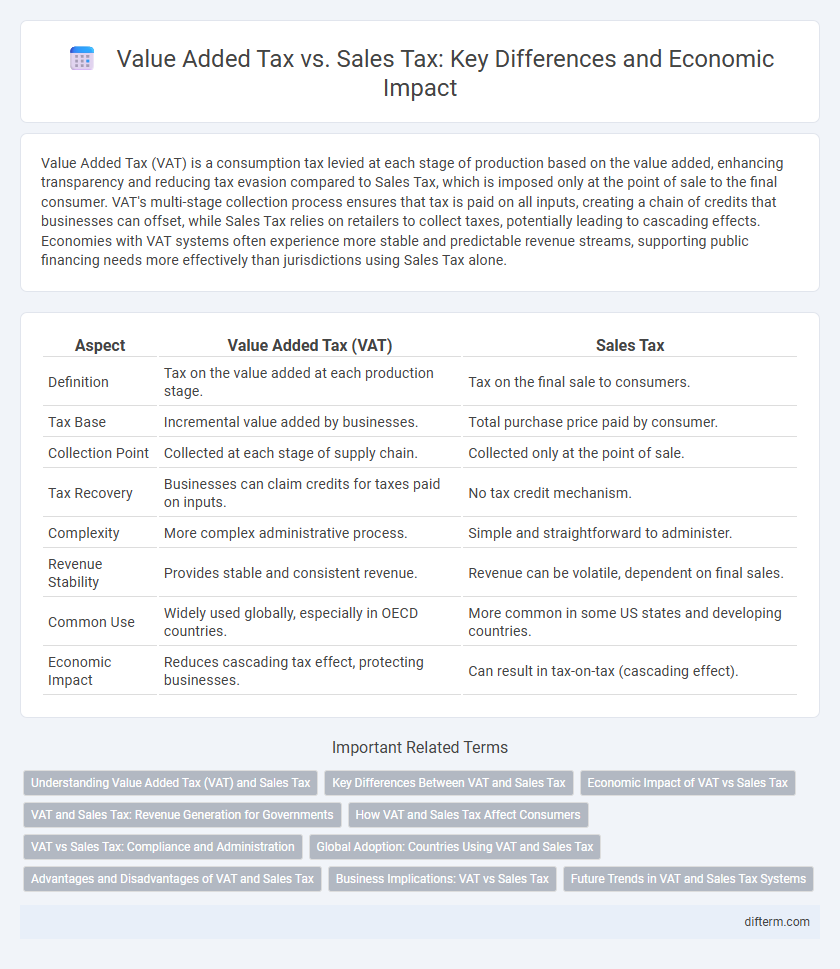

Table of Comparison

| Aspect | Value Added Tax (VAT) | Sales Tax |

|---|---|---|

| Definition | Tax on the value added at each production stage. | Tax on the final sale to consumers. |

| Tax Base | Incremental value added by businesses. | Total purchase price paid by consumer. |

| Collection Point | Collected at each stage of supply chain. | Collected only at the point of sale. |

| Tax Recovery | Businesses can claim credits for taxes paid on inputs. | No tax credit mechanism. |

| Complexity | More complex administrative process. | Simple and straightforward to administer. |

| Revenue Stability | Provides stable and consistent revenue. | Revenue can be volatile, dependent on final sales. |

| Common Use | Widely used globally, especially in OECD countries. | More common in some US states and developing countries. |

| Economic Impact | Reduces cascading tax effect, protecting businesses. | Can result in tax-on-tax (cascading effect). |

Understanding Value Added Tax (VAT) and Sales Tax

Value Added Tax (VAT) is a consumption tax levied on the value added at each stage of production or distribution, ensuring that tax is collected incrementally along the supply chain. Sales Tax is a single-stage tax imposed only at the point of sale to the final consumer, calculated based on the total purchase price. Businesses collect VAT on sales and claim credits for VAT paid on purchases, whereas Sales Tax is typically collected directly from consumers without input tax credits.

Key Differences Between VAT and Sales Tax

Value Added Tax (VAT) is imposed on the value added at each stage of production and distribution, while Sales Tax is levied only at the point of final purchase by the consumer. VAT ensures tax is collected incrementally throughout the supply chain, reducing tax evasion and cascading effects common in Sales Tax systems. Sales Tax typically results in a single-stage tax collection, making VAT more efficient for tracing and administrative purposes in complex economies.

Economic Impact of VAT vs Sales Tax

Value Added Tax (VAT) generates more stable government revenue compared to sales tax due to its multi-stage collection process, reducing tax evasion and boosting fiscal sustainability. VAT encourages formalization of businesses and improves economic transparency, while sales tax disproportionately burdens final consumers, potentially dampening consumption. Businesses benefit from VAT's input tax credits, which prevent tax cascading and promote efficient production and supply chains, enhancing overall economic growth.

VAT and Sales Tax: Revenue Generation for Governments

Value Added Tax (VAT) generates consistent revenue by taxing the incremental value at each stage of production, reducing evasion compared to Sales Tax, which is applied only at the final point of sale. Governments benefit from VAT's multi-stage collection mechanism that broadens the tax base and increases compliance through input tax credits. Sales Tax can cause revenue volatility due to its reliance on consumer purchases and susceptibility to underreporting in cash transactions.

How VAT and Sales Tax Affect Consumers

Value Added Tax (VAT) impacts consumers through incremental taxation at each production stage, often embedded in the final price, making it less visible but potentially increasing overall costs. Sales Tax is applied only at the point of sale, making the tax amount transparent but can lead consumers to alter purchasing behavior due to the direct added cost. Both taxes influence consumer spending patterns and overall demand, with VAT potentially reducing consumption more broadly due to its cascading presence in supply chains.

VAT vs Sales Tax: Compliance and Administration

Value Added Tax (VAT) requires businesses to track and report tax at each stage of production, ensuring greater transparency and reducing tax evasion compared to Sales Tax, which is collected only at the point of sale to the final consumer. VAT compliance involves detailed record-keeping, invoices, and periodic filings that increase administrative burden but improve revenue accuracy for governments. In contrast, Sales Tax administration is generally simpler but prone to under-reporting and loss of tax revenue due to less rigorous oversight of intermediary transactions.

Global Adoption: Countries Using VAT and Sales Tax

Value Added Tax (VAT) is widely adopted by over 160 countries globally, including the European Union, Canada, and Australia, due to its efficiency in reducing tax evasion and generating stable revenue streams. In contrast, Sales Tax is primarily used in the United States, parts of Canada, and some other countries, where it is applied at the point of sale, often leading to narrower tax bases. The global preference for VAT over Sales Tax reflects its ability to capture value added at each production stage, enhancing compliance and fiscal transparency.

Advantages and Disadvantages of VAT and Sales Tax

Value Added Tax (VAT) enhances government revenue through multi-stage collection, reducing tax evasion compared to Sales Tax, which is simpler but prone to underreporting at the retail level. VAT's input tax credits promote business compliance and transparency, while Sales Tax offers straightforward administration and immediate consumer price impact. However, VAT can increase costs for small businesses due to complex filing requirements, whereas Sales Tax may lead to revenue leakage and tax cascading.

Business Implications: VAT vs Sales Tax

Value Added Tax (VAT) impacts businesses by taxing each stage of production, enhancing transparency and reducing tax evasion, whereas Sales Tax applies only at the final sale, potentially leading to tax cascading if inputs are also taxed. VAT requires meticulous accounting and documentation, increasing compliance costs but providing input tax credits that lower overall tax burden for businesses. Sales Tax may simplify collection but can distort pricing strategies and competitiveness, particularly for companies engaging in multi-stage manufacturing or cross-border trade.

Future Trends in VAT and Sales Tax Systems

Future trends in Value Added Tax (VAT) and sales tax systems emphasize digital transformation and enhanced data analytics to improve compliance and reduce evasion. Governments increasingly adopt real-time reporting and automated tax collection mechanisms powered by artificial intelligence and blockchain technology. Cross-border digital transactions drive harmonization efforts, promoting seamless VAT and sales tax administration in global e-commerce markets.

Value Added Tax vs Sales Tax Infographic

difterm.com

difterm.com