Hot money refers to short-term investments that move quickly across borders seeking immediate returns, often causing market volatility. Patient capital, in contrast, involves long-term investments aimed at sustainable growth and development, providing stability to economies. Understanding the balance between hot money and patient capital is crucial for fostering economic resilience and attracting quality investment.

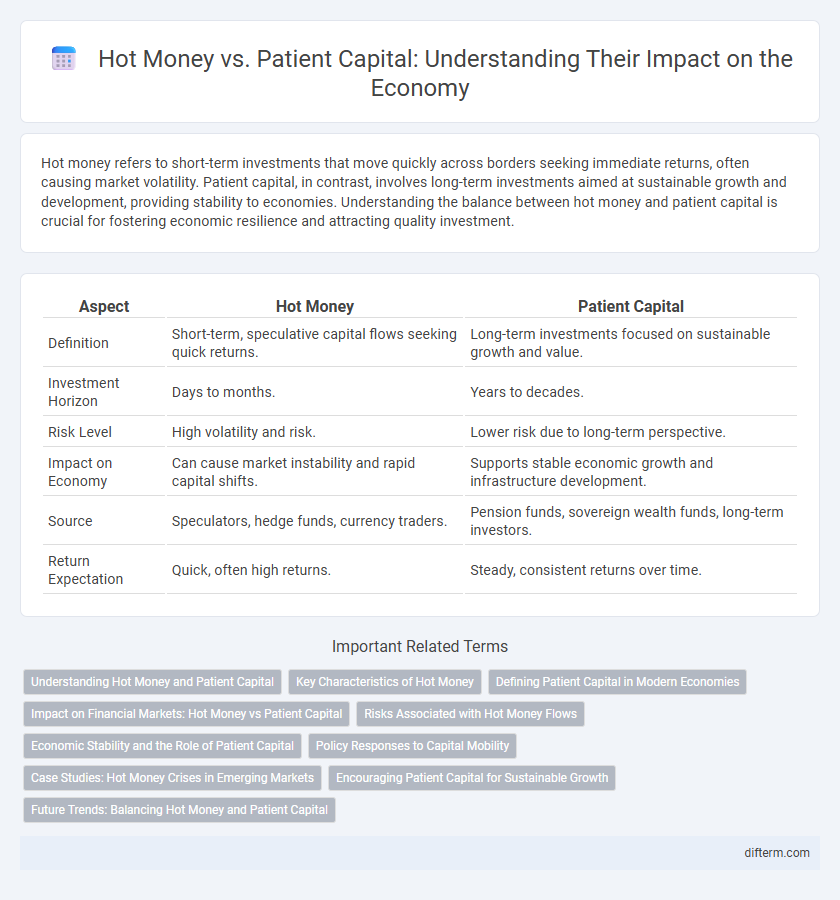

Table of Comparison

| Aspect | Hot Money | Patient Capital |

|---|---|---|

| Definition | Short-term, speculative capital flows seeking quick returns. | Long-term investments focused on sustainable growth and value. |

| Investment Horizon | Days to months. | Years to decades. |

| Risk Level | High volatility and risk. | Lower risk due to long-term perspective. |

| Impact on Economy | Can cause market instability and rapid capital shifts. | Supports stable economic growth and infrastructure development. |

| Source | Speculators, hedge funds, currency traders. | Pension funds, sovereign wealth funds, long-term investors. |

| Return Expectation | Quick, often high returns. | Steady, consistent returns over time. |

Understanding Hot Money and Patient Capital

Hot money refers to short-term, highly liquid investments that quickly move between markets seeking immediate returns, often causing volatility in financial systems. Patient capital, in contrast, involves long-term investments committed to sustainable growth and development, typically through private equity or venture capital with an extended time horizon. Understanding these distinctions is crucial for policymakers aiming to balance economic stability and growth by managing capital flows effectively.

Key Characteristics of Hot Money

Hot money is characterized by its short-term investment horizon and high liquidity, often driven by speculative motives seeking quick profits. It rapidly flows in and out of markets, causing volatility and posing challenges for economic stability. This capital contrasts with patient capital, which emphasizes long-term growth and sustained economic development.

Defining Patient Capital in Modern Economies

Patient capital in modern economies refers to long-term investments characterized by a willingness to forego immediate returns for sustainable growth and innovation. Unlike hot money, which rapidly moves in and out of markets seeking quick profits, patient capital supports ventures such as infrastructure, research and development, and social enterprises that require extended periods to mature. This investment approach fosters economic stability, encourages entrepreneurship, and drives enduring value creation across sectors.

Impact on Financial Markets: Hot Money vs Patient Capital

Hot money, characterized by short-term speculative investments, often leads to increased market volatility and sudden capital flight, disrupting financial stability. Patient capital, in contrast, supports long-term growth by providing steady funding to businesses and infrastructure, fostering sustainable economic development. The contrasting impacts of hot money and patient capital significantly influence asset prices, liquidity, and investor confidence in financial markets.

Risks Associated with Hot Money Flows

Hot money flows pose significant risks such as sudden capital flight, which can cause severe exchange rate volatility and destabilize financial markets. These short-term investments often lead to asset bubbles and increased vulnerability to external shocks, undermining long-term economic growth. In contrast, patient capital promotes stability by supporting sustainable investment projects with longer time horizons and lower liquidity pressures.

Economic Stability and the Role of Patient Capital

Hot money, characterized by rapid inflows and outflows of speculative investments, often leads to economic volatility and undermines financial stability in emerging markets. Patient capital, by contrast, involves long-term investments that support sustainable economic growth, infrastructure development, and job creation, thereby enhancing macroeconomic resilience. The role of patient capital is critical in fostering economic stability, as it mitigates the negative effects of capital flight and promotes steady wealth accumulation.

Policy Responses to Capital Mobility

Policy responses to capital mobility must balance the volatility of hot money flows with the stability of patient capital investments by implementing targeted capital controls and regulatory frameworks. Central banks often use macroprudential measures to mitigate rapid inflows and outflows of hot money, reducing financial market disruptions and exchange rate volatility. Encouraging patient capital through incentives like tax breaks or co-investment schemes can foster long-term economic development and resilience against speculative shocks.

Case Studies: Hot Money Crises in Emerging Markets

Hot money flows, characterized by rapid inflows and outflows of speculative capital, often trigger financial instability in emerging markets, as witnessed during the 1997 Asian Financial Crisis where sudden withdrawal of short-term investments led to currency collapses and stock market crashes. In contrast, patient capital, typified by long-term investments such as sovereign wealth funds or development finance institutions, has helped stabilize economies by funding infrastructure and industrial projects, as exemplified by Singapore's Temasek Holdings. A notable case is Argentina's recurrent hot money crises in the early 2000s, where speculative short-term capital exacerbated sovereign debt defaults, highlighting the volatility risks that patient capital seeks to mitigate.

Encouraging Patient Capital for Sustainable Growth

Encouraging patient capital catalyzes sustainable economic growth by promoting long-term investments in infrastructure, innovation, and human capital development. Unlike hot money, which seeks quick returns and often exacerbates market volatility, patient capital provides the stability necessary for enduring business expansion and resilience. Governments and financial institutions can stimulate patient capital through favorable policies, incentives, and transparent regulatory frameworks that reward prolonged commitment to productive economic sectors.

Future Trends: Balancing Hot Money and Patient Capital

Future economic growth hinges on balancing hot money's short-term liquidity infusion with patient capital's long-term investment strategies. Emerging market stability depends on policies that attract sustainable capital flows while mitigating the volatility associated with speculative hot money. Innovations in regulatory frameworks and fintech platforms will increasingly drive the efficient allocation of capital, fostering resilient economic development.

Hot money vs Patient capital Infographic

difterm.com

difterm.com