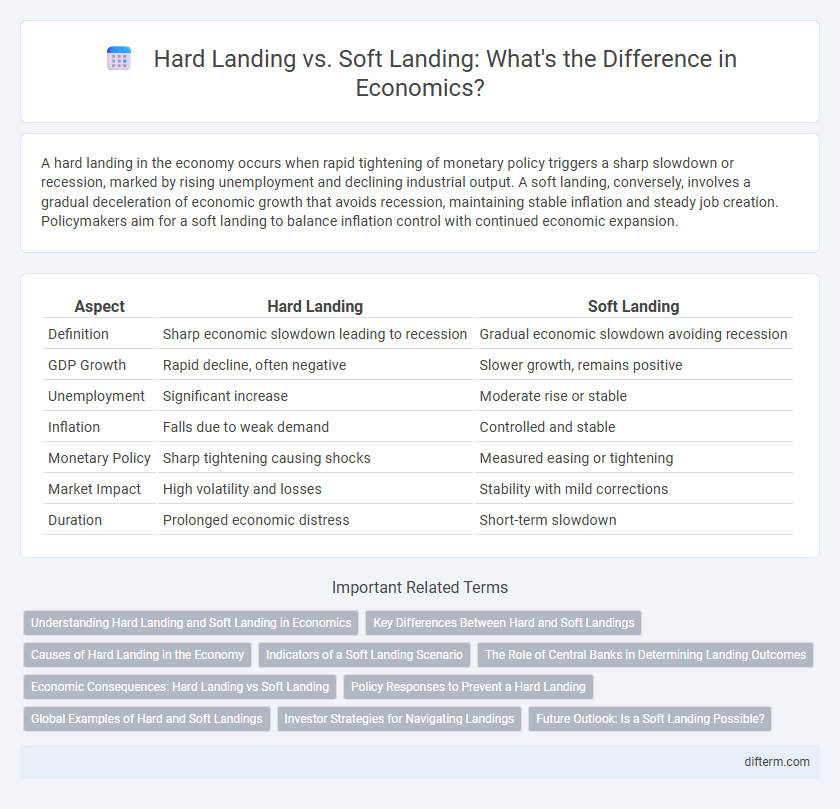

A hard landing in the economy occurs when rapid tightening of monetary policy triggers a sharp slowdown or recession, marked by rising unemployment and declining industrial output. A soft landing, conversely, involves a gradual deceleration of economic growth that avoids recession, maintaining stable inflation and steady job creation. Policymakers aim for a soft landing to balance inflation control with continued economic expansion.

Table of Comparison

| Aspect | Hard Landing | Soft Landing |

|---|---|---|

| Definition | Sharp economic slowdown leading to recession | Gradual economic slowdown avoiding recession |

| GDP Growth | Rapid decline, often negative | Slower growth, remains positive |

| Unemployment | Significant increase | Moderate rise or stable |

| Inflation | Falls due to weak demand | Controlled and stable |

| Monetary Policy | Sharp tightening causing shocks | Measured easing or tightening |

| Market Impact | High volatility and losses | Stability with mild corrections |

| Duration | Prolonged economic distress | Short-term slowdown |

Understanding Hard Landing and Soft Landing in Economics

A hard landing in economics refers to a sudden and severe economic slowdown or recession following a period of rapid growth, often marked by sharp declines in GDP, rising unemployment, and financial market instability. In contrast, a soft landing denotes a gradual deceleration of economic growth that avoids triggering a recession, maintaining steady increases in employment and consumer spending while controlling inflation. Central banks aim for a soft landing by adjusting monetary policy to cool overheating economies without causing a drastic contraction.

Key Differences Between Hard and Soft Landings

A hard landing in the economy is characterized by a rapid and severe slowdown, often leading to a recession with high unemployment and declining consumer spending. In contrast, a soft landing achieves a gradual deceleration of growth, avoiding recession and maintaining stable inflation and employment levels. Key differences include the speed of economic contraction, impact on labor markets, and central bank policies aimed at controlling inflation without triggering a crisis.

Causes of Hard Landing in the Economy

Rapid tightening of monetary policy, such as aggressive interest rate hikes by central banks, often triggers a hard landing by abruptly reducing consumer spending and business investments. Supply chain disruptions and rising input costs can exacerbate inflationary pressures, forcing policymakers into abrupt corrective measures that stall economic growth. Excessive debt levels and speculative asset bubbles create financial vulnerabilities that can collapse under tightening conditions, driving the economy into a sharp recession.

Indicators of a Soft Landing Scenario

A soft landing scenario in the economy is indicated by steady GDP growth above 2%, moderate inflation rates around 2-3%, and stable labor market conditions with unemployment rates remaining near natural levels. Consumer spending and business investment show resilience without sharp declines, while central banks maintain gradual interest rate hikes to avoid tightening financial conditions excessively. Leading economic indicators such as manufacturing orders and housing starts typically demonstrate sustained or modest growth, signaling balanced demand and controlled inflation pressures.

The Role of Central Banks in Determining Landing Outcomes

Central banks play a crucial role in determining whether an economy experiences a hard landing or a soft landing through their monetary policy decisions. By adjusting interest rates and controlling money supply, institutions like the Federal Reserve influence inflation, consumer spending, and investment trends. Their ability to balance economic growth and inflationary pressures often dictates the smoothness of the transition during economic slowdowns.

Economic Consequences: Hard Landing vs Soft Landing

A hard landing in the economy typically results in a sharp decline in GDP, rising unemployment rates, and increased financial market volatility due to rapid tightening of monetary policy or external shocks. In contrast, a soft landing is characterized by a gradual slowdown in economic growth, controlled inflation rates, and stabilized employment levels, achieved through careful policy adjustments and market confidence. The economic consequences of a hard landing often include prolonged recessions and higher fiscal deficits, whereas a soft landing tends to preserve economic stability and minimize structural damage.

Policy Responses to Prevent a Hard Landing

Policy responses to prevent a hard landing focus on calibrated monetary easing, targeted fiscal stimulus, and regulatory adjustments to stabilize financial markets. Central banks may lower interest rates gradually and provide liquidity support to sustain credit flow, while governments implement infrastructure spending and social support programs to maintain consumer demand. Coordinated international cooperation enhances the effectiveness of these measures, reducing the risk of abrupt economic contraction and financial turmoil.

Global Examples of Hard and Soft Landings

China's hard landing in 2023 showcased a sharp GDP slowdown sparked by aggressive zero-COVID policies and real estate sector stress, similar to Japan's asset bubble burst in the 1990s. In contrast, the United States achieved a soft landing in 1994 by carefully managing interest rate hikes, which curbed inflation without triggering a recession. Germany's soft landing in the early 2000s demonstrated how strong fiscal discipline and labor market reforms can stabilize growth amid global uncertainties.

Investor Strategies for Navigating Landings

Investors navigating hard landings prioritize capital preservation through increased allocation to defensive sectors such as utilities and consumer staples, while favoring high-quality bonds to mitigate credit risk. In contrast, during soft landings, strategies shift toward selective growth equities and cyclical sectors that benefit from stable economic expansion, leveraging moderate risk exposure. Tactical asset allocation, combined with rigorous market analysis, enables investors to adapt portfolios dynamically to evolving macroeconomic signals.

Future Outlook: Is a Soft Landing Possible?

Economic experts analyze diverse indicators such as inflation rates, employment trends, and monetary policies to assess the likelihood of a soft landing amid global uncertainties. Central banks' decisions on interest rates and fiscal stimulus measures play pivotal roles in steering the economy away from a hard landing scenario characterized by recession and market volatility. While a soft landing remains challenging, careful management of economic growth and inflation control enhances prospects for a stable future outlook.

Hard Landing vs Soft Landing Infographic

difterm.com

difterm.com